| | | |

Dear Readers,

The Lufthansa Group is committed to the European idea. Not only on the cover of our new Policy Brief, but also with our flying ambassadors in the skies. With the clear commitment “Yes to Europe”, four planes of our Group airlines are flying throughout Europe just in time for the start of the European election campaigns, advocating for a positive attitude towards the EU and for active participation in the election. Flying to and from Germany is expensive. Almost no year goes by without an increase of air travel costs. 2024 is no exception: As of May 1st, the aviation tax will be increased again. This trend of constantly rising state levies must be corrected. Otherwise, Germany risks being left behind in the long term. The waves of strikes in recent months have also caused economic damage. Not only, but also in aviation, the limits of proportionality were often exceeded in the industrial disputes. How could things be done differently? We make suggestions in this new issue of our Policy Brief. Thirdly, costs: the question of feasibility and financial viability remains unanswered when it comes to sustainable fuels. Sustainable Aviation Fuels (SAF) are the kerosene of the future. At present, however, they are only available in small quantities and at horrendous prices. Even though a self-sustaining market is not yet in sight, neither in Germany nor in Europe, in a few months the EU blending mandate will come into effect. From 2025, airlines will have to refuel with biogenic SAF when departing from a European airport. In 2030, a blending obligation for synthetic fuels (power-to-liquid = PtL) will be added. Why these quotas are out of touch with market reality and what needs to be done, is also discussed in the following pages. Enjoy the reading! Andreas Bartels

Head of Corporate

Communications

Lufthansa Group | Dr. Kay Lindemann

Head of Corporate

International Relations and

Government Affairs

Lufthansa Group

|

| |

| | | | “YES TO EUROPE”Flying ambassadors for the European ElectionsIn just over six weeks, around 350 million Europeans will be called upon to cast their votes. This election is crucial, as Europe needs stability. Four Lufthansa Group airlines are flying for the European idea. | |

| | | | A clear message on the ground and at an altitude of more than ten kilometers, spread across the entire continent! Starting this week, Lufthansa Group planes will be flying across our skies with the statement “Yes to Europe”. A total of four Airbus A320 will become ambassadors of the European idea in light of the EU elections. With the special livery, the Lufthansa Group calls for participation in the European elections, which take place every five years. Every day, the airlines of the Lufthansa Group connect thousands of people through Europe and from there out into the world. With this initiative, the Lufthansa Group is sending out a signal for a free, united continent and a strong democracy. European Stars in the European Sky

Lufthansa and Eurowings will kick things off this week. In the following days, Austrian Airlines and Brussels Airlines will each send a special livery plane into the European sky. The words “Yes to Europe” can be read on the fuselage, framed by the European stars. During the European Parliament elections in 2019, Lufthansa had already made a similar commitment to Europe with a special livery, thereby advocating for active participation in the voting process. The elections to the European Parliament will take place between 6th and 9th June, 2024. In the 2019 elections, over 50 percent of eligible Europeans exercised their right to vote. This marked the highest voter turnout in 20 years. | |

| | | | HIGH LOCATION COSTSGermany is losing outFlying to and from Germany is becoming increasingly expensive. While most other EU countries have overcome the crisis, the recovery in Germany is faltering. A strong aviation location requires a political change in direction. | |

| | | | Expensive air traffic location

If an intra-European flight with the medium-haul A320 neo aircraft takes off from Stuttgart, Frankfurt, or Düsseldorf, almost 4,000 euros in state-imposed charges* (excluding airport charges) are due. An amount that is much larger than in other EU countries. The Spanish state, for example, charges only 600 euros at Madrid and Barcelona airports. By the way: Lufthansa earns an average of around 15 euros per passenger.

| |

| | | | Air traffic is growing, but not in Germany. While most European countries have already returned to pre-crisis levels by 2023, seat capacity in Germany is only around 80 percent compared to before the Covid-19 pandemic. That figure is even lower for some airports, such as Berlin, Stuttgart, or Düsseldorf. The loss of connectivity for the affected economic regions is considerable. Traffic within Germany is particularly weak. According to forecasts by the German Aviation Association (BDL), the recovery rate in summer 2024 will be around 50 percent compared to 2019; and only at 25 percent without hub traffic. There are also serious cutbacks in connections with European metropolitan regions. Excluding tourist destinations, the point-to-point route network with a starting point in Germany has thinned out noticeably. Government location costs keep rising

