| | | | Policy briefSeptember 2024 | |

| | | |

Dear Readers,

The new EU Commission aims to take office by the end of the year at the latest. The strategic guiding principle for the next five years is the so-called “Clean Industrial Deal”. It is intended to make Europe more competitive and to balance industrial and climate protection policy. Mario Draghi’s report underscores the urgency of this. Even if some of his proposed solutions are open to discussion, his analysis is accurate: the EU is falling dramatically behind in global competition and urgently needs to realign its economic policy. This applies in particular to aviation. According to Draghi, the sector is a guarantor of prosperity, but it urgently needs fair global level playing field and substantial investment. One of the Draghi Report’s key recommendations for the aviation industry is to promote sustainable aviation fuels (SAF) while maintaining a level playing field for EU airlines. Although policymakers in Germany and Europe have already adopted blending mandates and ramp-up plans for SAF and Power-to-Liquid (PtL), there is a lack of production and competition-neutral regulation. Prices will remain high for the foreseeable future, and the enormous costs are to be borne unilaterally by domestic airlines. Where does the market for SAF stand and what should policymakers do now? These questions are examined in the second article of this policy brief. In just over three months, the first stage of the European SAF blending mandate will come into effect. Not only the EU, but also Germany urgently needs to reform its aviation policy. Disproportionately high government levies are making flight connections within and from Germany increasingly unprofitable. Connectivity, especially in regions away from the major hubs, is declining dramatically. For an export and transit nation in the heart of Europe, this is a mistake. Sweden is currently providing a positive inspiration for a political course correction. From July 2025, there will no longer be a Swedish aviation tax. Enjoy the reading!

Andreas Bartels

Head of Corporate

Communications

Lufthansa Group | Dr. Kay Lindemann

Head of Corporate

International Relations and

Government Affairs

Lufthansa Group

|

| |

| | | | Draghi report A reform agenda for the EU The Draghi Report holds up a mirror to the EU. The state of competitiveness is alarming. The new EU Commission must take countermeasures quickly – also in the aviation sector. | |

| | | |

»There is a risk of business diversion from transport hubs in the EU to those in the EU’s neighbourhood, unless effective solutions for ensuring a level playing field are found at the international level.«Mario Draghi

Special Advisor to Ursula von der Leyen | |

| | | | It could hardly be more urgent: a radical change of course is needed to secure the EU’s competitiveness in the long-term. Otherwise, Europe faces “slow agony”. One key area for action is the transport sector, which, according to Draghi, is the basis for prosperity and social cohesion in the EU. The challenges for the aviation industry are considerable. The report classifies the sector as particularly difficult to decarbonize. The analysis confirms what European airlines and airports have been criticizing for a long time: the EU’s climate protection policy leads to competitive disadvantages for domestic companies. As long as there is no international level playing field, value creation will shift to non-European countries. In addition, European aviation is suffering from high energy costs and a lack of public support to achieve the ambitious CO2 targets. The report estimates that the investment required to decarbonize EU aviation will amount to over 60 billion euros per year. In total, more than 1.2 trillion euros will be needed by 2050 – an immense amount. The focus here is on sustainable aviation fuels (SAF). They are regarded as the technological key, but production capacities are still far from sufficient. SAFs are not competitive in terms of price and are foreseeably unaffordable for widespread use. In short, climate protection and the competitiveness of European aviation must urgently be reconciled. To this end, the report calls for effective solutions: targeted funding and the build-up of European SAF production. In addition, it is important to continuously analyze carbon leakage risks. Also, a legal level playing field is needed internationally, for example at the level of the International Civil Aviation Organization (ICAO). This is the only way to effectively prevent hub traffic from being shifted outside the EU. A reform of European airspace is also called for. Investments in digitization and new technologies could improve efficiency here. The report must be followed by action

Active action is now required to maintain and expand the strategically important autonomy of the EU in aviation. Firstly, the European SAF blending mandate must be corrected and made competition-neutral. In addition, a targeted reform of merger control and a determined reduction of red tape are essential for long-term success. An integrated industrial, climate and competition policy must also be reflected in the daily work and cooperation in Brussels. President von der Leyen is right: “Those who are not competitive will become dependent.” The new EU Commission must be judged by this insight. | |

| | | | Sustainable aviation fuels Blending mandates alone are not enough It is increasingly fashionable to set new, precisely quantified political targets. However, the reality is often at odds with their implementation. This also applies to the targets for sustainable fuels in aviation. There is a wide gap between aspiration and reality. | |

