| | | | Dear Readers, The Lufthansa family is planning to grow. Subject to approval by the authorities, Lufthansa will acquire a minority stake of 41 percent in ITA Airways. Lufthansa’s entry will secure the future of ITA, which cannot survive as a standalone company in national and international competition. The air transport market in Italy is currently dominated by low cost airlines. A strengthened ITA would offer new routes and additional flights, more choice, and more competition, which would benefit passengers, the tourism industry, and the country’s economic regions. The transaction would also be good for Europe, since ITA, as part of the Lufthansa Group with its multi-airline, multi-brand, and multi-hub strategy, would strengthen Italy’s connectivity within the EU and its connection to the rest of the world. Above all, the right regulatory steps are needed to secure Europe’s competitiveness as an air transport location. Unfortunately, despite many political commitments to fair international competition, there are no comparable competitive conditions between EU and non-EU airlines. On the contrary: The latest decisions make this imbalance worse. The best example of this is the binding quota for sustainable aviation fuels (SAF) adopted in the ‘Fit for 55’ climate protection package. Due to low availability and high prices for SAF, the quota will foreseeably lead to a one-sided burden on European airlines, driving up the costs of long-haul flights from European hubs in particular. We call for course corrections. On the other hand, the inclusion of air traffic in the EU taxonomy is a generally correct step toward more climate protection. The climate protection goals can barely be achieved without the financing of sustainable investments, such as fuel-efficient aircraft and SAF. However, for the taxonomy to have the desired effect, the specifications must be realistic and competitively neutral. To encourage more people to fly more sustainably, the Lufthansa Group introduced a new fare in February: The ‘Green Fares’ already include offsetting of individual, flight-related carbon emissions. Read in this issue of our Policy Brief how the offer has been received so far. We hope you enjoy reading it, and we wish you a pleasant summer and happy traveling! Andreas Bartels

Head of Communications

Lufthansa Group | Dr. Kay Lindemann

Head of Corporate International

Relations and Government Affairs

Lufthansa Group |

| |

| | | | Lufthansa and ITAGreater connectivityLufthansa is set to acquire a minority stake of 41 percent in ITA Airways, pending approval by the relevant authorities. The Italian Ministry of Economy and Finance has reached an agreement with Lufthansa on the acquisition. The transaction will foster competition in Italy and Europe, ultimately benefitting passengers. | |