The main reason for this development: Flying to and from Germany is too expensive. The already high costs have recently increased significantly again. The most striking examples are the air traffic tax, which was increased by up to 77 percent in 2020, and the air traffic control charges, which have more than doubled since 2021. Low-cost airlines have reacted to the cost explosion by significantly reducing their domestic flight offers – they are expanding elsewhere. Relief is not in sight. On the contrary, the cost disadvantages threaten to become structurally entrenched. On May 1, 2024, the air traffic tax will increase by another 20 percent. Aviation security fees will increase in 2025 by up to 50 percent. In many parts of Germany, total costs have long since become an obstacle to international connectivity. This is exacerbated by the one-sided, competition-distorting burdens of EU climate protection policy. For Germany’s competitiveness, this development is dangerous. Intermodal services cannot compensate for the lack of medium-haul routes. And on long-haul routes, the domestic aviation industry risks losing important market share. After all, it is not the environment that benefits from more expensive domestic feeder traffic – even if this is a widespread misconception. Instead, the winners are international network airlines that direct transfer passengers from Germany to their foreign hubs. The airlines from the Gulf and Bosporus, in particular, are uncompromisingly supported in this strategy by their national governments. All of this must be taken into account by policymakers. Targeted corrections are necessary, relief is overdue. Otherwise, Germany will lose valuable market share in air transport and growth potential in its export-oriented industry. Those who continue to drive up costs will also jeopardize the country’s strategic independence and autonomy in the long term. The traffic figures clearly show one thing: International aviation continues to grow – with or without Germany. | |

| | | | SAF blending mandate from 2025Where is the market? From January 1, 2025, airlines departing from the EU will be obliged to cover an average of two percent of their fuel requirements from sustainable aviation fuels (SAF). By 2050, this requirement is to rise to 70 percent. Despite assurances to the contrary, a functioning SAF market and an effective support strategy are not in sight. | |

| | | | SAF demand significantly exceeds supply

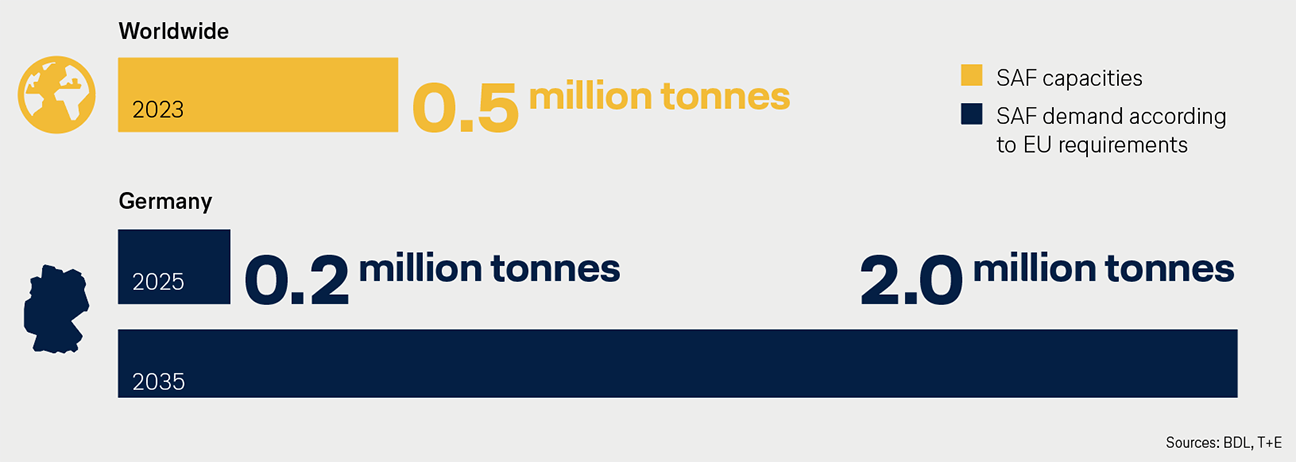

In 2023, 500,000 tonnes of SAF were produced worldwide. Germany alone will need 200,000 tonnes in the coming year to meet the European SAF blending mandate requirements. In view of the global competition for SAF, it is difficult to imagine that sufficient capacities will be available in the short term.