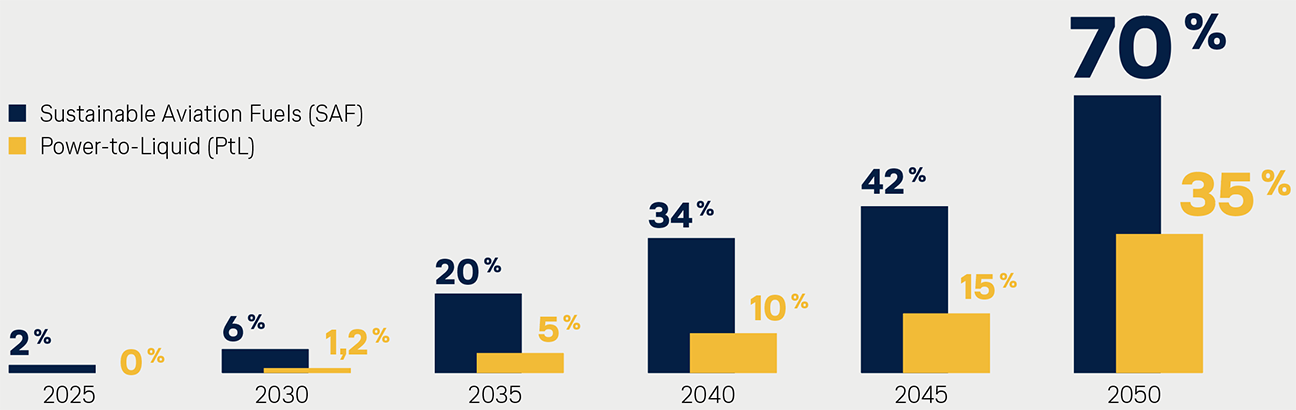

| | | | 2025: EU SAF blending mandate starts

ReFuelEU Aviation envisages a PtL blending mandate from 2030.

| |

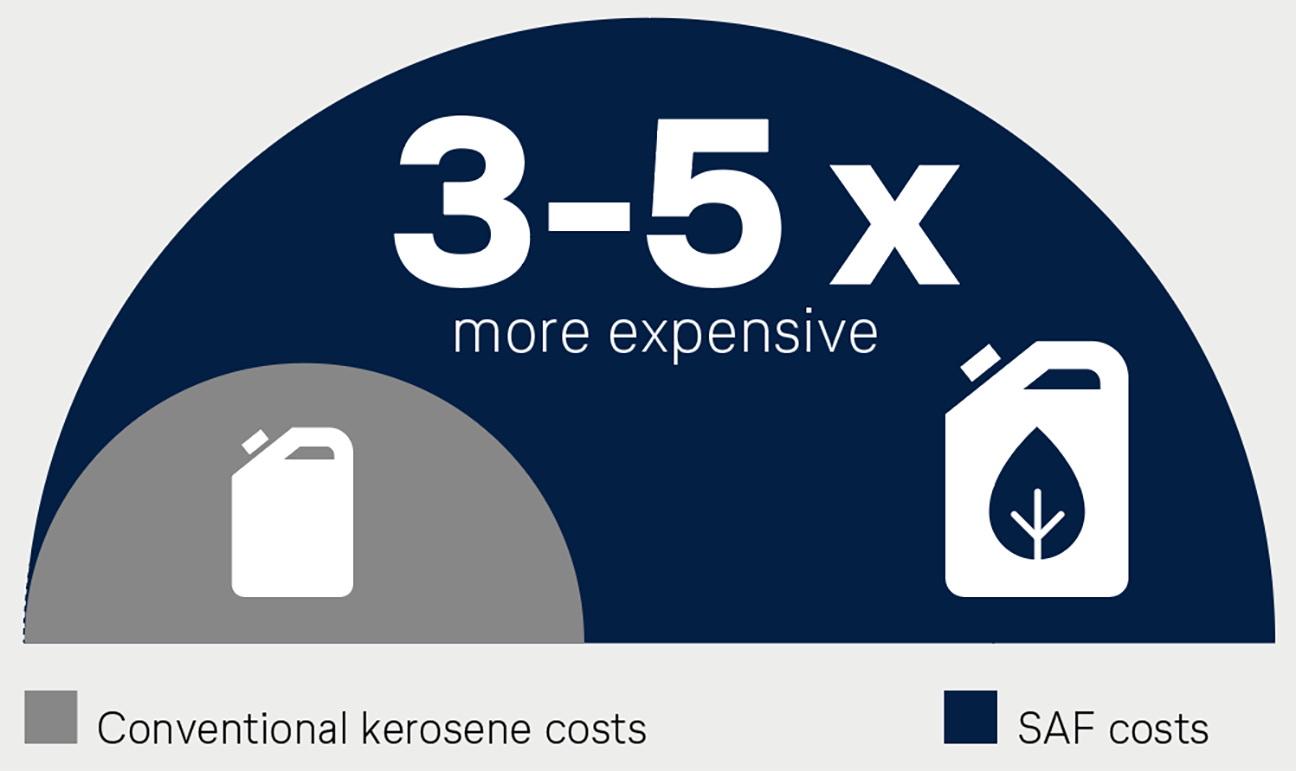

| | | | In its “Green Deal”, the European Union has adopted comprehensive measures to decarbonize the aviation sector while maintaining competitiveness. It is now clear that this was wishful thinking. The regulations weaken EU airlines and hubs in international competition because they make transferring in Europe more expensive. Furthermore, a strong industrial policy to support the expensive climate protection measures is lacking. Lack of supply, high prices