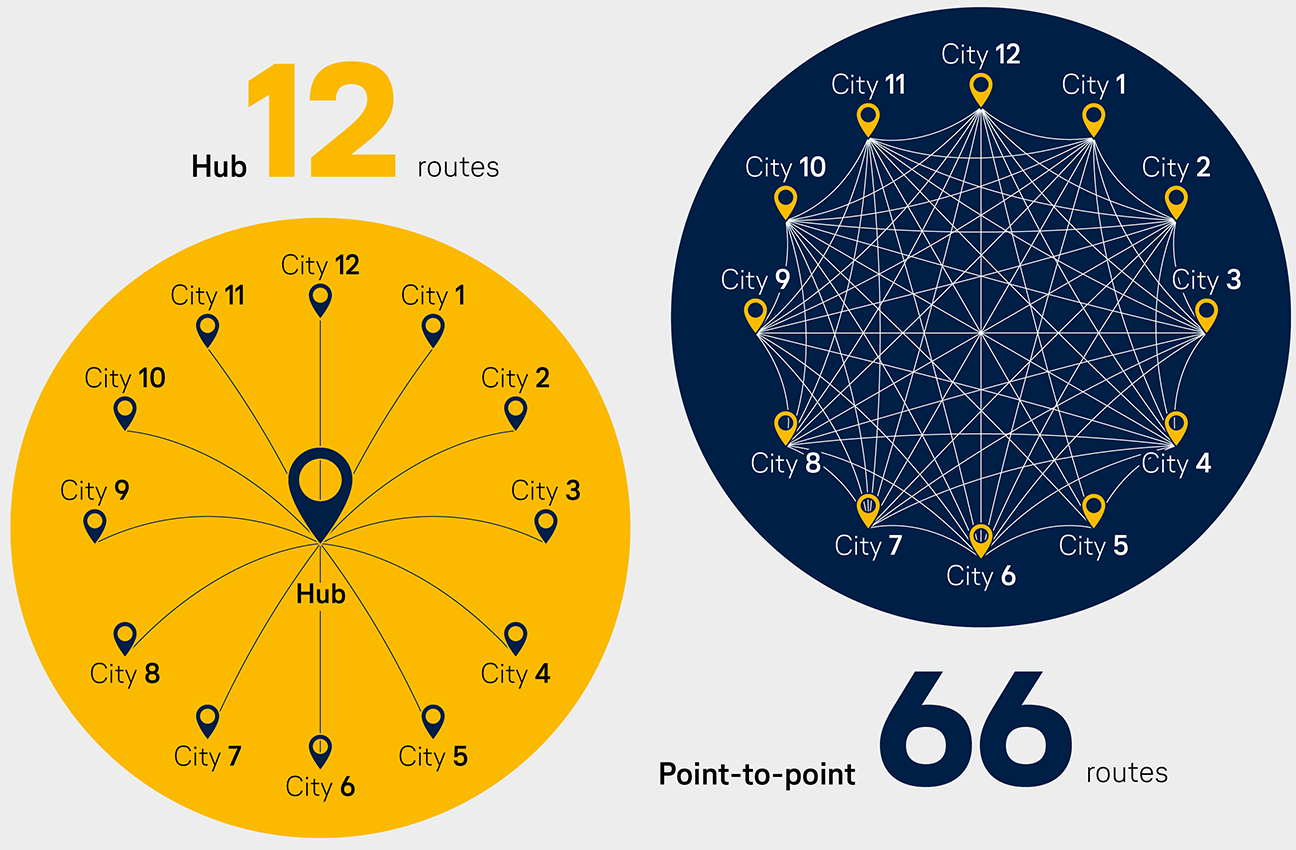

| | | | Hubs guarantee efficient and sustainable connectivity

Hub: Connecting 12 destinations with single transfer via a hub requires12 routes. Cities with lower demand benefit from the variety of hub connections.

Point-to-point: Connecting 12 destinations directly requires 66 routes and correspondingly high local demand between the cities.

| |

| | | | Currently, low-cost airlines dominate the Italian market. In 2022, Ryanair and easyJet had a combined market share of almost 50 percent in terms of passengers carried. ITA ranked fourth with 8 percent – still behind low-cost carrier Wizz Air. Lufthansa’s involvemeant will enable ITA to offer new routes and additional flights within Italy, Europe, and even intercontinentally. So far, the two airlines‘ services overlap only slightly, and ITA and Lufthansa will continue to operate different routes in the future. The overarching goal is to expand the route network and increase competition. Passengers will be provided with more options and fairer prices. Transaction secures the future of ITA

Since its establishment in 2021, ITA has faced significant financial losses. As a rather small airline, it cannot compete internationally in the medium term. Size is crucial for optimal investment, capacity and network planning. As an independent brand in the Lufthansa family – alongside Swiss, Austrian, Brussels Airlines, Eurowings, Eurowings Discover, Edelweiss, and Air Dolomiti – ITA can develop into a competitive airline while maintaining its Italian identity. With the privatization, the government in Rome is also responding to the ongoing criticism of the European Commission that repeated state aid to Alitalia has been distorting competition. In doing so, the government in Rome is continuing the path outlined by the Commission in its decision to approve the capitalization of ITA. Strong network airline for Europe

A strengthened ITA within the Lufthansa Group is not only beneficial for Italy, but for European aviation as a whole. On international routes, EU airlines compete with both European and non-European counterparts. Over the years, the high regulatory burden within the EU has led to a diversion of transfer traffic to other regions. As part of the Group, ITA would strengthen Europe’s connectivity in the domestic and international markets. In the LHG network, long-haul flights transport passengers from local catchment areas as well as well as from various cities grouped together through hubs. Passengers take short and medium-haul domestic and international flights to a hub airport, where they then transfer to their long-haul flight. This combination of local and transfer passengers ensures optimal capacity utilization and extensive connectivity – unlike direct connections. It offers advantages from both economic and environmental perspectives. Hubs are vital for reliable connections between Europe and the rest of the world. They provide flexibility, reduce dependence on individual locations, and offer a wide range of extensive intercontinental flights at competitive prices. As a network airline with a well-functioning hub in Rome, ITA is an ideal addition to the Lufthansa airline group. It will deliver benefits for the company, customers, and employees, and thus also for Italy, Germany, and Europe. | |

| | | | Sustainable fuelsThesis on falling costs is thinProposals to tighten the Emissions Trading System (ETS) and a blending quota for Sustainable Aviation Fuels (SAF) were adopted for the aviation sector as part of the “Fit for 55” climate protection package. Given the projected scarcity and high cost of sustainable aviation fuels, the quota must ensure a level playing field for airlines in the EU vis-à-vis non-European competitors. Additionally, it is crucial to establish a dedicated SAF funding program. | |