| |

| | | | 500,000 tonnes – that’s how much or how little sustainable kerosene was available worldwide in 2023. The annual fuel requirement of global air traffic is 280 million tonnes. This shows that SAF is barely available at the moment. The Lufthansa Group airlines could only fly for a few weeks with all the SAF currently available worldwide. However, the EU’s blending mandate will enter into force in just eight months. In Germany alone, around 200,000 tonnes of SAF will be needed by then and as much as two million tonnes by 2035. These quantities are currently not available. The necessary production ramp-up is more uncertain than ever. Current PtL blending mandates cannot be met

The situation is even worse for electricity-based fuels (power-to-liquid = PtL). From 2030, the EU stipulates that 1.2 percent PtL must be blended in. At German airports, the target is 0.5 percent from 2026. Yet, it is already clear today that these blending mandates cannot be met because there will not be enough synthetic fuel available. In Europe, only three PtL plants are currently in the concrete planning stage. Even if they were completed on time, the total capacity of 100,000 tonnes produced there would not even cover the German demand in 2030. A reality check of these requirements is needed. Germany has to abandon its special path and align its PtL targets with those of the EU. Additional distortions of competition inevitable

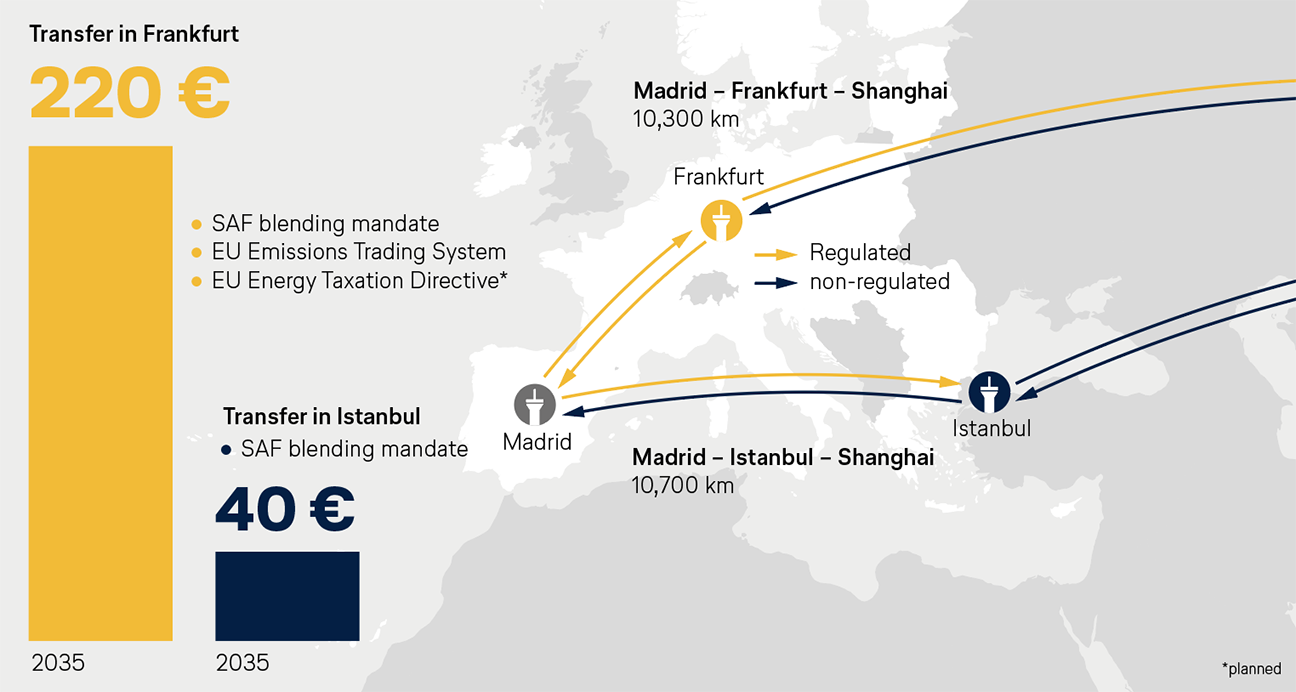

The second obstacle to the increased use of SAF is its high price. Biogenic SAF currently costs around three to five times more than fossil kerosene, while PtL is forecasted to be up to ten times more expensive. This puts European network airlines at a significant competitive disadvantage as it increases the cost of transfer via EU hubs where SAF must be refuelled: A Lufthansa flight from Madrid with a transfer in Frankfurt to Shanghai and back will cost around 220 euros more in 2035. In contrast, for a journey with a non-EU airline via Istanbul, the costs per ticket will only increase by around 40 euros. The Singapore model

The example of Singapore demonstrates how the ramp-up of SAF can be financed and distortions in competition mitigated. The country recently decided on a passenger levy based on the distance of a flight from Singapore. The revenue will then be used to purchase SAF, which will ensure a more stable supply. Targeted promotion of SAF

A similar strategy has so far been lacking in the EU as well as in Germany. The planned SAF blending mandates would be a further competitive disadvantage for European airlines and hubs, which already have to bear significantly higher cost burdens than airlines outside Europe due to numerous EU regulations and requirements. Effective incentives are needed: - Use German air traffic tax for SAF: As originally planned, the revenue from the aviation tax should be used to promote sustainable aviation fuels. Corresponding funds must be made available in the 2025 budget.