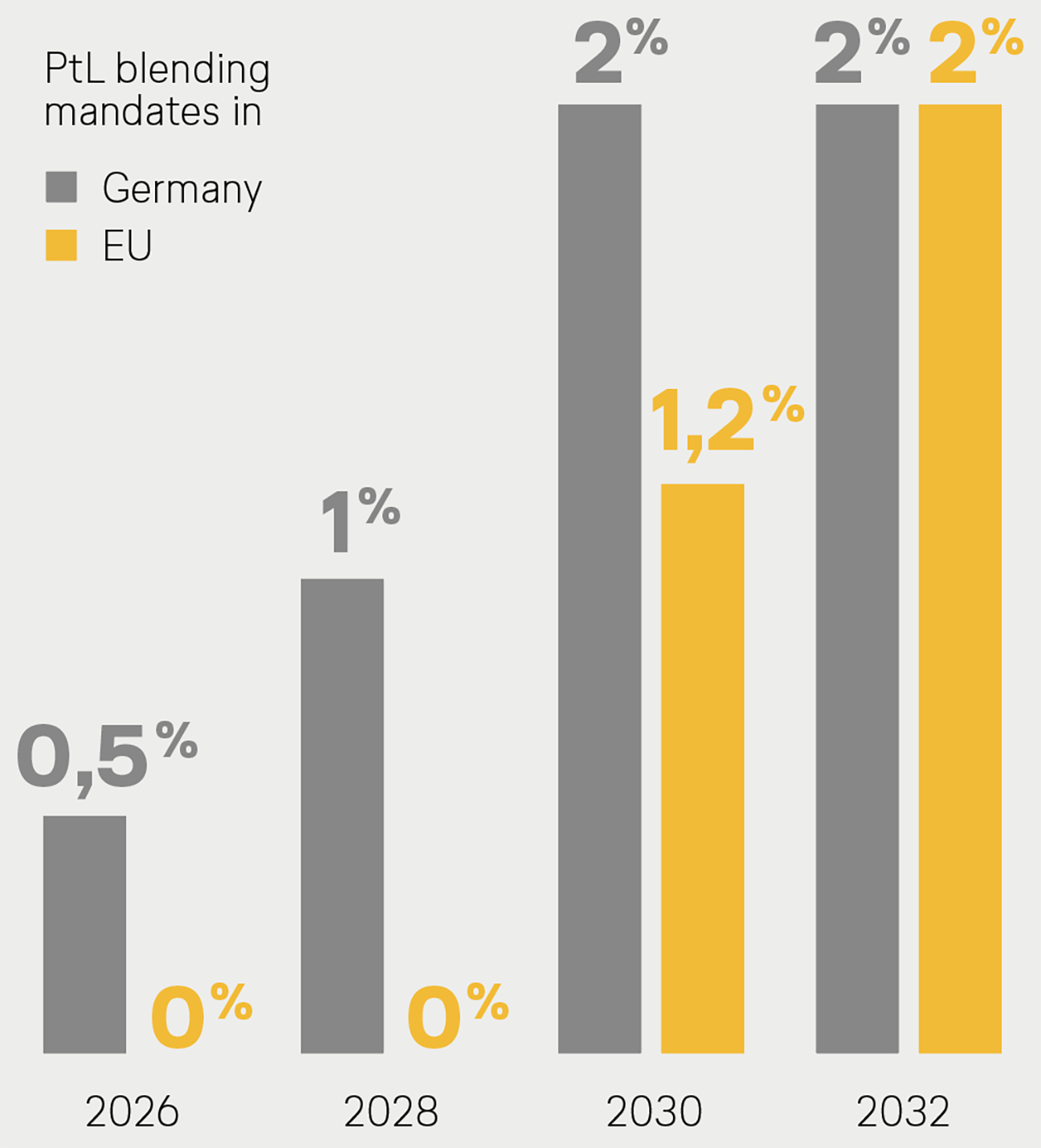

The best example of this is the blending mandate for sustainable aviation fuels (SAF). From January 2025, all kerosene used at EU airports must contain two percent SAF. By 2050, this proportion is to increase to 70 percent. However, there is a significant supply and price problem: biogenic SAF is only available in small quantities and is three to five times more expensive than fossil kerosene. In 2023, only around 0.2 percent of the fuel needed worldwide could be covered by SAF. The Lufthansa Group airlines could only fly for a few weeks on the total global supply of SAF. Due to the limited supply, prices will remain high for the foreseeable future. The situation is even more problematic for power-based fuels (Power-to-Liquid, PtL). According to EU regulations, 1.2 percent PtL must be added from 2030, and by 2050 it should be 35 percent. However, there is currently not a single PtL production plant in the whole of Europe. In fact, some projects that have already been launched are being put on hold. Germany is adding to the pressure by stipulating that 0.5 percent PtL must be available at local airports for refueling from 2026. It has long been clear that this blending mandate cannot be met due to a lack of availability. | |

| | | | Electricity-based kerosene: H2Global tender for PtL has failed The market ramp-up for electricity-based kerosene (Power-to-Liquid, PtL) has so far failed to get off the ground. High costs, legal uncertainties and bureaucratic requirements are deterring potential investors. This summer, for example, the German Federal Ministry for Economic Affairs and Climate Action attempt to conclude supply contracts with producers via a call for tenders conducted by the “H2Global” foundation failed. No bidders were found, partly because the contract value and duration were underestimated in view of the investment volume and the development time required to construct a PtL plant. | |

| | | | Planned SAF blending mandates distort competition

There is a lack of effective innovation and investment incentives for the production and use of sustainable aviation fuels, in both Germany and Europe. The current German coalition government has reduced funding for PtL production plants and research to 17 million euros, virtually eliminating it, and instead significantly increased the aviation tax. Blending mandates alone are not enough to create a self-sustaining SAF market. The current regulatory framework does not succeed to eliminate the large price difference between conventional kerosene and SAF. Therefore, the regulatory framework in place represents a significant competitive disadvantage for EU carriers in relation to their competitors from the Gulf, Bosporus and China. The SAF requirement of 2 percent in 2025 alone means an additional three-digit million euro amount for the Lufthansa Group. | |

| | | | National PtL blending mandate

Contrary to the EU requirements, PtL will be used for refueling in Germany from 2026.

