| | | | Policy BriefDecember 2022 | |

| | | |

Dear Reader,

The year 2022 is now entering the final track. For the Lufthansa Group, the prospects of being able to report a successful result at the end of an eventful year are good. The company has flown back into the black. We have achieved the three essential goals we set ourselves at the start of the pandemic. Firstly, we were able to secure more than 100,000 jobs, and the Lufthansa Group is currently employing around 108,000 people again. Secondly, we have maintained our place among the top five airlines worldwide, and we are number one in Europe. And we have made the company more agile and efficient. Another milestone is that since September Lufthansa has been completely back in private hands again. By the end of the year, we will have repaid the state stabilisation funds in all our four home markets – much earlier than planned. However, there is also cause for concern. Apart from the geopolitical imponderables, this is, above all, the economic policy course that Brussels is taking. Many projects on the agenda have one thing in common: they ignore the fact that aviation has to compete not only within the borders of Europe, but globally too. This insufficiency is clearly reflected by yesterday's agreement on the ETS reform. It unilaterally disadvantages EU airlines and leads to carbon leakage. The ETS creates a two-tier system between airlines operating their long-haul routes from European hubs and those departing from hubs outside the EU. This provides no climate benefit, but harms Europe's connectivity. Instead of working towards an international level playing field and creating a fair starting position for the domestic industry, the EU wants to create additional and, above all, one-sided burdens for European companies with various regulations. That is why a new show of strength for greater competitiveness is needed – and not only in air transport. Europe and Germany must do more to preserve our economic model. On the other hand, though, there is more positive news from Berlin, where the Lufthansa Group is once again the market leader. Eurowings alone is going to double its services at BER in the coming year. While other airlines regularly come and go in Berlin, the airlines of the Lufthansa Group serve the capital in a reliable and sustainable manner. You can read explanations and background information about our commitment at the capital‘s airport in this policy brief – as well as the latest climate protection initiatives in the Lufthansa Group. We wish you an interesting read and look forward to seeing and communicating with you again in 2023. Until then...all the best! Andreas Bartels

Senior Vice President

Corporate Communications

Lufthansa Group | Dr. Kay Lindemann

Senior Vice President

Corporate Policy

Lufthansa Group |

| |

| | | | Industrial competitivenessThe new reality calls for new responsesThe challenges facing Germany have reached a new dimension. Therefore, we need a turnaround in economic policy. Berlin and Brussels must rethink their policy design. What is needed is a European show of strength for greater competitiveness. | |

| | | | The Russian war of aggression, energy shortages, high inflation and the loss of purchasing power, the rivalry between the two largest economic powers: the events of recent months show that our economic success is fragile and depends on many factors. Acute crisis management is vital, but is falling short. We need to secure the future of our economic model now. Competition between locations is coming to a head

Other airlines have long since engaged in locational competition. The USA is backing a concerted industrial policy and is enticing firms with attractive conditions. The goal is to combine strategic autonomy, climate protection and re-industrialization. Future technologies “Made in America”. Major funding has also been set aside for sustainable aviation fuels. Ever more voices in the EU are advising caution. The Belgian Prime Minister is warning of a “deindustrialisation of the European continent”. Germany, with its broad industrial base, is particularly challenged. In economic forecasts for 2023, we are at the bottom of the EU league table. In the midst of this new reality, economic policy also requires strategic rethinking. Our location must not miss the boat. Time is of the essence. | |