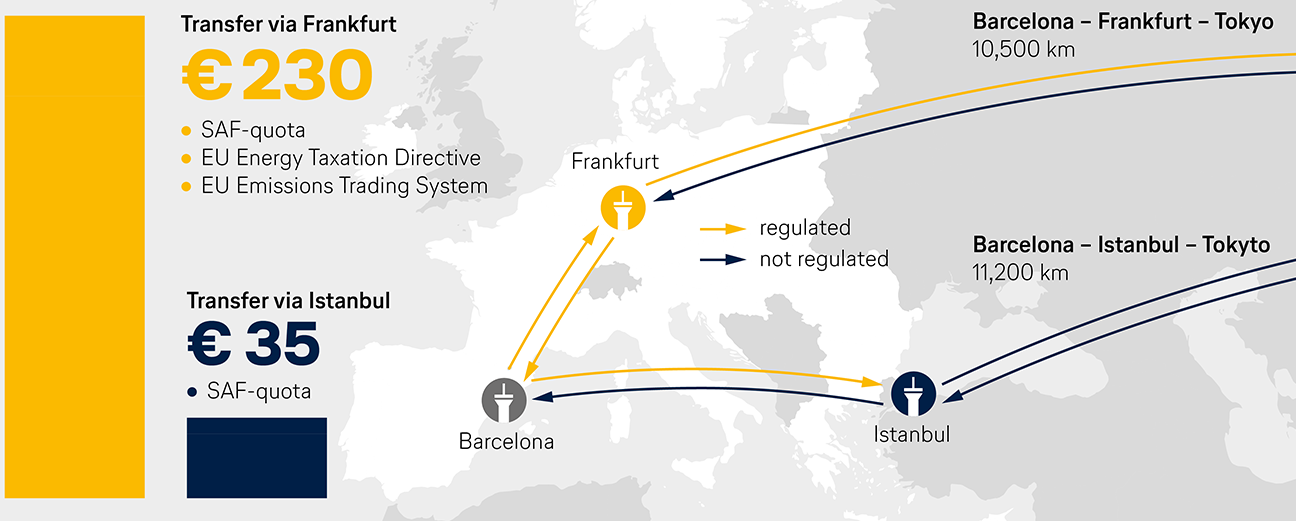

| | | | “Fit for 55” extra costs per ticket 2035

| |

| | | | Both the reform of the ETS and the quota for sustainable aviation fuels create unfair competitive conditions as they primarily affect European airlines. In particular, the design of the SAF quota has a distorting effect on competition, as it unilaterally increases the costs of connecting flights through European hub airports. Airlines with hubs at the gateways of Europe, such as Istanbul or Doha, benefit from this situation as they can offer long-haul connections at a significantly lower price. This quota is detrimental in terms of both industrial and climate policy, as it merely shifts emissions instead of reducing transport-related CO2 emissions (carbon leakage). The following example illustrates the extent of the competitive disadvantage created by the “Fit for 55“ measures: According to current predictions, a Lufthansa flight from Barcelona to Tokyo with a layover in Frankfurt and a return trip will cost approximately 230 euros extra per ticket in 2035. A flight via Istanbul with a competitor, on the other hand, will only cost about 35 euros extra per ticket. The decisive factor here is the SAF quota. Most of these additional costs, more than 170 euros per ticket, are due to the high price of sustainable kerosene. The SAF costs alone for the Lufthansa Group are enormous: around 4.6 billion euros per year from 2035. In comparison, Lufthansa Group’s profit averaged around 1.2 billion euros during the successful period between 2010 and 2019. In addition, Lufthansa invests billions every year in climate protection measures, regardless of any regulatory requirements. In addition to its commitment to SAF, these investments primarily focus on new aircraft. | |