| |

| | | | Clean Industrial Deal to combine climate protection and economic growth

The “Clean Industrial Deal” announced by EU Commission President Ursula von der Leyen raises hopes that climate protection and economic growth will go hand in hand in the future. For aviation, this means: - Creating fair competition: If long-haul flights via hubs in Turkey or Dubai, for example, are cheaper due to EU regulations, this will lead to a shift in traffic and emissions to the outskirts of the EU (“carbon leakage”) – without any environmental benefit, but at the expense of European value creation, jobs and connectivity.

- Design a competition-neutral SAF blending mandate: A fair solution for financing the SAF blending mandate would be a European climate protection levy for all airlines, depending on the destination. Another way to ensure a level playing field is to introduce a carbon border adjustment mechanism (CBAM) for airlines that evade the EU blending mandate.

- Promote SAF market ramp-up: To ensure that Europe has sufficient sustainable aviation fuels at competitive prices in the future, it needs targeted import and funding strategies for biogenic SAF and PtL. In Germany, the revenues from the aviation tax should be used to promote SAF, as envisaged in the coalition agreement.

- Abolish national PtL blending mandates: The German government must abandon its solo endeavor and take account of the EU harmonization of PtL blending mandates. Otherwise, airlines and their customers will end up paying absurd penalties for not using a fuel that does not even exist.

| |

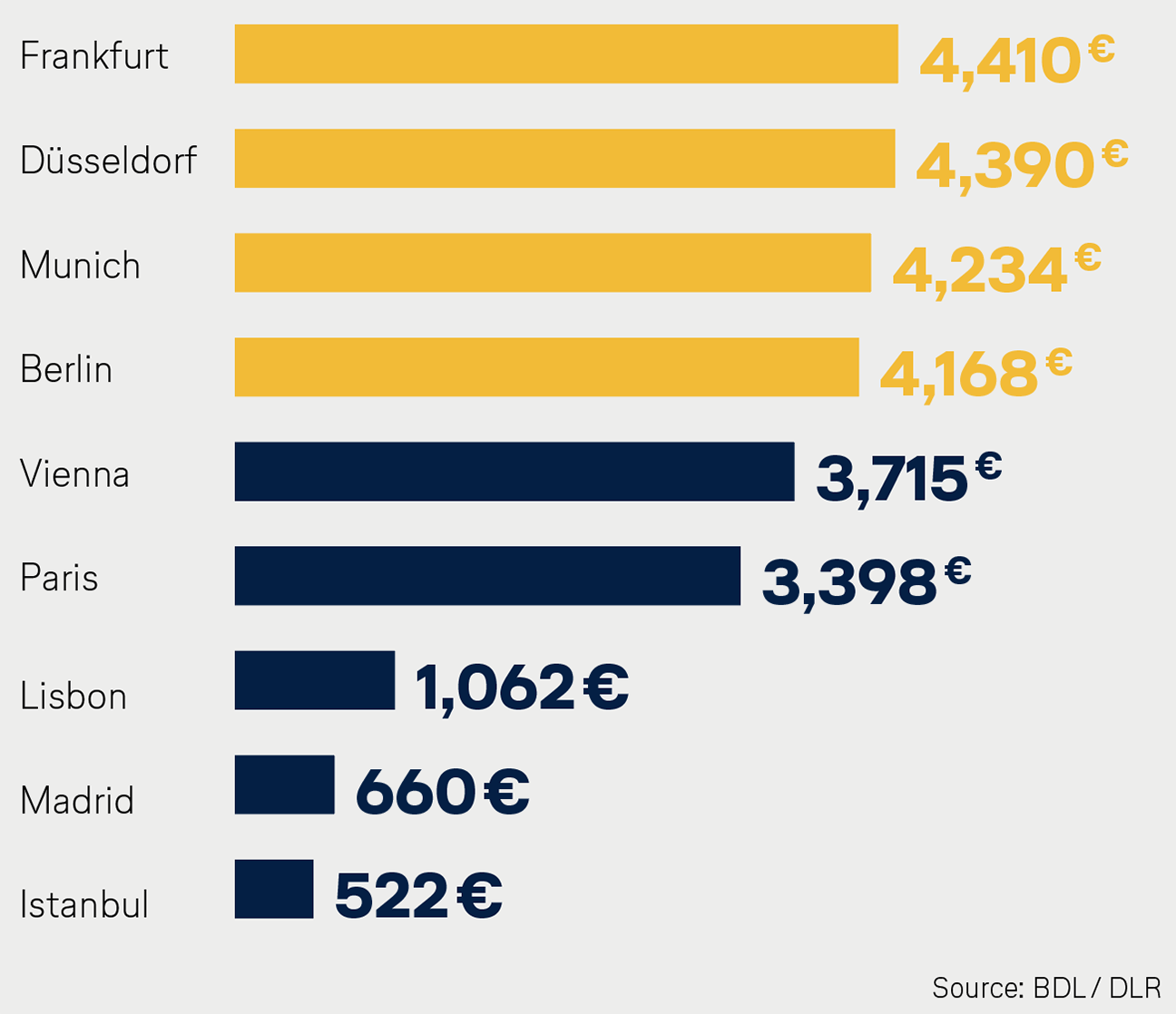

| | | | Cost burden is massive

The SAF target of 2 percent in 2025 means additional costs of around 300 million euros for the Lufthansa Group alone.

