| | | |

Dear Readers,

Carbon-neutral flying is no longer a vision for the future – it has long been possible. Until now, we have offered our customers this option via our “compensaid” platform. Now we have made it even easier and more convenient: the Lufthansa Group is the world’s first airline group to offer its passengers a fare that completely offsets the emissions produced by their flight. 20 percent of this offsetting is achieved through the use of sustainable kerosene and 80 percent through high-value climate protection projects. Customers who opt for this new air fare will not only fly sustainably, but they can also enjoy substantial advantages: a Green Fare ticket can be rebooked free-of-charge and offers additional status miles. You can read all about our new product, which is available for both Economy and Business Class tickets, in this edition of our Policy Brief. With profits of EUR 1.5 billion, 2022 has been one of the most successful years in Lufthansa's history. In terms of revenue, we are number four after the three large US airlines. One reason for this global strength is the multi-hub, multi-airline strategy of the Lufthansa Group. Our group network of independent airlines operating via five hubs with carefully coordinated flight schedules, creates economic synergies, reduces capacity risks and enables us to offer our passengers a wide range of international flights. While consolidation is the order of the day in Europe, the signs in the Middle and Near East and Turkey continue to point to maximum expansion. States such as the United Arab Emirates, Qatar and Saudi Arabia are not only supporting their airlines excessively, but also create the infrastructure for even more artificial growth with their oversized hubs. Especially worrying: consumer, social and environmental standards that are binding for EU airlines simply do not apply in any of these countries. The EU must respond to this imbalance; otherwise Europe will fall even further behind as an aviation location in global competition. We wish you an enjoyable read! Andreas Bartels

Senior Vice President

Corporate Communications

Lufthansa Group | Dr. Kay Lindemann

Senior Vice President

Corporate Policy

Lufthansa Group |

| |

| | | | Lufthansa and ITAWin-Win for Germany and ItalyThe Lufthansa Group is seeking to acquire a stake in ITA Airways. Another airline, yet another hub – a good idea? Yes! Italy will benefit from having access to a strong airline with good international connections if the synergies of the LHG Family are utilised. | |

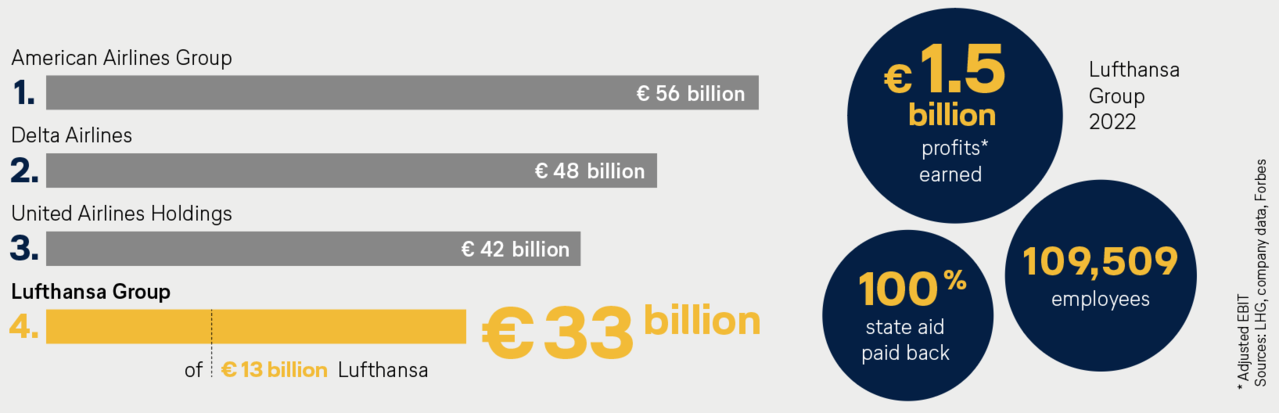

| | | | Top 4 airline groups by turnover

The Lufthansa Group achieved a turnover of EUR 32.8 billion in 2022, making it one of the four largest airline groups in the world. Of this, Lufthansa accounts for around EUR 13 billion. This strength pays off for our sites in Zurich, Brussels and Vienna, and hopefully soon in Italy as well.