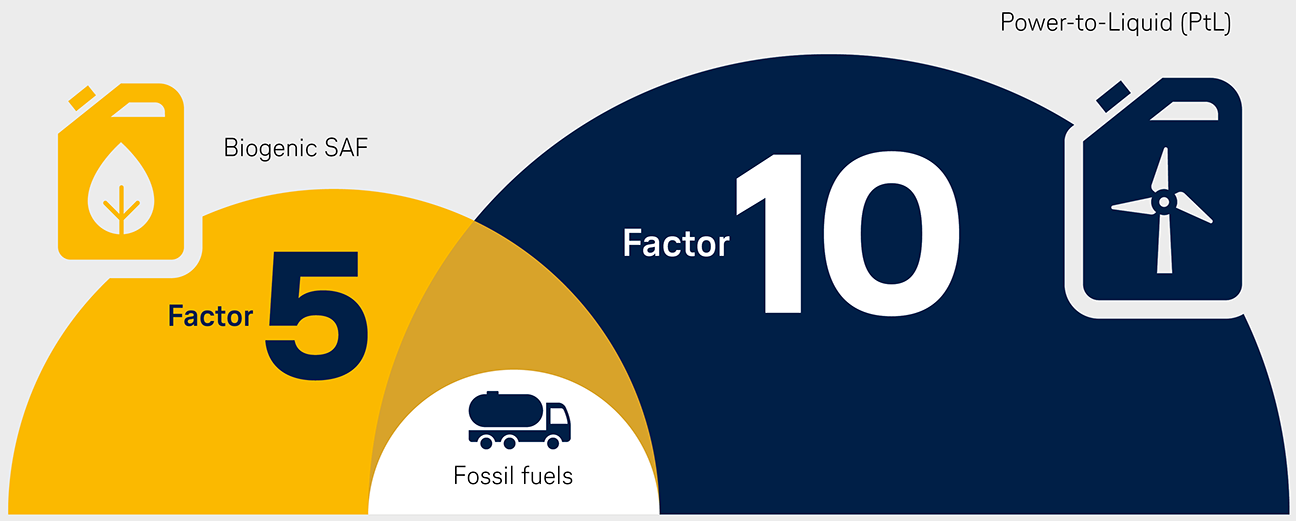

| | | | Massive price difference between fossil fuels and sustainable fuels

| |

| | | | Price development for SAF is uncertain

Currently, biogenic SAF is about five times more expensive than fossil kerosene, while electricity-based fuels (Power-to-Liquid = PtL) are even up ten times more expensive. Proponents of high quotas argue that the SAF market ramp-up will lead to lower prices. However, there is no evidence to suggest that such a reduction is happening anytime soon. A recent study conducted by the consulting firm Bain supports this notion, stating that the limited availability of biomass will likely keep the costs of SAF high. Even beyond 2050, forecasts indicate that SAF will remain approximately two to four times more expensive than traditional kerosene. Completely uncertain is the future price and production capacity of electricity-based fuels. Currently they are only available from test facilities. The consequences of the pandemic, war, inflation and supply chain disruptions are hindering production. Nevertheless, the EU has adopted a PtL sub-quota, which will start at 1.2 percent in 2030 and rise to 35 percent by 2050. All member states are expected to comply with this EU-wide requirement to avoid distorting competition within the EU. As things stand today, it is unlikely that there will be sufficient electricity-based fuel in order to meet the PtL quotas. If the fuel blending requirements increase in the EU over the years without a decrease of SAF prices, the gap between competitors will continue to widen. Price adjustments are necessary: - Germany: The German government must take account of the EU harmonization of PtL quotas and refrain from unilateral national initiatives before 2030. Incentive systems for SAF and PtL must promote production and use of sustainable aviation fuels. Effective funding mechanisms, primarily for initial cost-intensive large scale projects, need to be implemented unbureaucratically. This is the only way SAF and PtL quotas can be met.

- EU: The review process outlined in ReFuelEU must be used to correct the design of the SAF quota. Equal treatment of airlines and hubs in Europe vis-à-vis non-European competitors is necessary. One possible solution would be a European climate protection levy that would be charged to all airlines depending on the destination of travel (using the German air traffic tax as a model). In addition, an EU-wide SAF funding program is necessary. EU aviation agreements with third countries must focus more intensely on the market ramp-up for SAF.

- Globally: As an international climate protection instrument, CORSIA must be systematically implemented and further developed. A global SAF quota would be the right instrument to ensure fair international competition and accelerate market development.

| |

| | | | Air traffic in GermanyHigh location costs hindering recoveryAir transport in Europe is almost back to pre-crisis level. A number of countries are already setting new records. In Germany, however, air transport is recovering rather slowly. Why is that? | |