| |

| | | | Aviation in Germany Cutting high costs Sweden shows how it can be done. The country is abolishing its aviation tax in 2025 to strengthen domestic airlines. Germany should follow a similar path. After all, flying in Germany is the most expensive in Europe. | |

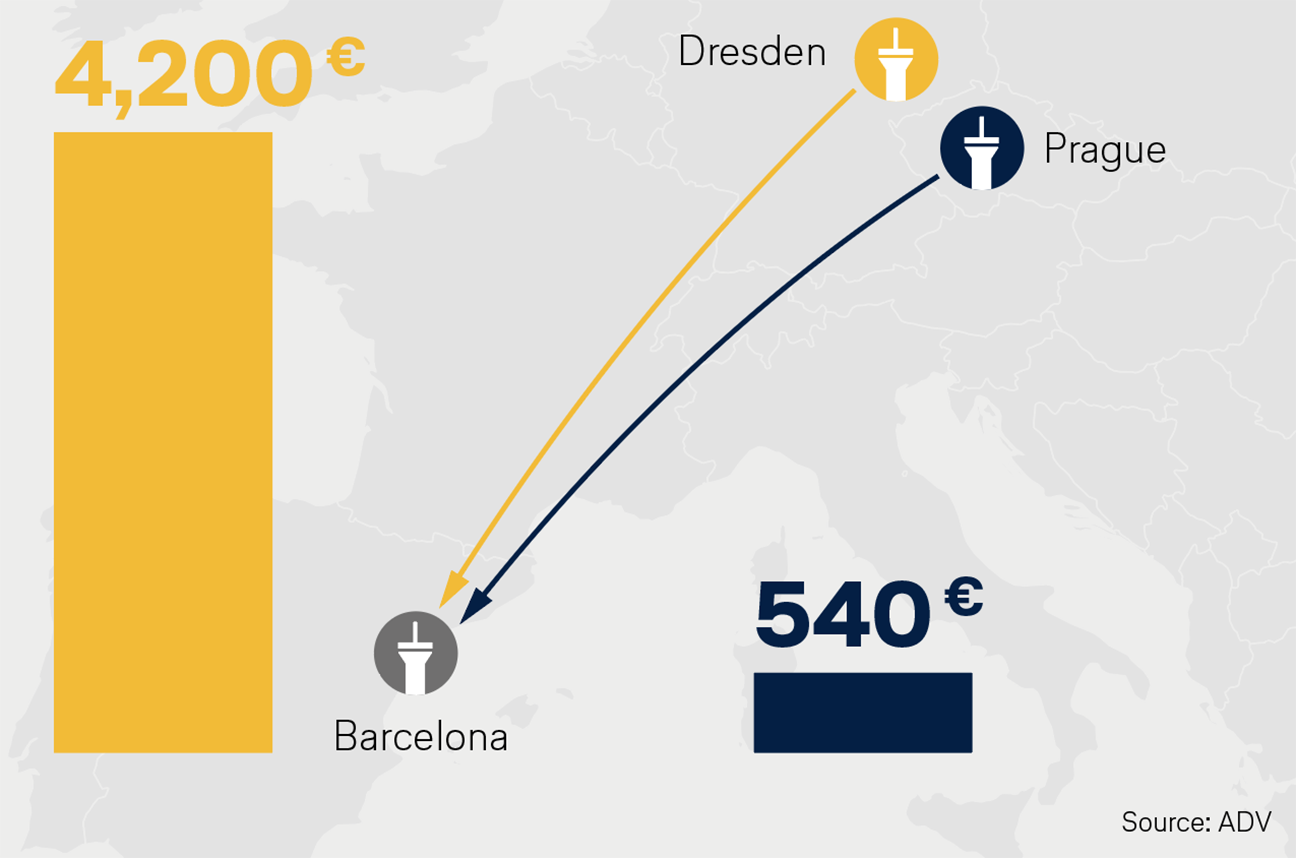

| | | | Governmental location costs in comparison

A320 aircraft with 150 passengers; as of May 2024

| |

| | | | Air traffic is growing – except in Germany. The main reason for this is that excessive government levies make the location unattractive. Since 2020, aviation security levies, air traffic control charges and the aviation tax have almost doubled. The effects are serious: the number of European and, in particular, domestic German connections has declined significantly. Low-cost airlines are increasingly leaving German airports. Important economic regions are at risk of being left behind. Traffic and value creation are shifting abroad. One example illustrates the dynamics: when an A320 takes off from Dresden on a flight to Barcelona, the state levies are around eight times higher than for a take-off from nearby Prague. As a result, tickets from Prague can be sold at a lower price. More and more passengers from the Dresden region are deciding to travel to Prague and start their flight from there. This example from an airport shows where German aviation policy is leading. In addition, the burdens imposed by EU regulations are constantly increasing. Germany and Europe urgently need to reform their location conditions to promote growth and competitiveness. The German aviation tax in particular leads to a considerable competitive disadvantage in the European market. Only a minority of the 27 EU member states currently levy an aviation tax. Everywhere, it is significantly lower than in Germany. Denmark abolished the tax a good 15 years ago, and since then domestic aviation has grown strongly there. Germany, on the other hand, has massively raised the aviation tax since the pandemic – by 71 percent for long and medium-haul flights and 111 percent for short-haul flights. Sweden will no longer levy an aviation tax from July 1, 2025. The largest Scandinavian country wants to strengthen the competitiveness of its own aviation industry. This decision is already having an impact: Ryanair plans to offer more flights to and from Sweden from mid-year and expand its fleet by two aircraft. Germany should follow Sweden’s example and abolish the aviation tax. In any case, the German government should keep its promise to use the revenue from the aviation tax to promote sustainable aviation fuels (SAF). Currently, these funds flow into the general budget – which helps neither the climate nor Germany as a business location. | |

| | | | Example flight Dresden – Barcelona

For an A320 flight from Dresden to Barcelona, €4,200 is due in aviation tax, aviation security charges and air traffic control – while only around €540 is due at nearby Prague.

| |

| | | | Air freight Strengthening Germany as a business location Lufthansa Cargo is investing 600 million euros in the modernization of its cargo hub in Frankfurt. The export-oriented German economy will benefit from an innovative and efficient air freight center. In

addition, Lufthansa Cargo is investing in a highly efficient fleet. To enable air freight to grow in Germany and Europe, this loyalty to the business location must be properly supported by political measures. | |