| | | | Distorted competition in international air transport

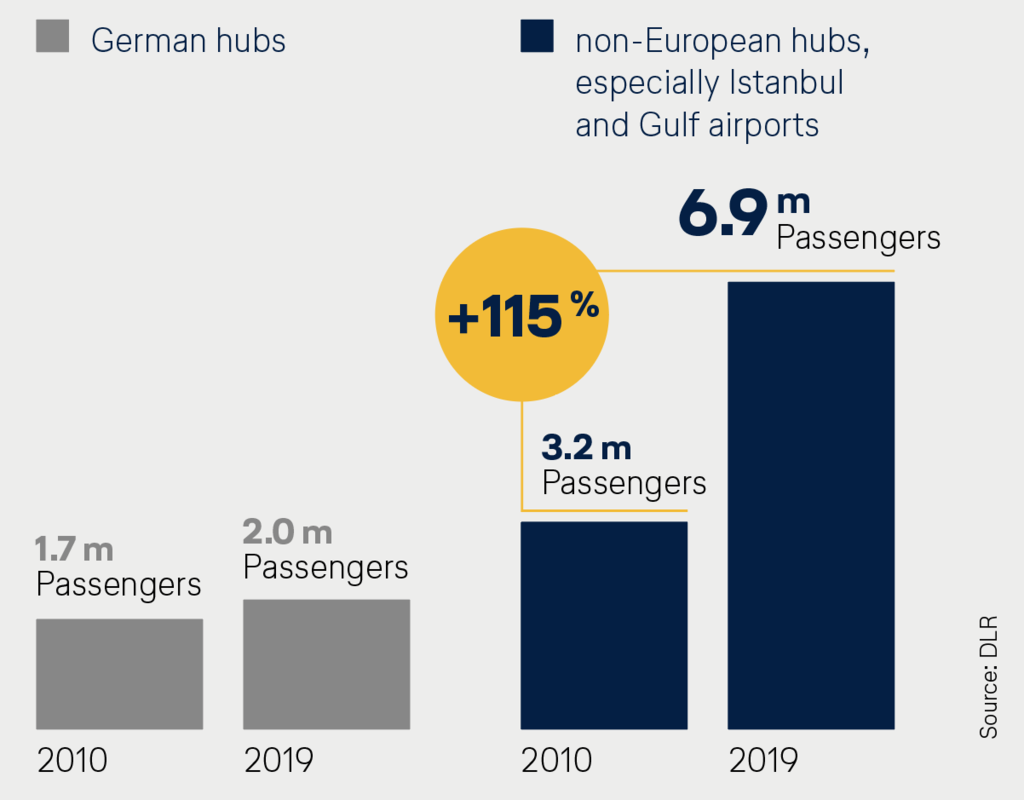

Between 2010 and 2019, passenger flows from Germany to Asia and Africa increased by 73%. However, Germany barely benefited from this as a transfer location (+15%). The vast majority of the growth was on routes via Istanbul and hubs outside Europe (+115%). The airlines on the Bosporus and the Persian Gulf are competing particularly intensively with the EU network airlines for added value. Lower social, sustainability and consumer protection standards give them significant cost advantages. Financial injections that the carriers receive from their home states usually remain non-transparent and condition-free. The competitive situation is thus particularly challenging for EU network airlines. At the same time, they are an important pillar of intra-European integration. More than that, they ensure a reliable global connection for the EU. Lufthansa or even Air France-KLM use their hubs to transport transfer passengers to destinations around the world. Only this “hub-and-spoke” model enables a network that many firms, especially those in the industrial SME sector, are reliant on to be run in an ecologically and economically sensible way. However, instead of working towards an international level playing field to create a fair starting position for domestic airlines, numerous EU projects are creating additional one-sided burdens. This does not fit with a time when we should be actively consolidating our strategic autonomy. Berlin and Brussels must have a fundamental rethink and focus more on competitiveness. There are enough starting points. | |

| | | | Traffic flows are shifting

Germany is losing its former role as a transfer country. Passenger flows from Germany to Africa and Asia 2010 vs. 2019 via:

| |

| | | | Fit for 55: It depends on the political will

The current proposals on the blending mandate for sustainable aviation fuels (SAF) and the ETS reform make traffic via European hubs massively more expensive and, above all, one-sided. Because connections via hubs at the gates of the EU are hardly affected. The same applies to a kerosene tax. This cannot be the purpose of European climate protection policy. Proposed solutions that address traffic shift and carbon leakage are on the table. They just need to be taken up. The federal government must take the lead here. Slot reform: allocation must remain reliable

For network airlines, planning reliability is indispensable. Long-term available slots at the airports are elementary for the business model. Therefore, slot allocation in the EU must be predictable and internationally compatible. Currently, these conditions are being met. And since the European market is already one of the most competitive in the world, is now really the right time to initiate a revision of the slot regulation? Brussels is getting its political priorities wrong. Air traffic agreements:

Make a level playing field binding

Air transport agreements are a vital instrument for fair competition. Accordingly, they must be used consistently to safeguard social, sustainability and consumer protection standards. Liberalisation at any price ultimately leads to the undermining of European standards. This also means that violations must be consistently sanctioned. Without such a level playing field, there should be no more landing rights in the EU in future. This also includes the reform of existing air transport agreements. It should go without saying that climate policy expectations should not be directed unilaterally only at EU airlines. Consumer protection: maintain advanced payment

The principle of advance payment has proven itself in global air transport and is, accordingly, uncontroversial. The fact that abolition is being discussed in Germany alone is an example of activism that ultimately does not benefit customers either. Airline tickets all become more expensive, while airlines are losing planning reliability. This serves no-one’s interest. In the light of the new reality, all political projects need to be reassessed. The coalition agreement of the ‘traffic light’ government accurately describes the need for action in air transport in many cases. With the required political will, we can drive competitiveness and decarbonisation concurrently. This is the only way to secure our prosperity in the long term. | |

| | | |

Stabilisation of the Lufthansa Group

Completely in private hands againThe Covid-19 pandemic hit the Lufthansa Group hard, causing great financial difficulties. In spring 2020, the governments of Germany, Austria, Belgium and Switzerland responded by pledging a total of €9bn in aid. In Germany, the federal government took a 20% stake in Lufthansa. By doing so, the politicians have stabilised the Lufthansa Group – and at the same time achieved a plus for the treasury. | |

| | | | The 20% stake was acquired by the federal government in the summer of 2020 via the Federal Republic’s Economic Stabilisation Fund (ESF) for a purchase price of €306m. Already in August 2021, the federal government reduced its participation again. In mid-September 2022 – and thus a good year before the deadline set by the EU – the ESF sold the last shares. In total, the ESF achieved sales proceeds of €1.07bn – and thus a profit of around €700m. | |

| | | | The Lufthansa Group had already repaid all loans and deposits from the federal government in November 2021. Interest of around €92m was paid for this part of the stabilisation package. Calculated on the basis of the aid utilised, this corresponds to a return for the federal government of 22% over two years. Government loans were also reduced in the other home markets of Lufthansa Group Airlines. SWISS was already able to repay the state loan in full and ahead of schedule at the end of May 2022. Interest and fees amounted to CHF60m. Austrian Airlines and Brussels Airlines will repay their stabilisation funds by the end of 2022. | |

| | | | “On behalf of all Lufthansa employees, I would like to thank politicians and taxpayers for their support of Lufthansa in the most serious financial crisis in the company’s history. Stabilisation has been successful and it is also paying off financially for the federal government.” Carsten Spohr

Chairman of the Executive Board of Deutsche Lufthansa AG on 14 September 2022 | |

| | | | BerlinLufthansa group is the market leader at BERIn October 2022, 2.1 million people took off from or landed at BER. This is only two-thirds of the October 2019 figure, but still represents the busiest month for travel at the new airport. The Lufthansa Group has a considerable stake in this. Group airlines offer the most flights, and the trend is rising. The debate about more intercontinental flights at BER is a recurring one – but not always one with factually correct information. | |