| |

| | | | Traditionally, Italy has always appealed strongly to private travellers from all over the world. At the same time, its strongly export-oriented economy makes it an important business travel destination. This is why the Italian airline, which has undergone far-reaching restructuring and operates from its hub in Rome, is an excellent fit for the Lufthansa Airline Group’s route network. Italy is already the most important market for the Lufthansa Group after the four home markets and the USA. At the end of January, Lufthansa and the Italian Ministry of Economy and Finance (MEF) signed a letter of intent for Lufthansa to acquire shares in ITA Airways. Since then, negotiations have been underway regarding the possible form of the stake, the commercial and operational integration of ITA into the Lufthansa Group and the synergies that will result from this. Size: a key factor of going global

Sceptics fear too much complexity in another investment/acquisition. However, Lufthansa has already demonstrated how this can be successfully implemented for both sides with the acquisitions of SWISS, Edelweiss, Austrian Airlines, Brussels Airlines and Air Dolomiti. To be globally successful as an aviation company, size is crucial. With a total of eleven airlines, the Lufthansa Group is the fourth largest airline group in the world in terms of revenue – behind the three major American airline groups. Lufthansa Airline alone isn’t even in the top ten of international competitors. That is why our airlines in Austria, Belgium and Switzerland strengthen Lufthansa and vice versa. From the perspective of the individual countries, it is important both economically and in terms of industrial policy to be a strong part of this air transport network. Independent airlines benefit from group synergies

With the route network of the individual airlines and the five hubs in Frankfurt and Munich as well as Vienna, Zurich and Brussels, the Lufthansa Group has built up a domestic market across Central Europe and offers a wide range of international flights. The advantage: a high degree of flexibility in route control and less dependence on individual locations. Crucial to the success of this multi-brand strategy is that each brand stands on its own and has a unique profile. Each Group airline is led by a local management, that appeals to customers in the local markets with its Airline’s individual identity and brand. Each airline thus plays its own role within the Lufthansa Group. As premium carriers with many destinations served with high frequency, Lufthansa and SWISS offer the highest degree of connectivity compared to other European airlines. Austria’s national carrier Austrian Airlines connects the country with the rest of Europe and the world. The core market of Brussels Airlines is Africa, with flights to 17 sub-Saharan destinations. The recipe for success of the airlines based in Vienna and Brussels is a combination of a high-quality offering and low costs, which enables them to compete also with low-cost carriers in their home markets. Lufthansa CityLine serves feeder routes to Frankfurt and Munich as well as shorter European routes. Eurowings is the Lufthansa Group’s value carrier and one of Europe’s largest leisure airlines. Eurowings Discover strengthens Lufthansa’s position in the tourism market. Edelweiss supports the services offered at the Zurich hub. Air Dolomiti serves the northern Italian market via its Munich hub. As an integrated member of the LHG Family, ITA will provide Italy with a range of international connections. | |

| | | | 2022: An overview of the airlines in the Lufthansa Group

The Lufthansa Group has extensive experience with restructuring airlines: SWISS was taken over in 2007, Austrian Airlines in 2009 and Brussels Airlines in 2016.

| |

| | | | New competition realities in international aviationThe EU needs to reactThe international aviation market is highly competitive. In many regions of the world, politicians are taking active measures to strengthen their own industries and to help them secure market shares. This leads to an enormous distortion of global competition. The European Union is not only underestimating the risks associated with this – it could even well be said that the EU is actively exacerbating this imbalance with its policies. | |