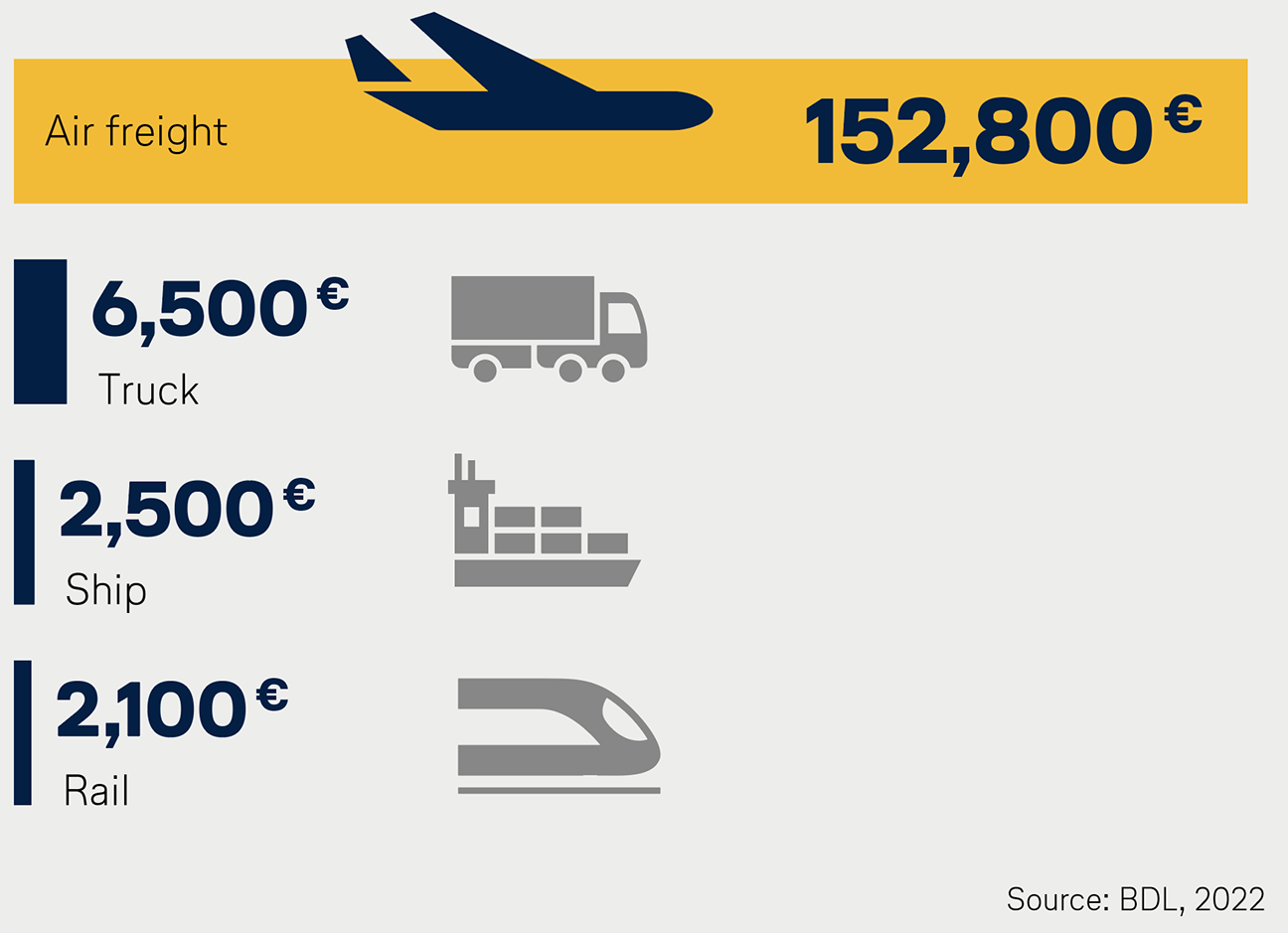

| | | | Air freight is particularly valuable

Average value per ton of freight

| |

| | | | Since it began operating in 1982, the Lufthansa Cargo Center (LCC) at Frankfurt Airport has been in operation 24 hours a day, 365 days a year. With a handling capacity of around 20,000 metric tons per week, it is Lufthansa Cargo’s largest logistics center worldwide. From here, goods are sent to 300 destinations in 100 countries. The LCC, which covers an area of about 46 football pitches, will be completely modernized by 2030. The aim is to enable a faster and more customized handling of goods. Sustainability on the ground and in the air

The LCC will set new standards in sustainability. Photovoltaic systems, state of the art thermal insulation, heat recovery and waste heat utilization increase energy efficiency and significantly reduce CO2 emissions. In addition, Lufthansa Cargo is investing around 3.5 billion euros in new aircrafts this decade. Since October 2021, the company has completely switched to the Boeing 777F on long-haul routes – the most modern freighter with the best environmental record. Aircraft of the latest generation consume up to 30 percent less fuel and emit correspondingly less CO2 than their predecessors. Unfair competition

In order to remain attractive as a cargo hub in the future, Frankfurt needs competitive conditions as a business location. Political requirements are currently weakening the industry in relation to its European and non-European competitors. The most important issues are: - Procedures and processes in Germany are often more complicated and lengthier than in other European countries. For example, comprehensive digitalization and automation at customs is crucial to ensure the rapid processing of the enormous increase in the number of shipments. An EU-wide harmonization requires a uniform interpretation of EU regulations.

- The German procedure for collecting import sales tax is a significant disadvantage for Germany as a business location. It unnecessarily ties up liquidity and thus causes increased costs for importers that do not arise in neighboring EU countries. A clearing model alone could reduce costs for businesses and authorities, while improving public revenue and the ecological footprint of the flow of goods.

