Air Berlin insolvency:German market remains highly competitive

The Lufthansa Group has submitted a bid for the takeover of parts of the Air Berlin Group. If the takeover negotiations are brought to a successful conclusion, Eurowings will be able to offer 3,000 additional employees good perspectives for the future.

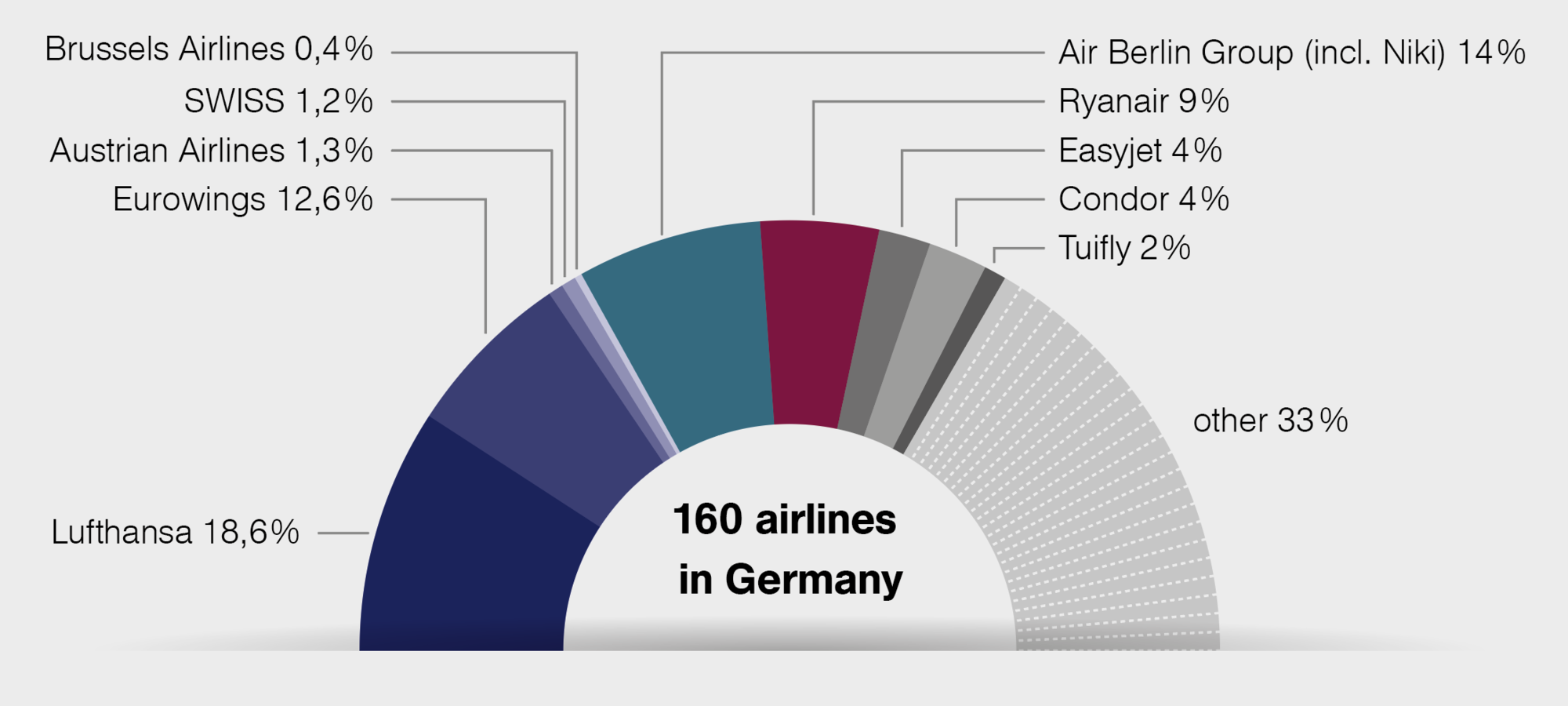

By their own account, Air Berlin is also negotiating simultaneously with Easyjet over the sale of some parts of the business. A few isolated competitors are warning against an apparent threat of market dominance by the Lufthansa Group. Yet there is an indication to the contrary, in the fact that air transport in Europe and Germany has been marked by intense competition for years – in Germany alone, there are 160 different airlines competing for passengers’ business. As a result of this, ticket prices have been falling steadily. This competition will continue to exist even once Air Berlin has exited the market. And – German and European competition regulators will strictly monitor any on-going transactions.