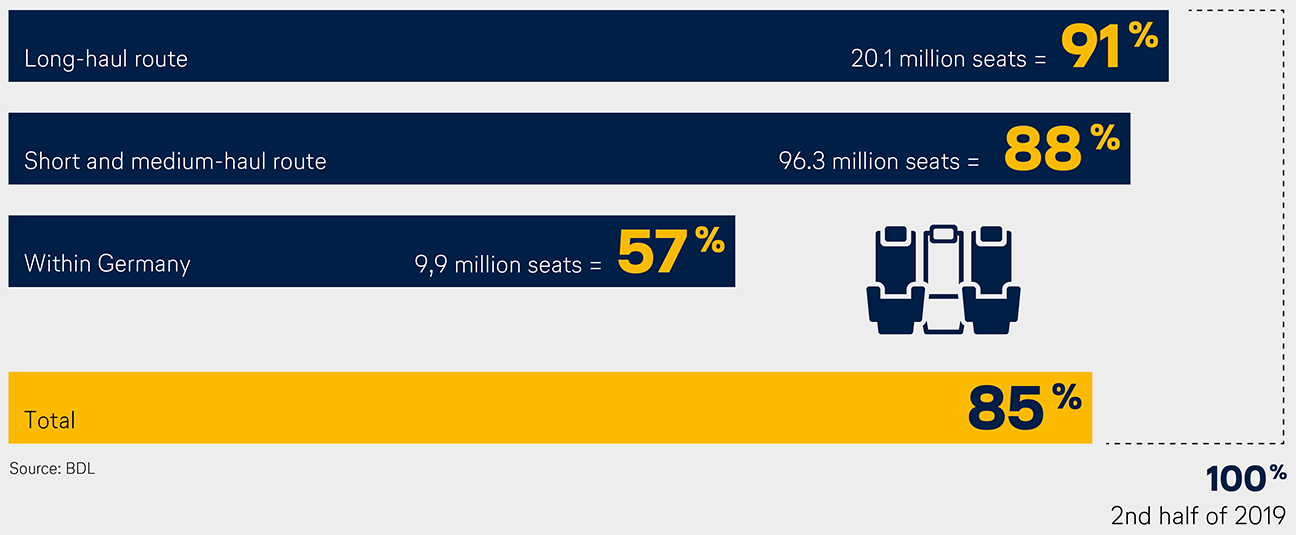

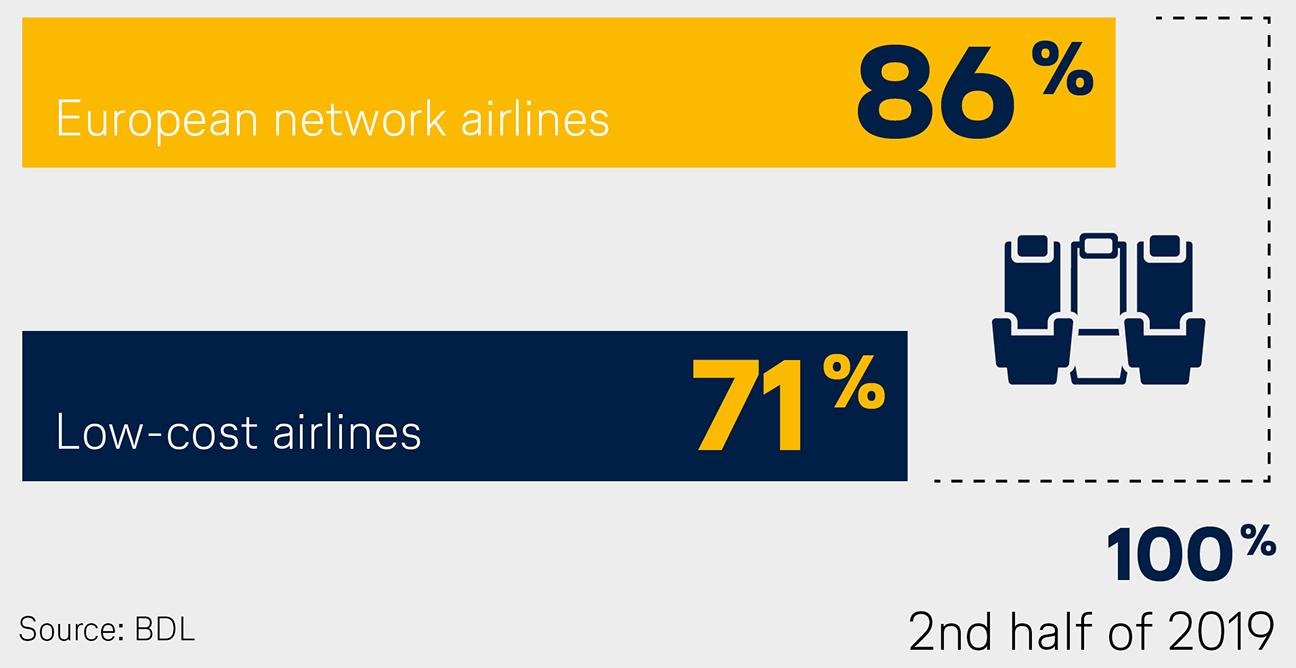

| | | | Seat capacity by target region

2nd half of 2023

| |

| | | | There is increasing speculation about Lufthansa’s influence on the still underdeveloped flight offer in the German aviation market. The facts: In Europe and Germany, high demand for air travel often meets an infrastructure with limited capacity. Following the events of last summer, the industry has drawn important conclusions to bolster its resilience. Lufthansa is currently in the midst of a robust staffing initiative, and many airports are actively seeking new employees. Priority: stable flight plan