- Like passenger traffic, airfreight is also exposed to competition-distorting burdens due to increasing EU climate protection requirements. The goal remains a global level playing field.

- Compared to the rest of Europe, costs in Germany are very high. Take air traffic control fees, for example: in Frankfurt, they amount to more than 1,000 euros per take-off for a Boeing 777-200F. In Paris, they are around a fifth cheaper. And, as incredible as it may sound, there are no air traffic control fees at all in Liège.

All this entails the risk of cargo traffic being increasingly shifted abroad. Even today, 40 percent of air freight between the EU and Asia is sent via non-European locations. There has not been a European location among the top ten worldwide air freight airports for a long time. All this must be taken into account by policymakers. | |

| | | | Frankfurt AirportStudy confirms advantages of flat takeoffsThe steeper an aircraft takes off, the less noise it causes for the region – that was a common assumption. A study has now disproved this for the Frankfurt region. Some German airports recommend steep takeoff procedures for aircraft. The reasoning: in contrast to a “flat takeoff”, a steeply rising takeoff generates less noise. A study commissioned by the “Forum Flughafen & Region” has now proven the opposite for Frankfurt: according to the study, the flat takeoff leads to less noise overall in the region of the airport because the low altitude means that the noise is concentrated mainly in areas near the runway. This means that fewer residents are exposed to noise pollution in total. In addition, flat takeoffs are more climate-friendly. The Lufthansa Group has therefore been using this procedure in Frankfurt since 2013. This saves up to 7,000 tons of CO2 per year. Following a comparable analysis for the Leipzig site, the Frankfurt study is already the second scientific proof of the advantages of flat takeoffs. Airports should review their recommendations for take-off procedures and noise charges based on them accordingly. | |