- Leverage the potential of the Net-Zero Industry Act: The Net-Zero Industry Act (NZIA) provides the framework for EU member states to introduce effective SAF support programs. It is crucial to seize this opportunity and ensure that Europe has sufficient SAF at competitive prices in the long term.

- Correct EU aviation policy: Fit for 55 must not lead to the weakening of airlines and hubs in the EU. Corrections are needed to ensure fair global competition. To finance the SAF blending mandate, a SAF levy should be introduced, similar to that in Singapore, depending on the destination – but regardless of where connecting passengers change planes. This would ensure equal treatment between EU airlines and their non-European competitors.

| |

| | | | SAF blending mandates unilaterally drive up costs for EU airlines

The SAF blending mandates are by far the biggest cost drivers in the EU’s Fit for 55 package.

| |

| | | | Air travel strikesClear rules necessaryCancelled business appointments, shattered vacation dreams, or missed family visits: The recent strike waves in Germany’s aviation industry have put a severe strain on passengers, companies, and the German economy. Strikes were once considered the sharpest weapon in the struggle for wage agreements, but now they seem to become the standard. Legislators should regulate the right to strike for critical infrastructures accordingly. | |

| | | | Strikes in the first quarter of 2024

| |

| | | | In Germany, practically everything is regulated by law, except the right to strike. The courts have the right to decide on the proportionality and legality of strike actions on the basis of judicial law. This leads to considerable legal uncertainty, as judicial rules on labour disputes are case-specific and decisions are often only made at the last moment. Learning from other EU countries

Our European neighbours demonstrate that this can be done differently. Several European countries have established legal rules for strikes. Spain in particular can serve as a role model in this regard: A triad of notification periods, emergency service agreements, and a mandatory arbitration procedure ensure proportionality in the right to strike. Politics, trade unions, and companies should jointly examine the Spanish model and derive regulatory principles for labour disputes in Germany. 16 strike waves in three months

Otherwise, developments like those we experienced in the first quarter of 2024 will be repeated in the future: In Germany, there were a total of 16 waves of strikes in the aviation sector in the first three months of the year. For the Lufthansa Group alone this meant a loss of revenue of more than 350 million euros. Unlike in the manufacturing industry, this loss of revenue cannot be compensated for by subsequent extra shifts. A flight cancelled due to a strike cannot be made up and is therefore a lost flight. Arbitration before strikes