There are, however, still bottlenecks with service providers, airspace management and spare parts supply. Given this situation, Lufthansa’s main focus is offering as many connections as possible that can be operated reliably. Our top priority is to maintain a stable flight schedule, particularly in hub traffic. The feeder network requires careful coordination and reliable execution. Despite the diligent planning, there may be instances where our customers experience a decline in service quality due to certain shortcomings, such as baggage transport issues. In addition to this: For numerous domestic routes, the train presents a convenient alternative. Lufthansa has further strengthened and expanded its cooperation with Deutsche Bahn. For every feeder flight to Frankfurt, Lufthansa now offers an intermodal option: Lufthansa Express Rail. A total of 550,000 passengers opted for this combined ticket last year. The offer covers 26 destinations across Germany. | |

| | | | Trend in seat capacity from Germany

2nd half of 2023 compared with the same period in 2019

| |

| | | | Low-cost airlines are withdrawing

Point-to-point traffic within Germany – beyond the Frankfurt and Munich hubs – is in noticeable decline. This is due to the gradual withdrawal of low-cost airlines from Germany. The trend began even before the Coronavirus pandemic – and it continues. In August 2019, for example, Ryanair decided to remove all domestic flights in Germany from its program. Since then, the Irish company has reduced its fleet stationed in Germany almost by half. EasyJet has significantly reduced its presence at Berlin airport, operating from a much smaller base than before. Eurowings has partially filled the gap left by easyJet‘s withdrawal. The decision of the low-cost carriers appears to be voluntary and intentional, for one recurring reason: High location costs in Germany. Consequently, for airlines such as Ryanair it is simply more profitable to allocate their aircraft to other regions in Europe. These low-cost airlines aggressively seek growth primarily in Southern and Southeast Europe, showing limited commitment to specific locations. They tend to withdraw their services in regions where subsidies are not or no longer available. Interestingly, there is little disparity between price developments in markets dominated by low-cost operators and those in international aviation. For instance, in Italy, Ryanair holds a dominant market position as the leading low-cost provider, alongside two other competitors. Nevertheless, despite this strong competition, the price increase in the Italian market remains notably higher than in Germany. | |

| | | | Train to the plane

Lufthansa offers ICE feeder connections to Frankfurt Airport from 26 cities - with one ticket and a transfer guarantee.

How to book Lufthansa Express Rail 1. In the flight search, select one of our many Lufthansa Express Rail stations as your departure airport.

2. Then determine your Lufthansa Express Rail connection in the flight overview.

3. Book easily and check in online for both your train and flight between 23 hours and 15 minutes before departure.

4. Enjoy a seamless and relaxed journey to your departure at Frankfurt Airport – with a transfer guarantee. | |

| | | | Location costs at a record level

Germany is one of the most expensive aviation locations in Europe. The air traffic tax was increased just before the coronavirus pandemic and the aviation security charges remain high. Moreover, at the beginning of 2023, air traffic control fees reached a record level. In just two years, the terminal charge in Germany has nearly doubled. These soaring charges are having a particularly strong impact on domestic air traffic within the country. Additionally, politically induced costs continue to rise, partly due to the latest EU resolutions on climate change policy. It is evident that an integrated transport and climate change policy is necessary to optimize Germany’s international connectivity. Unfortunately, Germany is falling behind in a European comparison due to the conflicting goals it pursues. The expectations to provide as many flight connections as possible are not realistic if the shift to rail is politically desired. | |

| | | | “Overall, Germany has become less attractive as a location. (…) There is a lack of incentives to expand our presence in Germany. (…) However, we will prefer to station new aircraft in other markets where airlines have incentives to station capacity, for example in Poland or Italy.” Annika Ledeboer

Ryanair, Country Manager for Germany | |

| | | | New fare for more climate-friendly flyingGreen Fares are hereFlying more sustainably is now just a click away. Since February, Lufthansa Group has been the world’s first airline group to offer fares that include offsetting of individual, flight-related CO2 emissions. Our goal is to encourage more people to choose sustainable flying options. | |