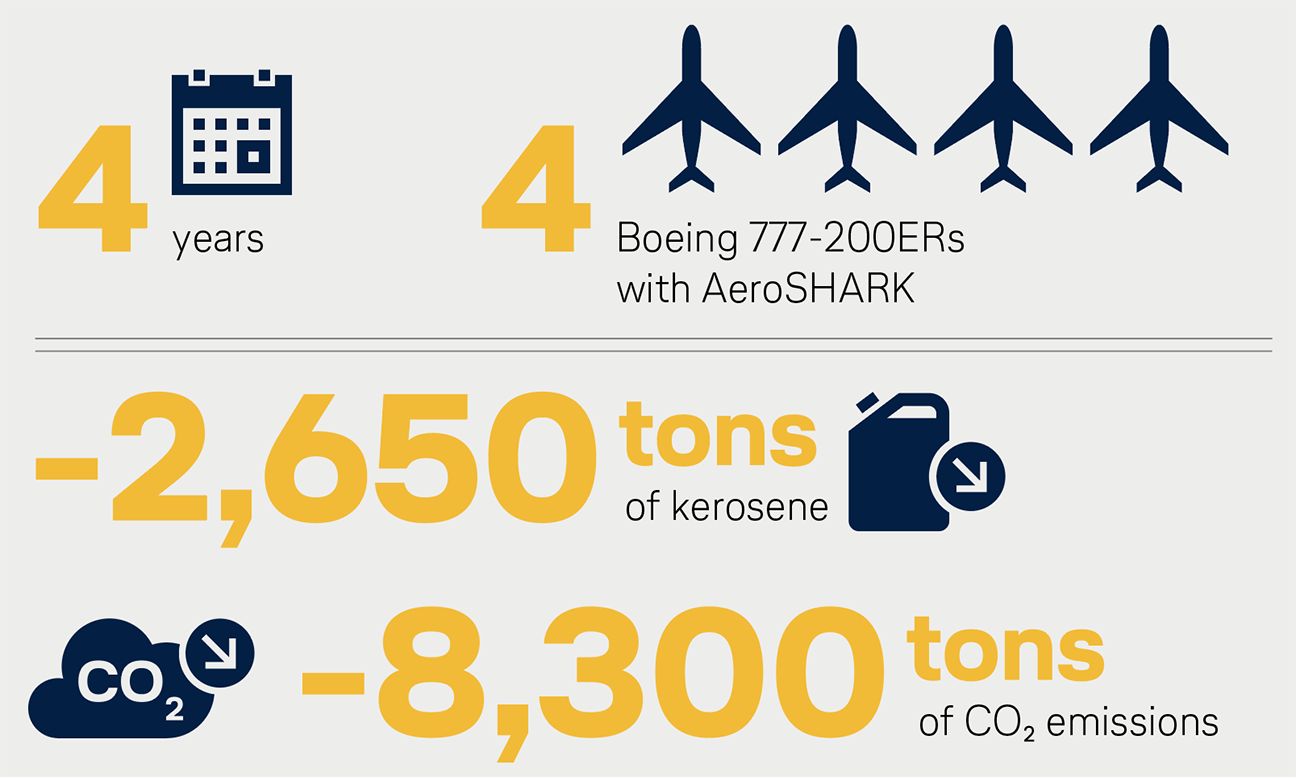

| | | | Shark in the skyAustrian Airlines flies with “shark skin”Austrian Airlines is the first airline in the world to equip Boeing 777-200ER aircraft with AeroSHARK. A total of four aircraft will be coated with the innovative surface technology from December 2024. | |

| | | | AeroSHARK reduces kerosene consumption

| |

| | | | The shark skin-inspired film reduces frictional resistance when flying, and thus lowering fuel consumption by up to one percent. This will enable the airline to save over 2,000 metric tons of CO2 per year in the future. This corresponds to roughly twelve flights from Vienna to New York. New technologies such as AeroSHARK are a key in making flying more sustainable. Austrian Airlines is already the fourth Lufthansa Group company to introduce this innovation into its flight operations. Lufthansa Airlines, SWISS and Lufthansa Cargo have already been using the film developed by Lufthansa Technik and BASF for several years. Since 2019, around 24,000 tons of CO2 have been saved in this way. | |

| | | | LUFTHANSA GROUPYour Contacts Show PDF Show PDF

Andreas Bartels

Head of Corporate

Communications

Lufthansa Group  +49 69 696-3659 +49 69 696-3659

andreas.bartels@dlh.de andreas.bartels@dlh.de

|

Dr. Kay Lindemann

Head of Corporate

International Relations and

Government Affairs

Lufthansa Group  +49 30 8875-3030 +49 30 8875-3030

kay.lindemann@dlh.de kay.lindemann@dlh.de

|

Martin Leutke

Head of Digital Communication

and Media Relations

Lufthansa Group  +49 69 696-36867 +49 69 696-36867

martin.leutke@dlh.de martin.leutke@dlh.de

|

Jan Körner

Head of Government Affairs

Germany and Eastern Europe

Lufthansa Group  +49 30 8875-3212 +49 30 8875-3212

jan.koerner@dlh.de jan.koerner@dlh.de

|

Sandra Courant

Head of Political Communication

and Media Relations Berlin

Lufthansa Group  +49 30 8875-3300 +49 30 8875-3300

sandra.courant@dlh.de sandra.courant@dlh.de

|

Ruben Schuster

Head of EU Liaison Office

Lufthansa Group  +32 492 228141 +32 492 228141

ruben.schuster@dlh.de ruben.schuster@dlh.de

|

| |

| | | | Published by:

Deutsche Lufthansa AG

FRA CI,

Lufthansa Aviation Center

Airportring, D-60546 Frankfurt Andreas Bartels

Head of Corporate

Communications

Lufthansa Group Dr. Kay Lindemann

Head of Corporate International

Relations and Government Affairs

Lufthansa Group Martin Leutke

Head of Digital Communication

and Media Relations

Lufthansa Group | Editor in Chief:

Sandra Courant Editorial Staff:

Grit Engelbart, Anton Heinecke, Thrasivoulos Malliaras, Marie-Charlotte Merscher, Dr. Christoph Muhle, Jan Paulin, Abdullah Sert, Steffen von Eicke Press date:

25 September 2024 Agency Partners:

Köster Kommunikation

GDE | Kommunikation gestalten |

| |

|