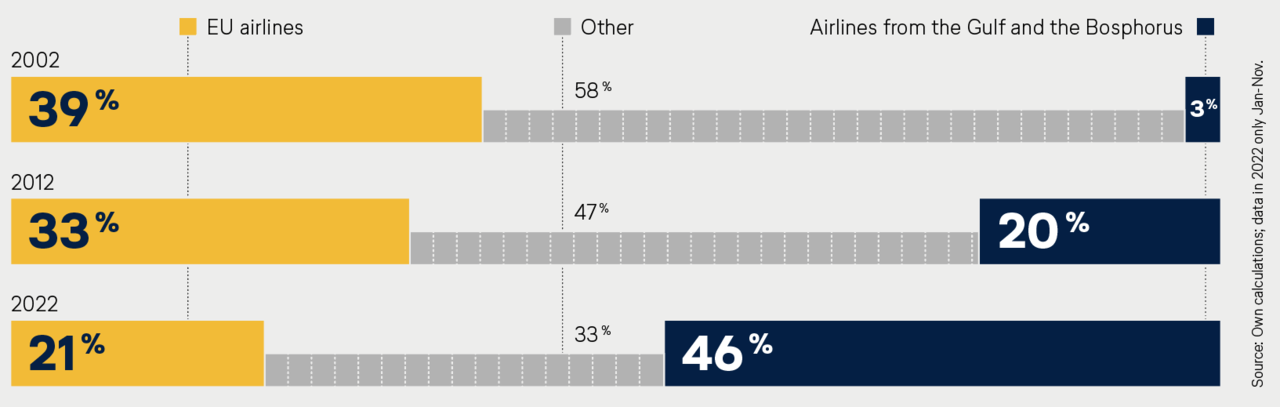

| | | | Travellers flying from Europe to Asia: EU airlines are losing a huge amount of market share

| |

| | | | Saudi Arabia’s announcement at the end of 2022 has attracted a lot of attention – there are plans for another airline and a new airport. By 2050, the capacity in Riyadh is to increase to 185 million passengers. The investment volume amounts to 100 billion US dollars. By comparison: less than half as many passengers travelled via Frankfurt Airport in the record year of 2019. There are also signs of expansion in Istanbul: the airport there is the home of Turkish Airlines. When it opened in 2018, its capacity was 90 million passengers. By 2027, it should be able to handle up to 200 million passengers. And then we have the United Arab Emirates and Qatar with their huge hubs. Their state infrastructure is highly developed and allows for unlimited growth – something unimaginable in Europe. These states have been subsidising their home carriers for years, and there is no transparency regarding the scale of the funding. This is the only way that Emirates and Qatar Airways can also offer flights on supposedly unprofitable routes. Market shares are shifting at the expense of the EU

The uncompromising investments in the Gulf and the Bosphorus have a direct impact on the EU. The competitive conditions for EU airlines and their hubs have steadily deteriorated. A look at the traffic between the EU and Asia confirms this: traffic flows are increasingly shifting out of the EU. In 2002, the market share of the airlines from the Gulf and the Bosphorus was 3 percent. By last year, this figure had already increased to 46 percent. And there are no signs of a trend reversal in this area. On the very contrary, the regulatory framework is favouring this development. The planned EU Climate Protection Policy (Fit for 55) is failing to seriously consider European network airlines’ expectations to have a level playing field. As a result, the competition is still benefiting from asymmetrical environmental, consumer protection and social standards “made in Europe”. | |