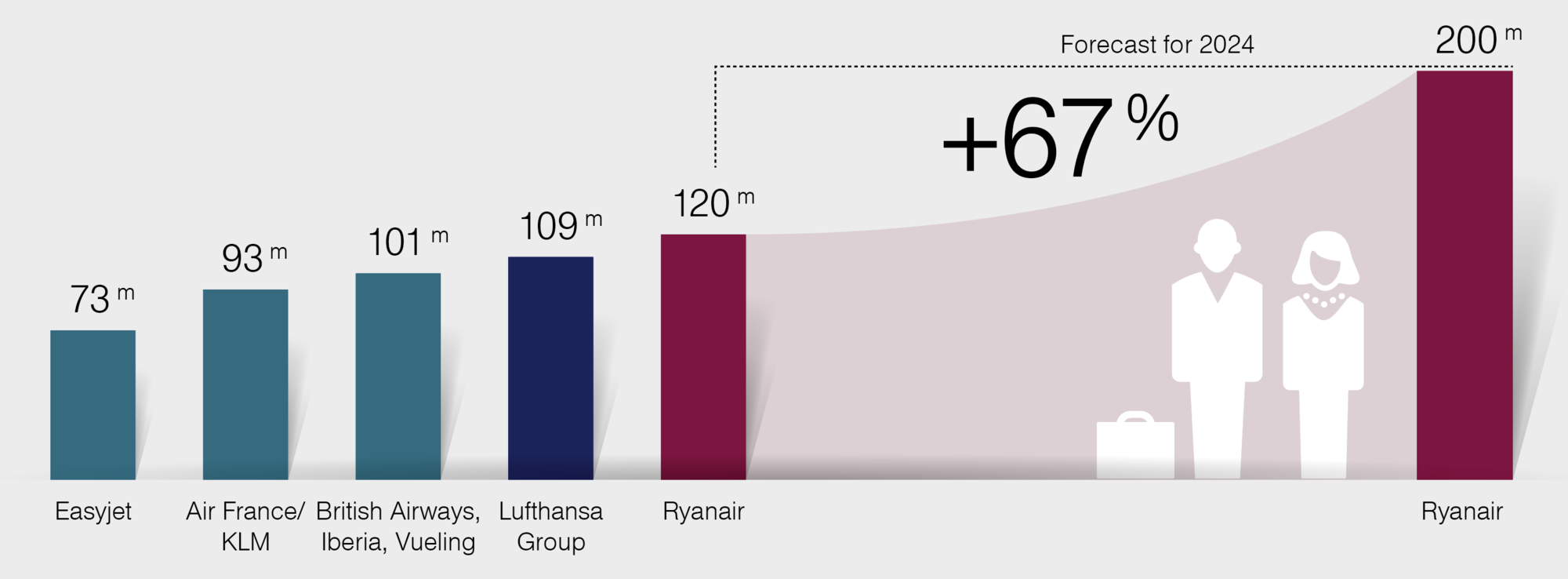

However, we have been hearing nothing but controversy from Ryanair, Europe’s largest airline in terms of passenger numbers. The Irish airline has refrained from submitting an offer of their own, as a way of potentially becoming involved responsibly in the German market. It seems rather to be a means of focusing media attention on the issue, in an attempt to distract from their own problems.

- A total of 160 airlines fly to and from Germany, resulting in fierce competition.

- The Lufthansa Group’s airlines together make up a market share of 34 percent; Air Berlin’s market share is 14percent.