Due to the “new normal” in negotiation tactics, Germany is at risk of falling even further behind in international competition. Confrontation instead of cooperation jeopardizes growth and prosperity. That is why a mechanism is needed that focuses on negotiations – and ensures that only if negotiations ultimately fail, strikes can be called. Especially in areas of critical infrastructure, such as the aviation industry, the following must apply: arbitration before strikes! | |

| | | | One year of Green FaresDemand is increasingSince February 2023, more than one million Lufthansa Group passengers have already opted for a Green Fares ticket and thus offset their individual flight-related CO2 emissions. In total, over 77,000 tonnes of CO₂ have been offset. | |

| | | | Green Fares make an impact

Green Fares tickets have already offset over 77,000 tonnes of CO2 – the equivalent of more than 12,000 flights from Hamburg to Munich.

| |

| | | | 20 percent of the CO2 emissions are offset through the use of sustainable aviation fuel (SAF) and 80 percent through a contribution to high-impact climate-protection projects. Since its introduction, an average of three percent of our passengers have opted for this offer – and the trend is rising. The new fare is particularly popular with business travellers: In Business Class, Green Fares tickets are already being selected for eleven percent of bookings via the Lufthansa Group portals. Green Fares are available for flights in Europe and to North Africa. The Lufthansa Group is currently also testing the fare on selected long-haul routes. | |

| | | | CO2 storageLufthansa invests in CCS technologyThe goal of the Intergovernmental Panel on Climate Change (IPCC) is clear: in order to limit global warming sufficiently, CO2 emissions must be massively reduced and additional carbon capture technologies are required. This applies in particular to sectors that are difficult to decarbonize, such as aviation. The Lufthansa Group is now one of the first aviation companies to take the pioneering role in this technology. | |

| | | | With the Direct Air Carbon Capture and Storage (DACCS) technology, CO2 is filtered out of the air and stored permanently. The Lufthansa Group has signed a contract with Airbus for the advance purchase of verified and permanent emission reduction credits for 40,000 tonnes of CO2 from DACCS technology. The certificates will be available from 2026. This approach complements the Lufthansa Group’s sustainability strategy, the key components of which are the consistent modernization of the fleet, the use of sustainable aviation fuels and the continuous optimization of flight operations. In addition, the Lufthansa Group airline SWISS is the first company in the airline industry to enter into a strategic partnership with the Swiss company Climeworks. The aim is to jointly scale this innovative technology for removing CO2 from the air. | |

| | | | LUFTHANSA GROUPYour Contacts Show PDF Show PDF

Andreas Bartels

Head of Corporate

Communications

Lufthansa Group  +49 69 696-3659 +49 69 696-3659

andreas.bartels@dlh.de andreas.bartels@dlh.de

|

Dr. Kay Lindemann

Head of Corporate

International Relations and

Government Affairs

Lufthansa Group  +49 30 8875-3030 +49 30 8875-3030

kay.lindemann@dlh.de kay.lindemann@dlh.de

|

Martin Leutke

Head of Digital Communication

and Media Relations

Lufthansa Group  +49 69 696-36867 +49 69 696-36867

martin.leutke@dlh.de martin.leutke@dlh.de

|

Jan Körner

Head of Government Affairs

Germany and Eastern Europe

Lufthansa Group  +49 30 8875-3212 +49 30 8875-3212

jan.koerner@dlh.de jan.koerner@dlh.de

|

Sandra Courant

Head of Political Communication

and Media Relations Berlin

Lufthansa Group  +49 30 8875-3300 +49 30 8875-3300

sandra.courant@dlh.de sandra.courant@dlh.de

|

Ruben Schuster

Head of EU Liaison Office

Lufthansa Group  +32 492 228141 +32 492 228141

ruben.schuster@dlh.de ruben.schuster@dlh.de

|

| |

| | | | Published by:

Deutsche Lufthansa AG

FRA CI,

Lufthansa Aviation Center

Airportring, D-60546 Frankfurt Andreas Bartels

Head of Corporate

Communications

Lufthansa Group Dr. Kay Lindemann

Head of Corporate International

Relations and Government Affairs

Lufthansa Group Martin Leutke

Head of Digital Communication

and Media Relations

Lufthansa Group | Editor in Chief:

Sandra Courant Editorial Staff:

Franziska Feinig, Anton Heinecke, Markus Karassek, Marie Merscher, Dr. Christoph Muhle, Albert Sauerwein Press date:

24 April 2024 Agency Partners:

Köster Kommunikation

GDE | Kommunikation gestalten |

| |

|