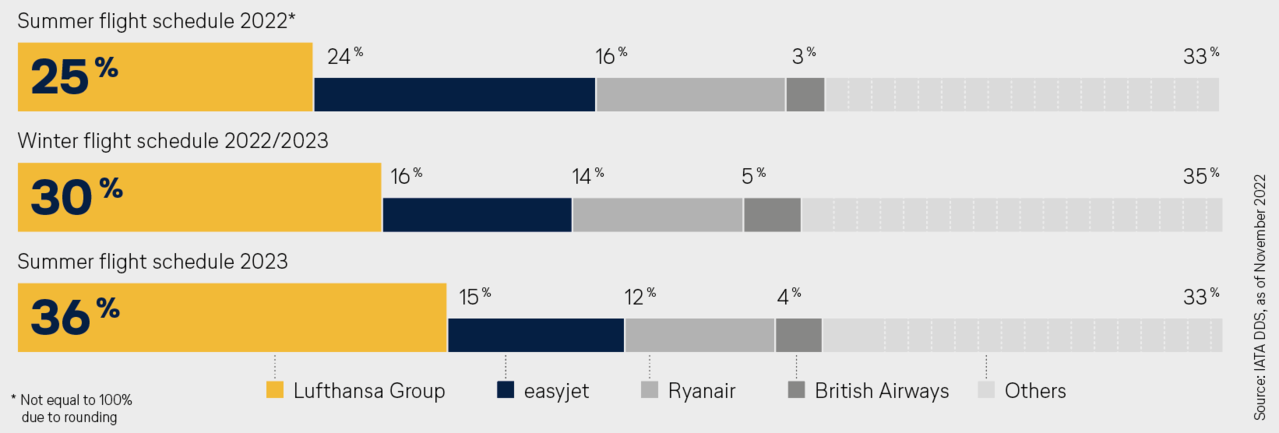

| | | | Lufthansa Group is continuously expanding market leadership

Share of flights per airline

| |

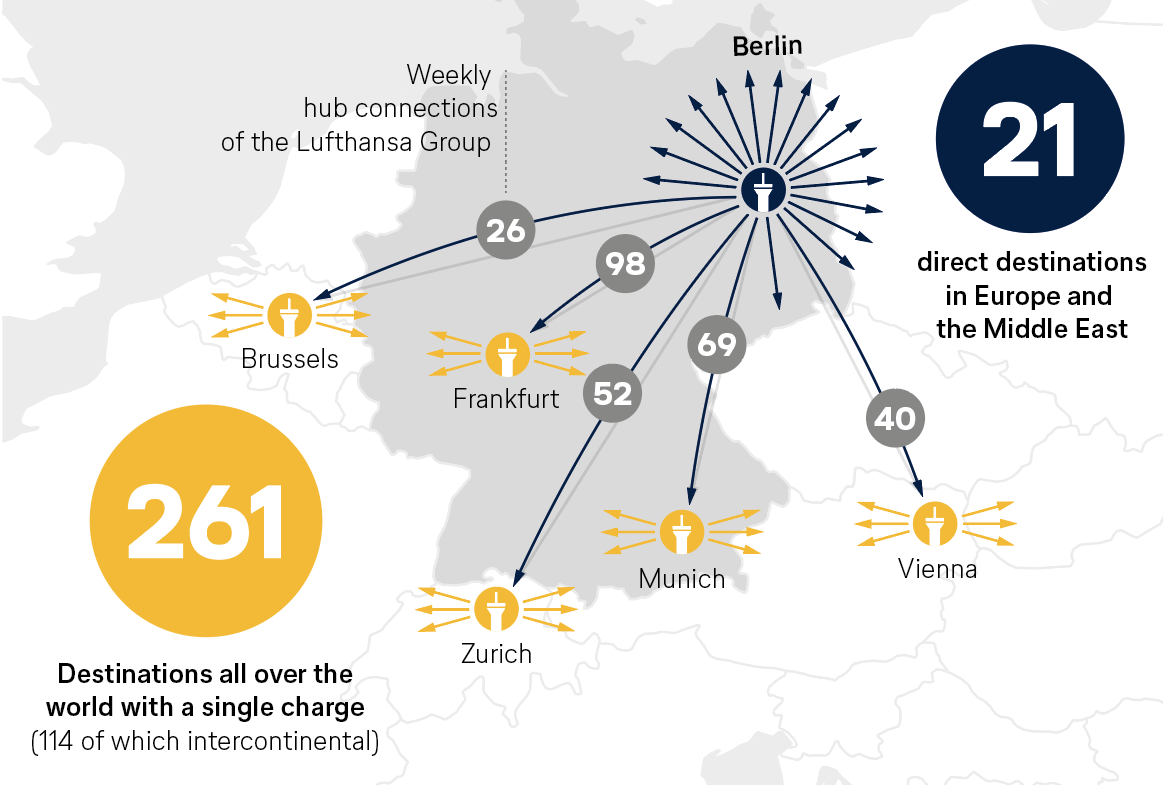

| | | | Travellers from the capital region can reach around 260 destinations with Lufthansa Group airlines – with a single change in Frankfurt, Munich, Vienna or Zurich. Currently, an average of 55 flights from Austrian Airlines, Brussels Airlines, Eurowings, Lufthansa and SWISS take off daily from Berlin Brandenburg Airport, making the Lufthansa Group the market leader at BER. In the current winter flight schedule, our five airlines offer just under a third of all flights to and from Berlin. As of today’s planning, in the summer of 2023, the offer of the Lufthansa Group, around 36% of all flights, will be more than double the size of the second largest carrier at the location. Low long-haul capacity due to historical reasons

However, the supply of direct intercontinental flights is stagnating. From the perspective of the capital region, this is unsatisfactory at first glance. However, the background is understandable. As a result of the division of Germany, Berlin has not been able to develop into an international hub. For historical reasons, these tasks fell to Frankfurt and Munich. At the same time, in Germany's federal structure, no region alone has the potential to become an airport hub. This is what set the German capital, Frankfurt and Munich apart from London, Madrid and Paris. In addition, the proportion of business travellers who use certain routes continuously is significantly lower in Berlin than in other EU capitals. As a result, the potential for fully utilized and thus profitable long-haul flights is low. As a political and cultural centre and as an outstanding attraction for tourists, Berlin is particularly attractive for private travellers. | |

| | | | Lufthansa Group carries passengers from Berlin all over the world

Details for the winter flight schedule 2022/2023

| |

| | | | Airlines from all over the world can fly to BER

Six airlines currently fly from Berlin to destinations in the USA and Asia. For the most part, they connect the capital with their own hubs. Lufthansa’s partner United, for example, flies to its home airport Newark. The fact that more international connections are not being established at BER is not due to a lack of landing rights, despite continual claims: all of the nearly 150 airlines that fly to Germany can fly to the capital. The existing traffic rights apply nationwide; no airport is favoured or disadvantaged. Air transport agreements must ensure fair competition