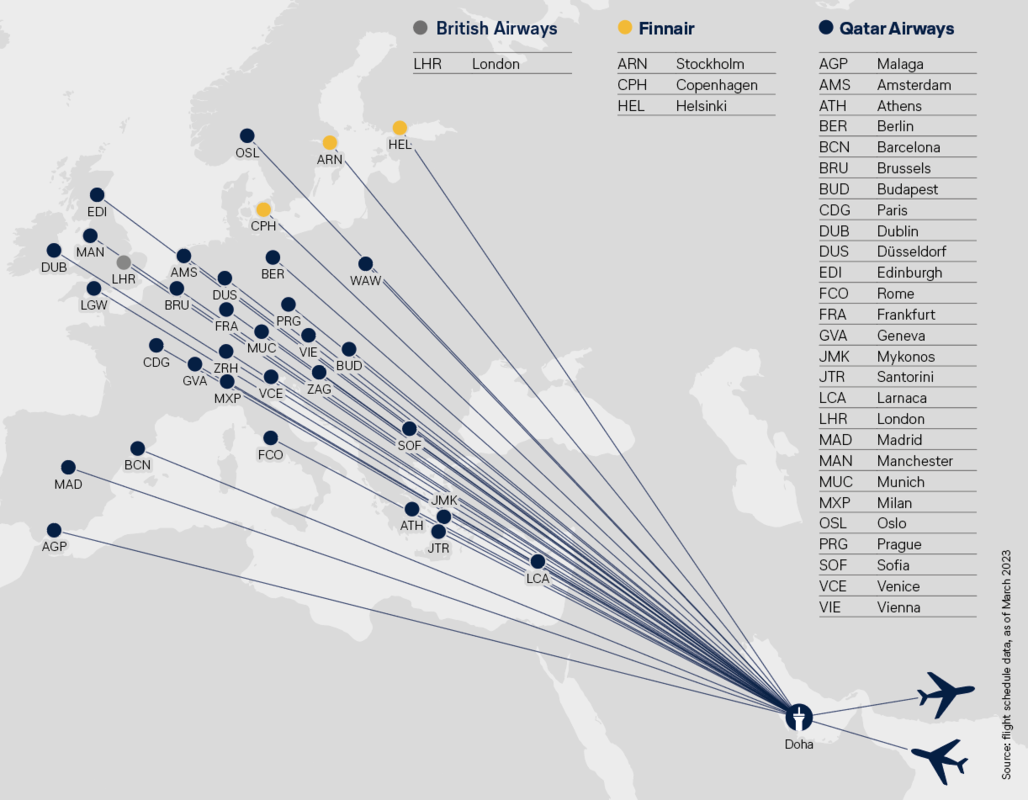

| | | | EU-Qatar Agreement: unfair distribution of the benefits

Another example: the EU’s air transport agreement with Qatar. The Comprehensive Air Transport Agreement (CATA) was signed in October 2021 and will gradually open up the European market to the point of complete liberalisation by the time the winter flight schedule for 2024/2025 is published. The CATA gives Qatar Airways free access to the EU economic area with its 450 million inhabitants; in return, European airlines will only be able to reach three million inhabitants in Qatar. Qatar’s business model is focused exclusively on transfer traffic and will put a huge amount of pressure on Europe: Qatar Airways is offering more than 350 flights from Doha to European destinations in the summer of 2023. By contrast, EU airlines rarely fly to Doha. Fair framework conditions are needed

The EU must finally acknowledge the reality of the competitive situation and take appropriate action. Distorting negative effects for EU companies must be avoided at all costs. EU regulation must, as a matter of principle, be designed in such a way that it treats European and non-European airline companies in a comparable way. Air transport agreements are a key lever in this context. Amendments and new agreements must set the same standards for environmental and social issues as well as with regard to competition. At the same time, specific instruments are needed to ensure that these agreements are binding and are, indeed, put into practice. This is the only way to achieve a fair level playing field. EU policymakers have further starting points. These include new and competitively neutral financing schemes for sustainable aviation fuels. The inclusion of aviation in EU taxonomy is also crucial if the shift to climate neutrality is to succeed. If the EU fails to take advantage of these positive incentives, it will miss the opportunity to benefit from value creation in Europe. It is already clear who the potential beneficiaries will be. | |

| | | | All routes between Europe and Doha

EU-Doha: unilateral advantages for the Qatari state-owned airline

Qatar Airways is picking up passengers across Europe to fill its XXL home hub with transfer passengers. EU airlines and sustainable aviation are losing out. The EU must react – and adapt the air traffic agreement with Qatar. | |

| | | | World premiereAir fare for sustainable travelCarbon-neutral by 2050. To reach this goal, the Lufthansa Group is investing in highly efficient aircraft, sustainable fuels and the optimisation of processes. At the same time, we want to bring the idea of sustainable flying closer to our passengers. With our new Green Fares tickets, environmentally friendly travel becomes very easy. | |