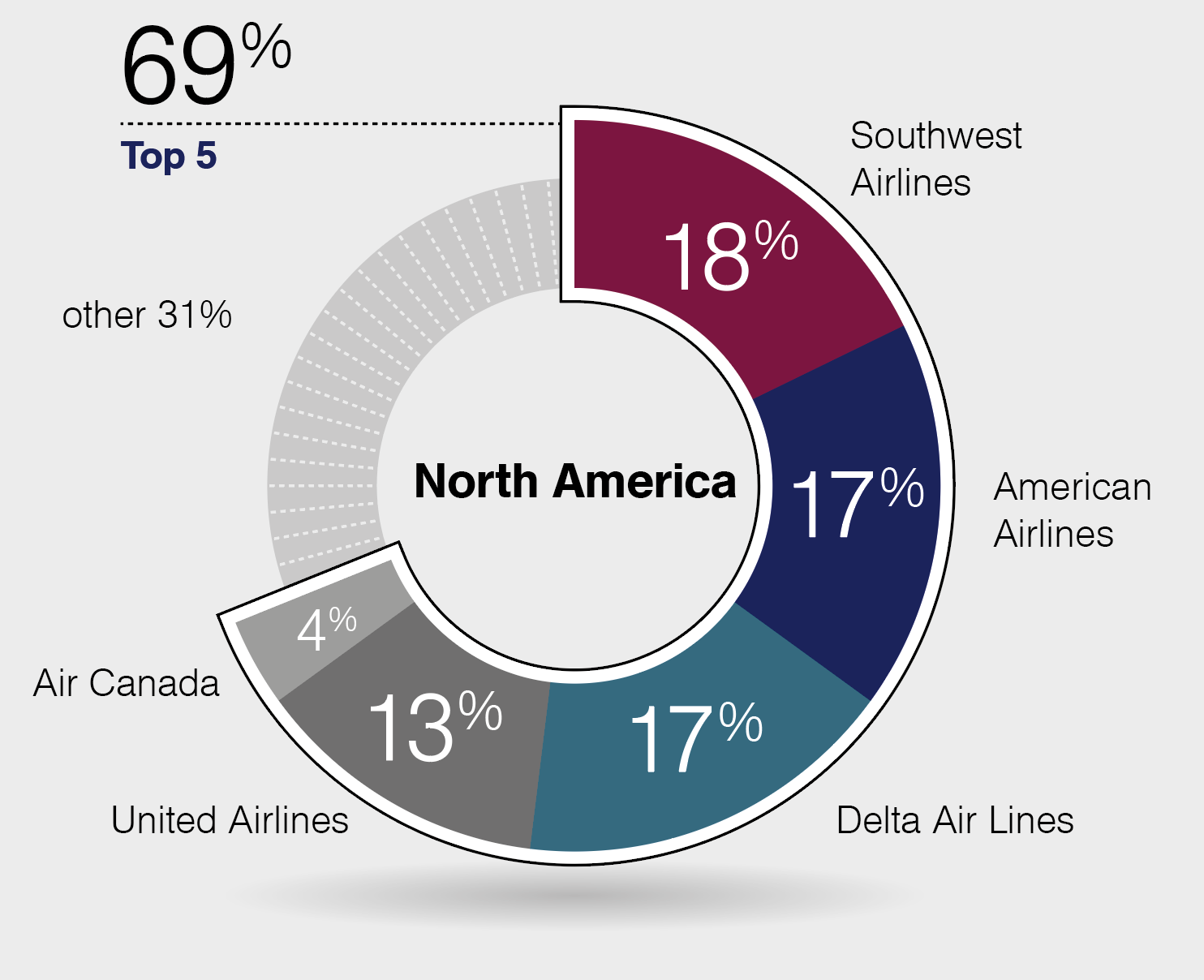

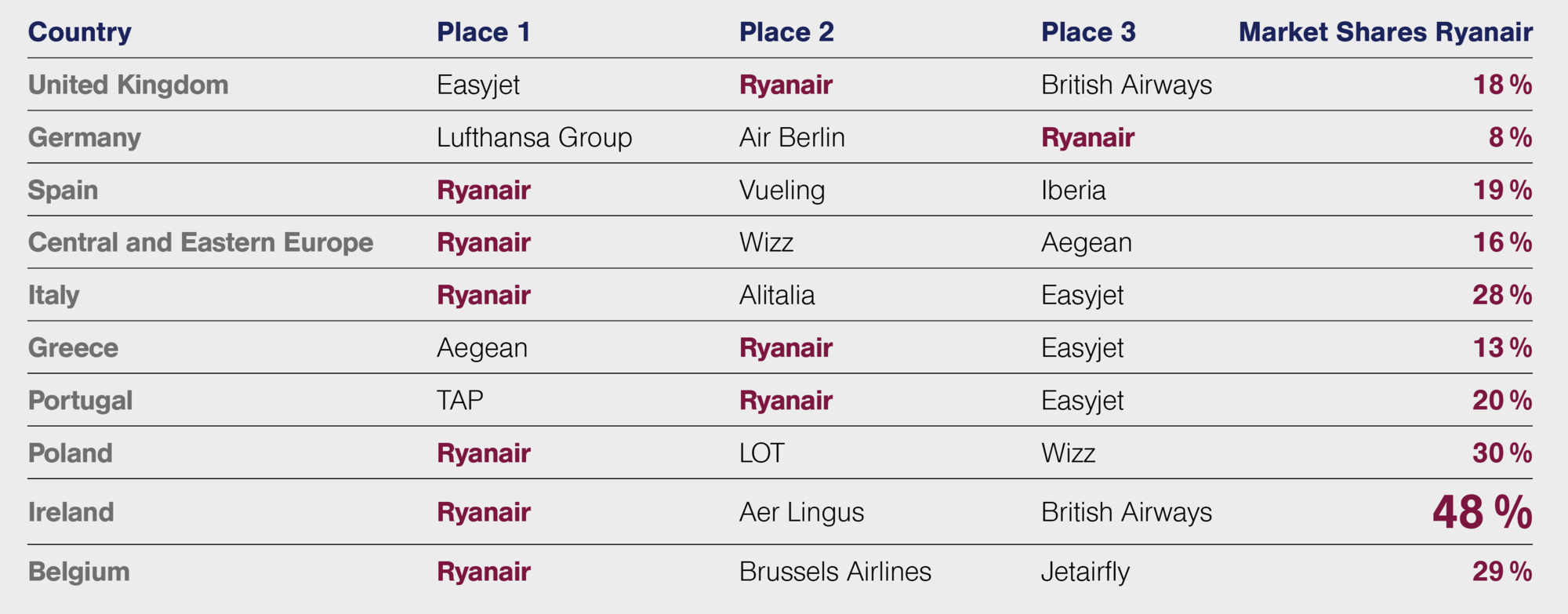

- The Lufthansa Group intends only to take over parts of Air Berlin. It is therefore clear that their market share will in the long term stay significantly below 48 percent – the market share which Ryanair has in Ireland.