If there are differences in traffic law, this is due to asymmetrical competitive conditions. According to the traffic agreement, UAE airlines are allowed to fly to four airports of their choice in Germany. Emirates has opted for Frankfurt, Munich, Düsseldorf and Hamburg – and so far does not want to give up any of these airports in favour of BER. Instead, the airline, which expanded its Dubai-Moscow route during the Russian war of aggression in Ukraine, is demanding additional landing rights. The German government has rejected this for good reasons, because as long as there is no level playing field for sustainability, consumer, competition and social standards, additional traffic rights will lead to the undermining of European rules. Europe must secure its connectivity and avoid being dependent on third countries. It is thus imperative that air transport agreements take into account the upholding of fair competition and ensure comparable market conditions. It is fundamentally misleading in this debate to equate additional traffic rights for state-subsidised Gulf airlines with a rise in intercontinental connections – after all, the point is to replace a European hub for transfers with a transfer facility in the Gulf. This does contribute towards increasing connectivity. The example of the EU agreement with Qatar has shown how not to do it. It gives Qatar Airways – a state-subsidised airline with a very small home market – unrestricted access to the European market. Among them Berlin. But instead of effective mechanisms to enforce inadequate workers’ rights and environmental requirements, the agreement to date contains only ambiguous and non-binding provisions. | |

| | | | Summer 2023: Eurowings doubles service at BER

While other airlines are reducing their aircraft fleets in Berlin, Eurowings is focusing on growth. Already in the current winter flight schedule, a fourth aircraft will reinforce the subsidiary of the Lufthansa Group, followed

by two more aircraft in March 2023. Eurowings CEO Jens Bischof says: “Berlin is and remains an absolute tourist magnet and culturally and historically one of Europe’s most exciting metropolises. So it’s only logical for us, as a German airline, to expand our presence and bring more Eurowings to the capital.”