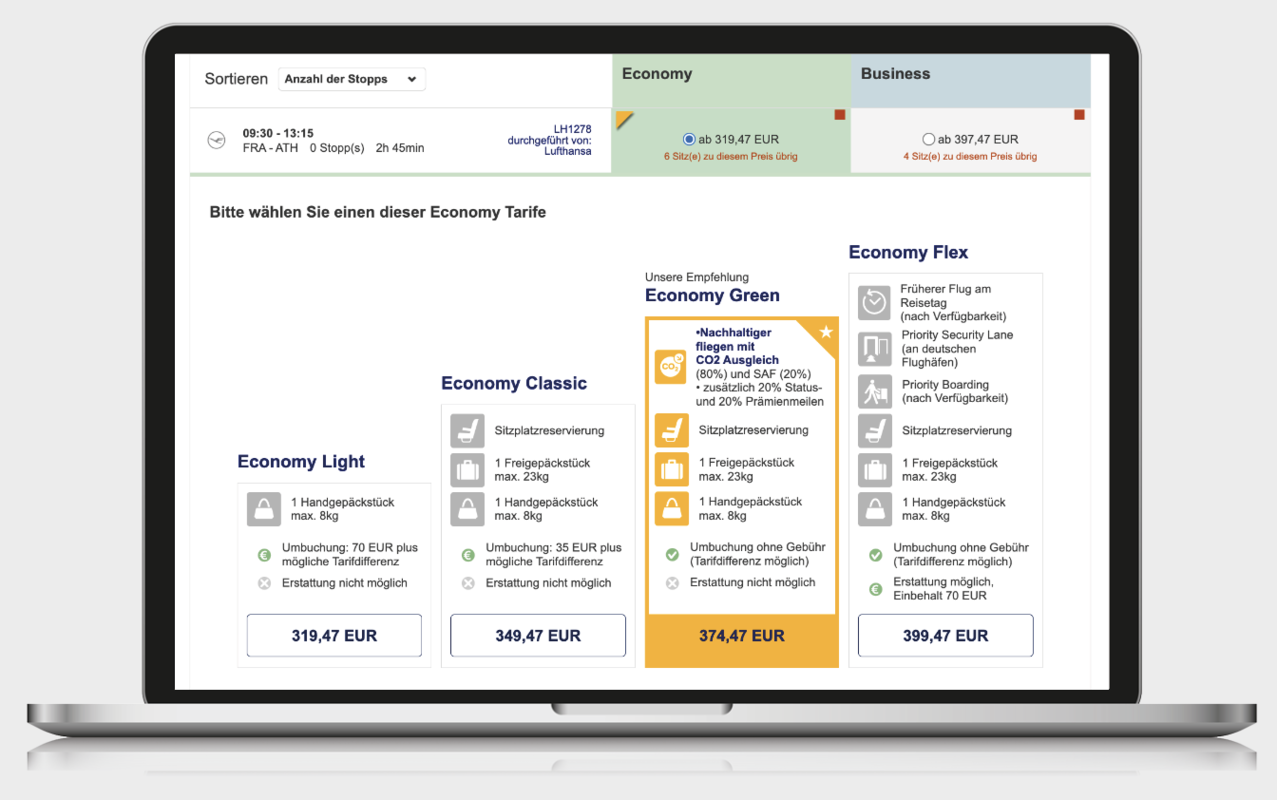

| | | | More convenient

Until now, travellers could add CO2 compensation to their flight at the end of the booking process. In contrast, our Green Fares are a separate type of air fare that can be selected directly. Booking the tickets is very easy and can be done on the websites of Austrian Airlines, Brussels Airlines, Lufthansa, SWISS, Air Dolomiti, Edelweiss and Eurowings Discover or at your travel agent. In Economy Class, prices start at EUR 115. In Business Class, fares start at EUR 255.