- In Germany and Europe, the relevant competition authorities ensure that no monopolies are created. Any possible Eurowings/Air Berlin transaction will be carefully examined by the so-called merger control scheme, and conditions will be imposed if necessary. In the process, the fact will also be taken into consideration that, on domestic German routes, travellers always have a choice of other modes of transport (rail, coach, car) as well as flights.

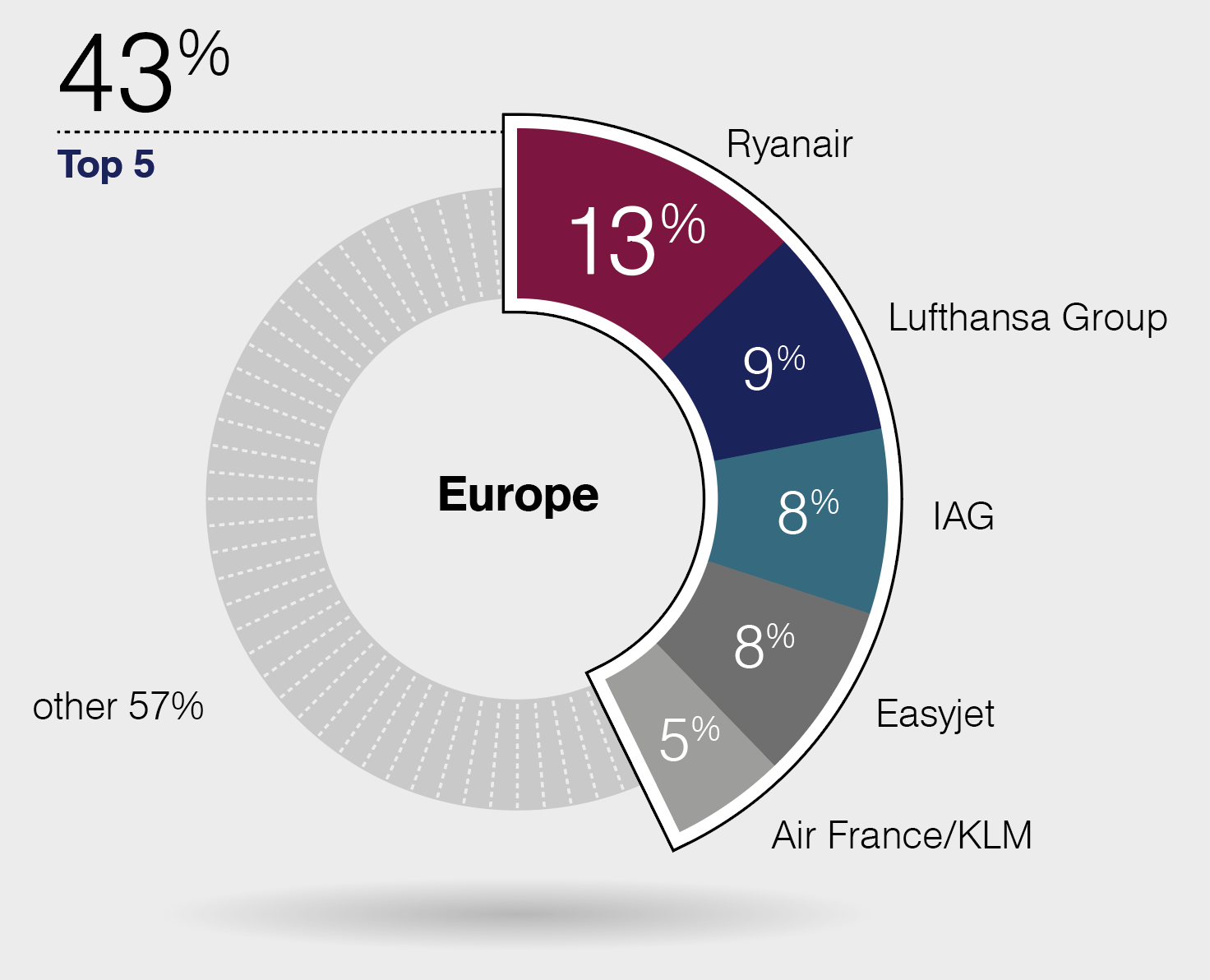

- In most European countries – for example, France, Spain, Italy, Poland, Ireland – it is only low-cost and tourist airlines, as well as international airlines, which provide competition for the respective major national airlines. There is no second major national airline in these countries (as was the case up to now with Air Berlin in Germany), yet despite this there are no monopolies.

