The federal government and the Federal State of Hesse had already been involved in the rescue of Condor with a bridging loan of 380 million euros. Jobs could be saved for the time being and Condor passengers could start their journeys. This shows that there are substantial reasons for politicians to come to the rescue of companies in certain situations. If it’s just a one-off crisis intervention, this makes sense. However, it becomes problematic when state interventions become the rule. And this is increasingly the case in Europe: for many years, airlines, which often no longer have a sustainable business model, have been kept flying by governments. This is the case for LOT. Poland has helped its state airline back on its feet several times.

Political Market Interventions Damage Competition and the Climate

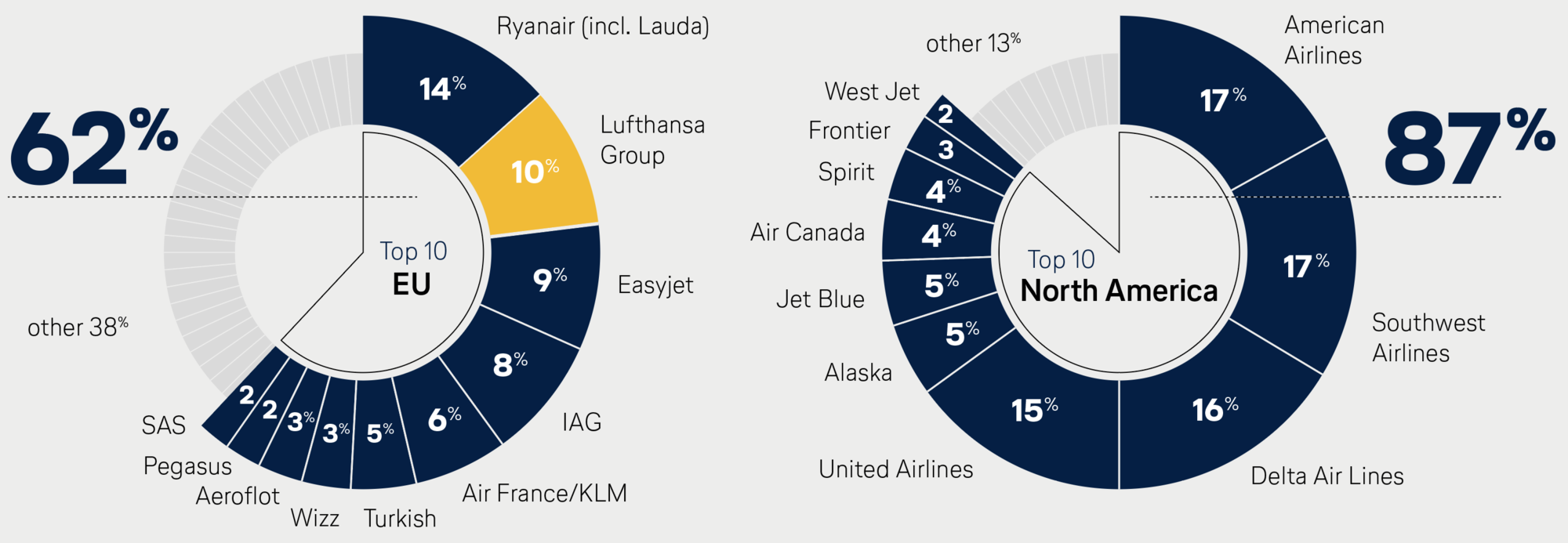

Permanent survival assistance of this kind not only distorts competition, it also harms the climate. Because it prevents the consolidation of the industry that is so necessary in Europe. Capacities are artificially maintained. The inconsistencies of political action are obvious here: on the one hand, aviation is supposed to be being made more expensive and reduced. On the other, state money is being used to fuel the price war in the skies and low-cost flights are being indirectly supported.

Permanent State Aid is Catching On

Alitalia is also a case in point. Since 2017 alone, the airline has received state financial injections totalling 1.3 billion euros. This means that Alitalia can carry on flying without the pressure of profitability to which other airlines are subject. It is considered unlikely that the airline can afford the repayments. This means that the grants contravene EU law.

In Germany, too, it is not so long ago that there was unfair competition between the airlines of the Lufthansa Group and Air Berlin, which was kept going by the state-funded Etihad Airways.

Europe’s aviation market is characterised by overcapacity. All airlines are required to operate profitably and to close routes if necessary. For example, in the summer of 2019 Eurowings reduced its flights from Germany by 3.6 per cent. But political market interventions are ruining these efforts for more sustainability.