| |

| | | |

“Lufthansa and the German capital are linked by a long tradition,” stated Berlin’s Governing Mayor Franziska Giffey on the occasion of the christening of the first Lufthansa Dreamliner called Berlin. “Today, the Lufthansa Group links Berlin with the world.” | |

| | | | Lufthansa TechnikResearch for hydrogenOn the way to climate-neutral air transport, green hydrogen is one of the most important energy sources of the future. However, many questions are still unresolved: How can aircraft be refuelled quickly and safely? How do maintenance and servicing work? | |

| | | | Since the end of October, Lufthansa Technik has been working on answers in cooperation with the German Aerospace Centre (DLR), among others. In the coming months, the partners will equip a decommissioned Airbus A320 – previously in service for the Lufthansa Group – as a hydrogen “stationary laboratory” to clarify key questions. With the current state of the art, refuelling with liquid hydrogen, for example, takes several hours per long-haul flight – a real problem in view of the tightly scheduled operating procedures. Now, new options are to be tested. The hydrogen “stationary laboratory” is good for the climate and good for Germany as an aviation location of the future: Airbus wants to launch a market-ready passenger aircraft with hydrogen propulsion by 2035 – decisive know-how for global use will then come from Hamburg. | |

| | | | CO2-efficient “Shark” skinWorld premiere at SWISSSince mid-October 2022, SWISS has been the first passenger airline globally to use the new AeroShark technology developed by Lufthansa Technik and BASF. The transparent film, which is attached to the fuselage and engines, imitates the flow-optimising properties of sharkskin, thus optimising the aerodynamics of the aircraft at flow-relevant points. Fuel consumption is noticeably reduced, and annual CO2 emissions can be cut by several hundred tonnes per aircraft. SWISS will retrofit its entire Boeing 777 fleet with AeroShark technology in the coming months. | |

| | | | Globally availableCO2 compensation on boardSince the start of November, Lufthansa passengers can offset the CO2 emissions of their flight directly on board. Passengers decide for themselves how they want to offset the emissions: with sustainable aviation fuel from biogenic residues or via carbon offset projects of the non-profit organisation myclimate. A combination of both options is also possible. Those who use the on-board compensation option can also see how many passengers have already offset the CO2 emissions of their individual flight on that day – and thus become part of a growing community. | |

| | | | LUFTHANSA GROUPYour Contacts Show PDF Show PDF

Andreas Bartels

Head of Corporate

Communications

Lufthansa Group  +49 69 696-3659 +49 69 696-3659

andreas.bartels@dlh.de andreas.bartels@dlh.de

|

Dr. Kay Lindemann

Head of Corporate

International Relations and

Government Affairs

Lufthansa Group  +49 30 8875-3030 +49 30 8875-3030

kay.lindemann@dlh.de kay.lindemann@dlh.de

|

Martin Leutke

Head of Digital Communication

and Media Relations

Lufthansa Group  +49 69 696-36867 +49 69 696-36867

martin.leutke@dlh.de martin.leutke@dlh.de

|

Jan Körner

Head of Government Affairs

Germany and Eastern Europe

Lufthansa Group  +49 30 8875-3212 +49 30 8875-3212

jan.koerner@dlh.de jan.koerner@dlh.de

|

Sandra Courant

Head of Political Communication

and Media Relations Berlin

Lufthansa Group  +49 30 8875-3300 +49 30 8875-3300

sandra.courant@dlh.de sandra.courant@dlh.de

|

Jörg Meinke

Head of EU Liaison Office

Lufthansa Group  +32 492 228141 +32 492 228141

joerg.meinke@dlh.de joerg.meinke@dlh.de

|

| |

| | | | Published by:

Deutsche Lufthansa AG

FRA CI,

Lufthansa Aviation Center

Airportring, D-60546 Frankfurt Andreas Bartels

Head of Communications

Lufthansa Group Dr. Kay Lindemann

Head of Corporate International

Relations and Government Affairs

Lufthansa Group Martin Leutke

Head of Digital Communication

and Media Relations

Lufthansa Group | Editor in Chief:

Sandra Courant

Head of Political Communication

and Media Relations Berlin

Lufthansa Group Editorial Staff:

Maximilian Kiewel, Dr. Christoph Muhle, Dennis Weber Press date:

7 December 2022 Agency Partners:

Köster Kommunikation

GDE | Kommunikation gestalten |

| |

|