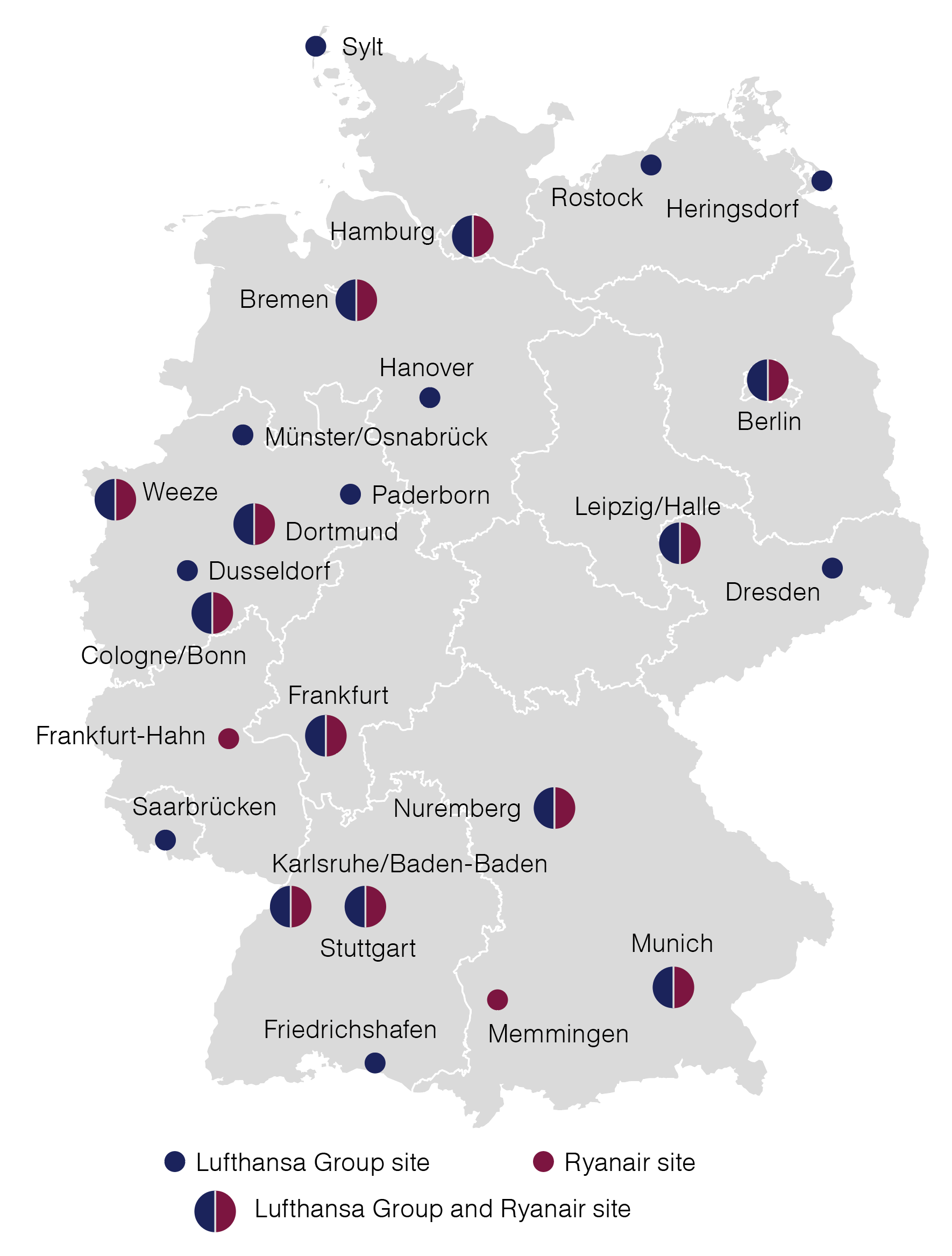

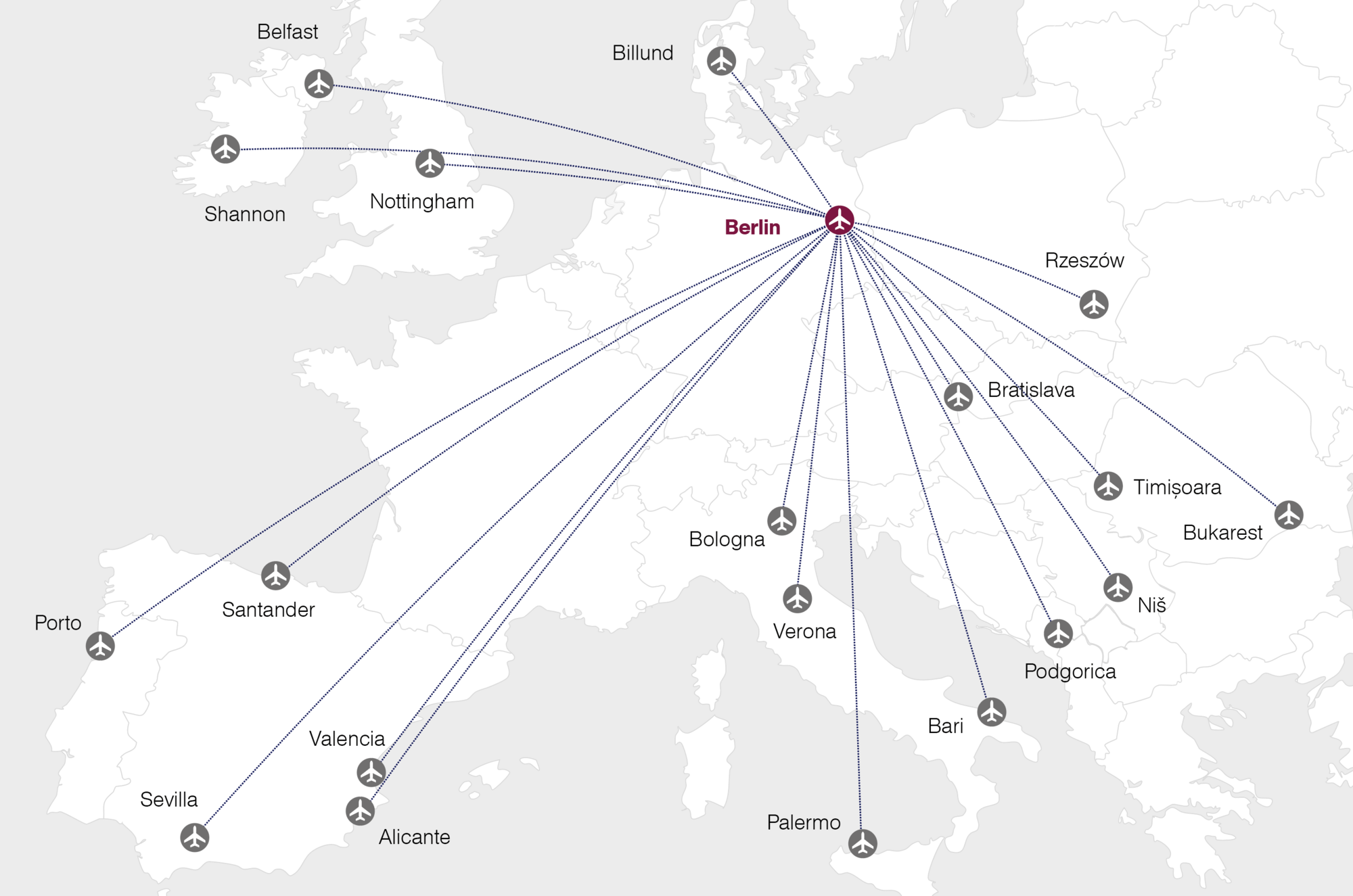

- At many German airports (such as Hamburg, Stuttgart, Berlin Schönefeld, Cologne/Bonn), slots for competitors are freely available. Unused slots are also available at other airports, spread out throughout the day. Ryanair and other low-cost airlines could already be making use of these slots to offer flights on domestic German routes. The low-cost airlines apparently do not want to do this – quite the opposite, Ryanair is planning to discontinue its only domestic route to date, Cologne/Bonn – Berlin Schönefeld. The operation of domestic German routes is evidently not attractive for many airlines.

- It is not uncommon in aviation for specific routes to be operated by just one airline. In fact, there are many hundreds of routes on which there is only one airline operating. For example, Ryanair alone offers 118 routes from Germany which are exclusively operated by the Irish airline. The competition is not undermined by this as, in most cases, passengers can reach their destination via alternative connections.

Competition doesn't stop at national borders

- In terms of passenger numbers, Ryanair is the largest airline in Europe with a market share of 13 percent, which means it is ahead of both the Lufthansa Group – Lufthansa, Swiss, Austrian Airlines, Eurowings and Brussels Airlines – and the IAG Group – British Airways, Iberia, Vueling, Aer Lingus and Level. According to its own data, Ryanair is already the largest provider in many European countries. It enjoys a market share of almost 50 percent in its home market of Ireland (source: Ryanair).

- The competition will continue to grow, which will lead to a further drop in air fares – the leading European low-cost airlines alone have 400 aircraft on order from Airbus and Boeing. It has already been announced that, post-Brexit, these aircraft will be mainly stationed in Continental Europe. Ryanair alone has plans for a further 20 percent growth in Germany in 2018. This will increase competition even further.