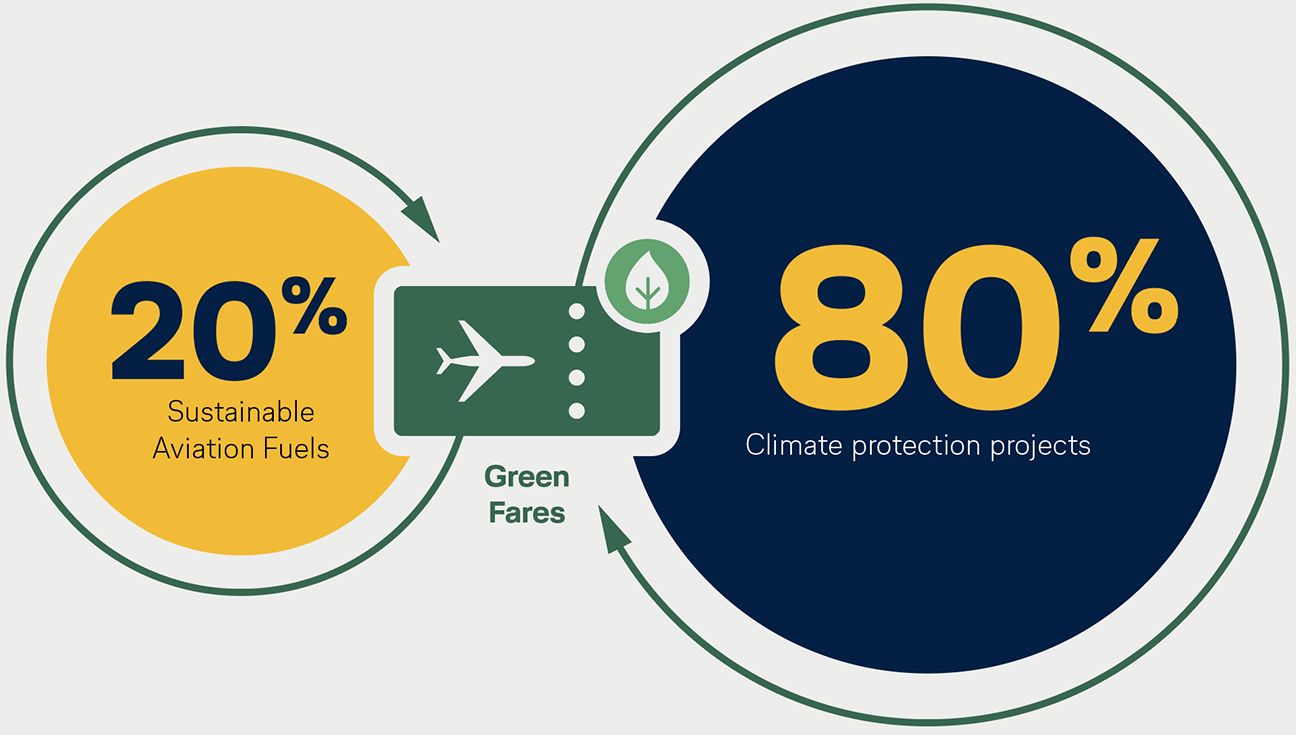

| | | | Green Fares

Reducing and offsetting CO2 emissions through alternative fuels and climate protection projects

Since the introduction of the new fare, more than 265,000 passengers have opted for Green Fares. They have thus reduced or offset their CO2 emissions by a total of 27,500 tonnes. The fares can be booked with Lufthansa, Austrian Airlines, Brussels Airlines, SWISS, Edelweiss, Eurowings Discover, and Air Dolomiti on more than 730,000 flights per year within Europe and to North Africa. The route with the most Green Fares bookings is Zurich-London with SWISS, followed by Hamburg-Munich with Lufthansa. | |

| | | | Lufthansa Group aims to halve its net CO2 emissions by 2030 compared to 2019, and to be carbon-neutral by 2050. To achieve this, we are investing billions of euros in modern, fuel-efficient aircraft. This year, Lufthansa Group received a new aircraft every ten days on average. We have been purchasing and using biogenic SAF (Sustainable Aviation Fuels) for several years, and are already investing in the next generation of SAF, such as Power-to-Liquid and Sun-to-Liquid technologies. The Lufthansa Group is actively involved in numerous collaborations and projects worldwide to ensure greater SAF availability. At the same time, we want to make it easier for our customers to reduce the carbon footprint of their flights. For quite some time now, Lufthansa Group passengers have had the option to offset the CO2 emissions of their journey. This can be achieved either by using SAF or through certified climate protection projects to offset flight-related emissions. In mid-February, Lufthansa Group launched a new fare that combines both measures. Green Fares offer numerous advantages: - Climate protection: For the offsetting of CO2 emissions, 20 percent are offset through the use of Sustainable Aviation Fuels (SAF), while the remaining 80 percent are achieved by contributing to climate protection projects certified to the highest standards.

- Convenience: The fare can be selected directly in the booking process. Previously, the compensation of the flight had to be selected at the end of the booking process.

- Attractiveness: Passengers who opt for Green Fares receive additional status miles and enjoy a free rebooking option.

