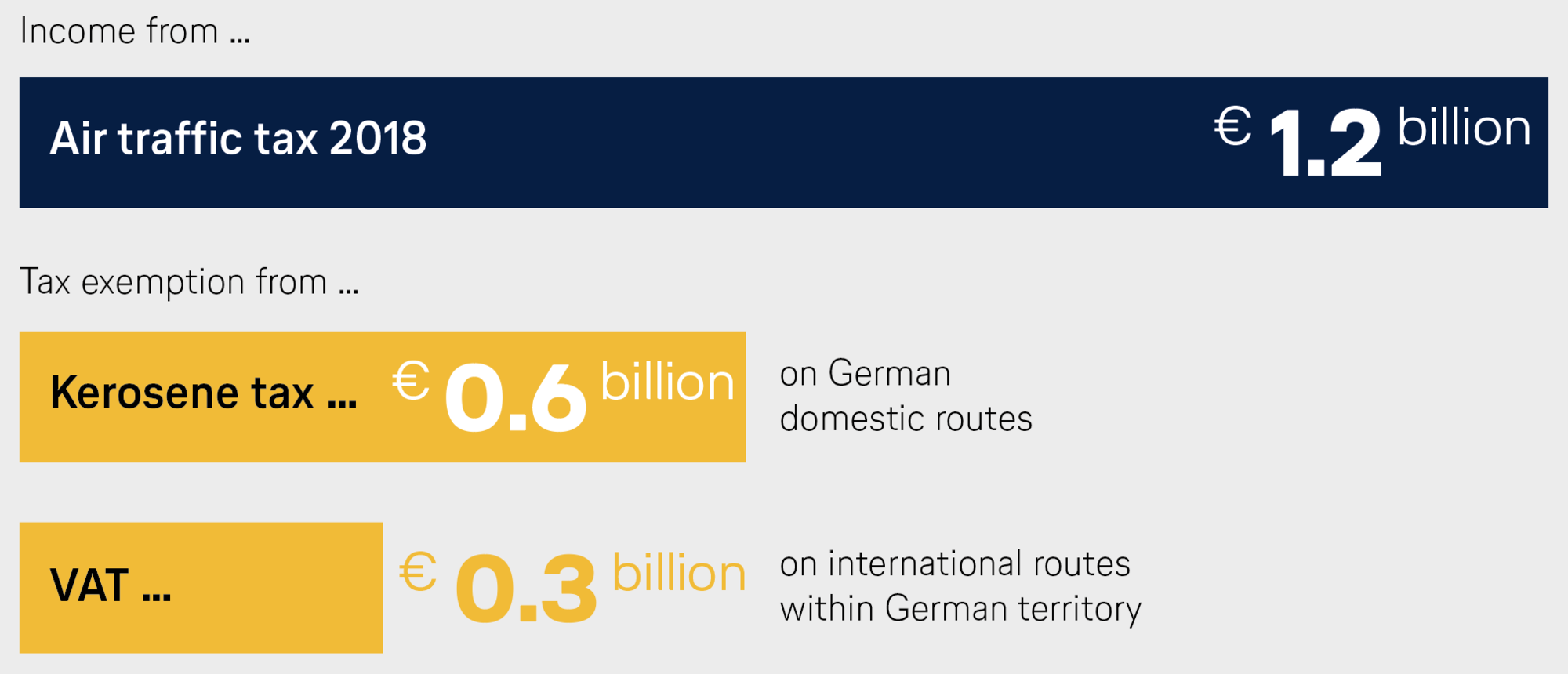

High tax burden for aviation

The aviation sector in Germany already bears a substantial tax burden on account of user-based financing and air traffic tax. It has a different structure in comparison to the financing of road and rail transport. Only air traffic has to bear the costs of the infrastructure and security required for its operations. This means that airlines in Germany pay an annual figure of around 6 billion euros for the use of the required infrastructure on the ground and in the air. In addition to this, there is a special tax per passenger in the form of the air traffic tax, which brings in more than 1.2 billion euros a year for the state.

What is the situation regarding kerosene tax and VAT?

In order to create fair competitive conditions worldwide, it was agreed in the Chicago Convention of 1944, that no kerosene tax or VAT would be charged for flights that crossed international borders. For German domestic routes, airlines pay the full rate of VAT. The federal government could charge a kerosene tax on German domestic flights. The potential income in taxes from this source would amount to around 570 million euros. VAT charged on flights crossing international borders – which could be charged exclusively over German territory – would raise around 300 million euros. The total from these sources of income would be significantly lower than the amount raised through the air traffic tax.

Isolated national initiatives will not help the climate

Aviation already pays a price for CO2 in Europe. Since 2012 it has been the only mode of transport that participates in emissions trading. Additional nationally levied taxes or bans on top of current air traffic tax would weaken Germany’s position as an aviation hub, without gaining any significant environmental or climate-related benefits. It would instead lead to emissions being shifted to hubs abroad. If a kerosene tax were to be introduced, airlines would increasingly start refueling in other countries. The additional weight carried during their flights would then in turn lead to an increase in CO2 emissions. This highlights the fact that, particularly in aviation, it is essential to work on strengthening climate protection rules that are applicable worldwide. The sector has already set an ambitious climate policy agenda with the global carbon offsetting system CORSIA.