- This level of growth is made possible through questionable working conditions and subsidies in the form of the low airport fees which the Irish company manages to negotiate. A current example – the 50 percent discount in Frankfurt. In the years previous to this, the airline pushed ahead with marketing subsidies and dumping prices at countless smaller German airports. Once these were no longer granted by the state or the municipality in question, then the subsidy-greedy Ryanair discontinued their flights and moved on.

- International airlines are quick to pick up on market opportunities – just one day after Air Berlin discontinued long-haul flights from Berlin Tegel, Qatar Airways announced their plans to expand their capacity in Berlin. Condor, Wizz Air, Germania and LOT are also looking to capitalize on Air Berlin's exit from the market by taking on new routes.

The majority of Lufthansa passengers within Germany are on connecting flights. They are not using their flight as a point-to-point connection between two German cities.

- Nearly two-thirds of Lufthansa passengers on a domestic flight are using this as part of an international flight route. For a passenger traveling from Shanghai via Frankfurt to Hamburg, for example, the domestic flight is just a part of their overall long-distance journey. Anyone complaining about the apparent market power of Lufthansa on German domestic routes would have to first take this 60 percent of passengers out of their calculations.

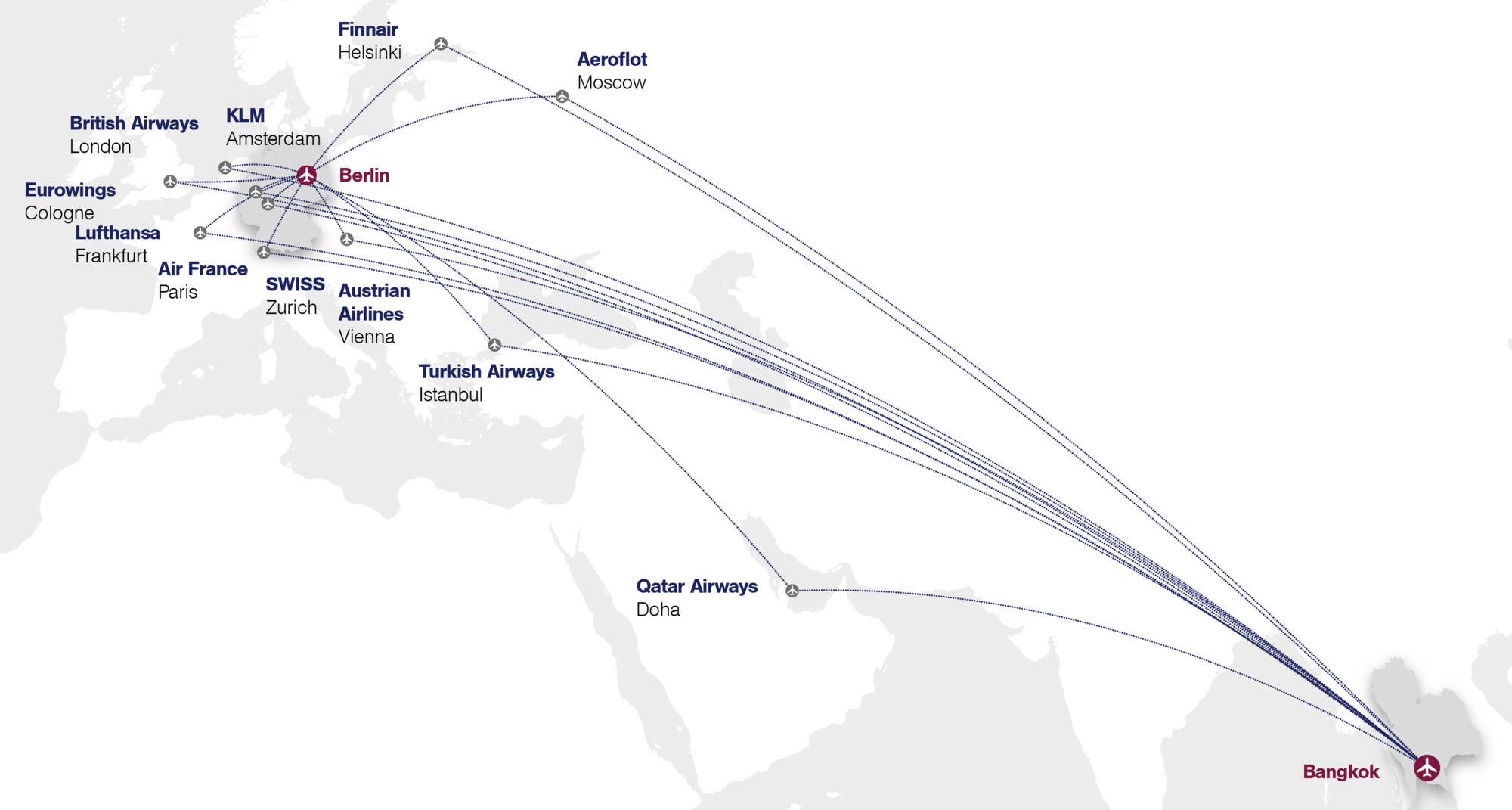

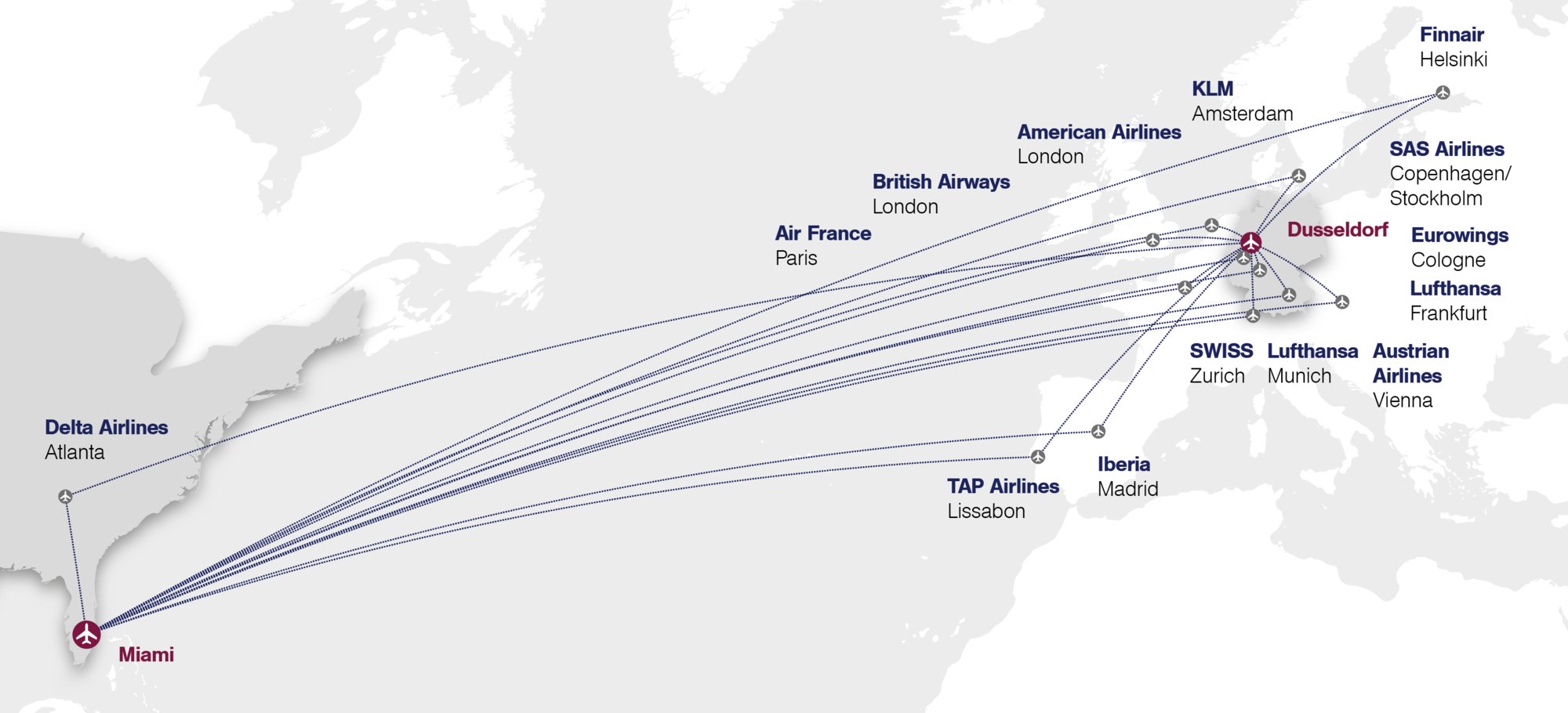

- Furthermore, both intercontinental and European travelers changing flights have a wide range of different options. From Berlin to Bangkok, a passenger can choose between ten different airlines, and there are options to change flights in Amsterdam, Doha, Helsinki, Istanbul, Frankfurt, Cologne, London, Moscow, Paris, Vienna and Zurich. On the Dusseldorf to Miami route, travelers have as many as 14 different transfer options to choose from.

Ticket prices have been falling steadily for years

- Despite the consolidation which has already started in Europe (for example the Lufthansa takeover of SWISS, Austrian Airlines and Brussels Airlines, and mergers between Air France and KLM or British Airways with Iberia and bmi), prices for air travel have fallen steadily in recent years.

- The departure of Air Berlin will strengthen the position of the Lufthansa Group’s competitors – such as Ryanair and Easyjet – here in Germany, and will therefore serve to further increase competition.