Green Fares have proven to be a successful product. Until the end of last year, only one percent of our passengers had chosen the offsetting option. This figure has now increased

to three percent. Our new goal is to reach five percent by the end of the year. | |

| | | | EU TaxonomyTransformation of aviation requires investmentThe EU Taxonomy defines sustainable economic activity and aims to stimulate private investment. The Taxonomy is also of central importance for climate protection in the aviation industry. However, the requirements are becoming increasingly unrealistic and are distorting competition. | |

| | | | In the Taxonomy Regulation presented in June, the European Commission expanded the scope to manufacturing, leasing, and operation of aircraft whereas previously, only airport infrastructure was included. The expansion to include modern aircraft and Sustainable Aviation Fuels (SAF) is a logical development. All are effective levers for transitioning to a carbon-neutral aviation industry. The financing and promotion of these technologies can therefore be classified as sustainable investment. The use of SAF and the procurement and leasing of new aircraft are very costly. According to a recent study, European airlines will need to raise an additional 820 billion euros to achieve carbon neutrality by 2050. Access to capital markets and investment funds is crucial for these enormous expenditures, which is why aviation must be included in the Taxonomy. Balancing ambition and feasibility for climate protection

In its proposal, the European Commission defines criteria for determining the extent to which an economic activity is or is not considered sustainable. To ensure that the Taxonomy has the desired effect, it is important that the specifications are realistic and promote fair competition. The assessment criteria for aviation are exceedingly ambitious by current standards and, in some cases, unattainable. For instance, the requirement for emission-free aircraft is an unrealistic expectation. Another example is the “one-in-one-out” rule for fleet modernization, which stipulates that for every newly purchased aircraft, a comparable previous model must be scrapped. Only then is operation of a new aircraft fully Taxonomy-compliant. This means that for the deployment of a newly purchased aircraft, a comparable previous model must be retired. Such a requirement unnecessarily hinders airlines’ ability to finance more sustainable growth. The same challenge applies to the mandated use of SAF in flight operations. To meet the Taxonomy criteria, older aircraft must operate with an average of 9 percent SAF starting as early as 2024 – with this percentage increasing by two points each year. Furthermore, new, low-emission aircraft must be fueled with an average of at least 15 percent SAF starting in 2030, with this target value also increasing by two percentage points annually in subsequent years. SAF incentives crucial for market development

In particular, the short-term rates of increase for the use of SAF are difficult to achieve in the foreseeable future, due to limited availability and high prices of SAF. Simply setting politically motivated targets is insufficient to develop a competitive and cost-effective SAF market. Targeted support, such as the US Inflation Reduction Act (IRA), which provides incentives for the production and use of SAF, is needed. The Taxonomy plays an important role in achieving climate targets in aviation. It is crucial that EU airlines are not disadvantaged compared to non-European competitors

in terms of operations and financing. The expansion of state airlines outside of the EU neither serves the climate nor the European economy. Being able to raise capital more easily

in high-revenue intercontinental traffic and bypassing the EU Taxonomy leads to carbon leakage, but also undermines the success of the long-term success of the Green Deal.

This is a case of overreach by the EU. | |

| | | | LUFTHANSA GROUPYour Contacts Show PDF Show PDF

Andreas Bartels

Head of Corporate

Communications

Lufthansa Group  +49 69 696-3659 +49 69 696-3659

andreas.bartels@dlh.de andreas.bartels@dlh.de

|

Dr. Kay Lindemann

Head of Corporate

International Relations and

Government Affairs

Lufthansa Group  +49 30 8875-3030 +49 30 8875-3030

kay.lindemann@dlh.de kay.lindemann@dlh.de

|

Martin Leutke

Head of Digital Communication

and Media Relations

Lufthansa Group  +49 69 696-36867 +49 69 696-36867

martin.leutke@dlh.de martin.leutke@dlh.de

|

Jan Körner

Head of Government Affairs

Germany and Eastern Europe

Lufthansa Group  +49 30 8875-3212 +49 30 8875-3212

jan.koerner@dlh.de jan.koerner@dlh.de

|

Sandra Courant

Head of Political Communication

and Media Relations Berlin

Lufthansa Group  +49 30 8875-3300 +49 30 8875-3300

sandra.courant@dlh.de sandra.courant@dlh.de

|

Jörg Meinke

Head of EU Liaison Office

Lufthansa Group  +32 492 228141 +32 492 228141

joerg.meinke@dlh.de joerg.meinke@dlh.de

|

| |

| | | | Published by:

Deutsche Lufthansa AG

FRA CI,

Lufthansa Aviation Center

Airportring, D-60546 Frankfurt Andreas Bartels

Head of Communications

Lufthansa Group Dr. Kay Lindemann

Head of Corporate International

Relations and Government Affairs

Lufthansa Group Martin Leutke

Head of Digital Communication

and Media Relations

Lufthansa Group | Editor in Chief:

Sandra Courant

Head of Political Communication

and Media Relations Berlin

Lufthansa Group Editorial Staff:

Franziska Feinig, Benedikt Jäger, Markus Karassek, Heide Kiser, Alexander Lutz, Dr. Christoph Muhle, Jan Pechstein Press date:

25 July 2023 Agency Partners:

Köster Kommunikation

GDE | Kommunikation gestalten |

| |

|