| |

| | | | With our new “Green Fares”, launched in February, passengers can fully offset the CO2 emissions from their flight with just one click. No other airline worldwide offers a comparable product. The Lufthansa Group’s Green Fares already make carbon-neutral flying possible today. A combination of reduction and offsetting

20 percent of the CO2 offsetting is achieved through the use of sustainable aircraft fuels and 80 percent through a contribution to climate protection projects certified to the highest standards. Green Fares can be booked for all flights within Europe and for flights to Morocco, Algeria and Tunisia. There are also further plans to include intercontinental routes. To make the programme more attractive, the special fares include additional status miles and a free-of-charge rebooking option. Paris Climate Agreement as a goal

Measures such as the Green Fares are an important component of our highly ambitious climate protection goals. As early as 2030, the Lufthansa Group aims to halve their net CO2 emissions compared to 2019 – the concrete timeline for reductions was confirmed in 2022 by the independent Science Based Targets Initiative (SBTi). This makes the Lufthansa Group the first airline group in Europe with a scientifically based CO2 reduction goal that is in line with the goals of the Paris Climate Agreement. | |

| | | | Modern security checksFast and broad deployment of technologyIt is not uncommon for security checks at German airports to result in bottlenecks. New technology and management by the operators can speed up the process. Frankfurt is at the vanguard here: Fraport has been responsible for security checks at Lufthansa’s largest hub since the beginning of the year. The model is to set a precedent throughout Germany. The Federal Ministry of the Interior is prioritising and accelerating this strategy of innovation. | |

| | | | Faster checks, greater convenience

Passenger checks per hour and sequrity lane through better technology

| |

| | | | Increasing passenger numbers, not enough staff and inefficient processes often lead to long queues at security checkpoints. The fastest solution is the use of computed tomography (CT) scanners. They provide greater security, are convenient and save time. This means that travellers don’t have to unpack their laptops or liquids for inspection. Security personnel can screen more than twice as many travellers in the same amount of time. In Munich, the state-of-the-art CT technology has been in trial use since 2019, and the security checkpoint in Munich’s Terminal 2 will be completely retrofitted by the autumn of 2024. In Frankfurt, seven of these devices are now in regular operation, and another 20 will be added this year. There are now no legal and technical obstacles to their widespread use in Germany. The procurement processes must now be driven forward quickly. Advancing with automation

Modern technology can compensate for a shortage of personnel in the medium term. This is because the automatic detection of dangerous items means fewer employees can check more and more people and their luggage. The authorities and the industry need to work together to drive forward the development of this technology and accelerate its certification. Above all, the EU must rapidly create a legal basis for the use of greater automation. Airports should manage security checks

Equally important: the modern technology available today must be used quickly by the airports. This is an area where the new distribution of tasks between the airport and the federal police – as is now the case in Frankfurt – offers huge opportunities. Until now, the federal police have been responsible for purchasing security technology at most airports. Making this the direct responsibility of the airport operator, under the supervision of the federal police, is more effective at many airports since the airport is best aware of the conditions and the number of passengers in the security lanes. It can adapt the procurement and deployment of safety technology with each specific situation and design processes to suit them. Moreover, the airports select the technology from a broad range; the federal police have so far limited themselves to a few standard configurations. The plan is for the “Frankfurt” model to become a role model for other German airports. The new distribution of tasks at Frankfurt Airport shows what is possible when the Federal Ministry of the Interior, the airports and the airlines are all pulling in the same direction. Germany must show that it is capable of combining cutting-edge technology with a high level of security. | |

| | | | Climate ranking Top marks for the Lufthansa Group | |

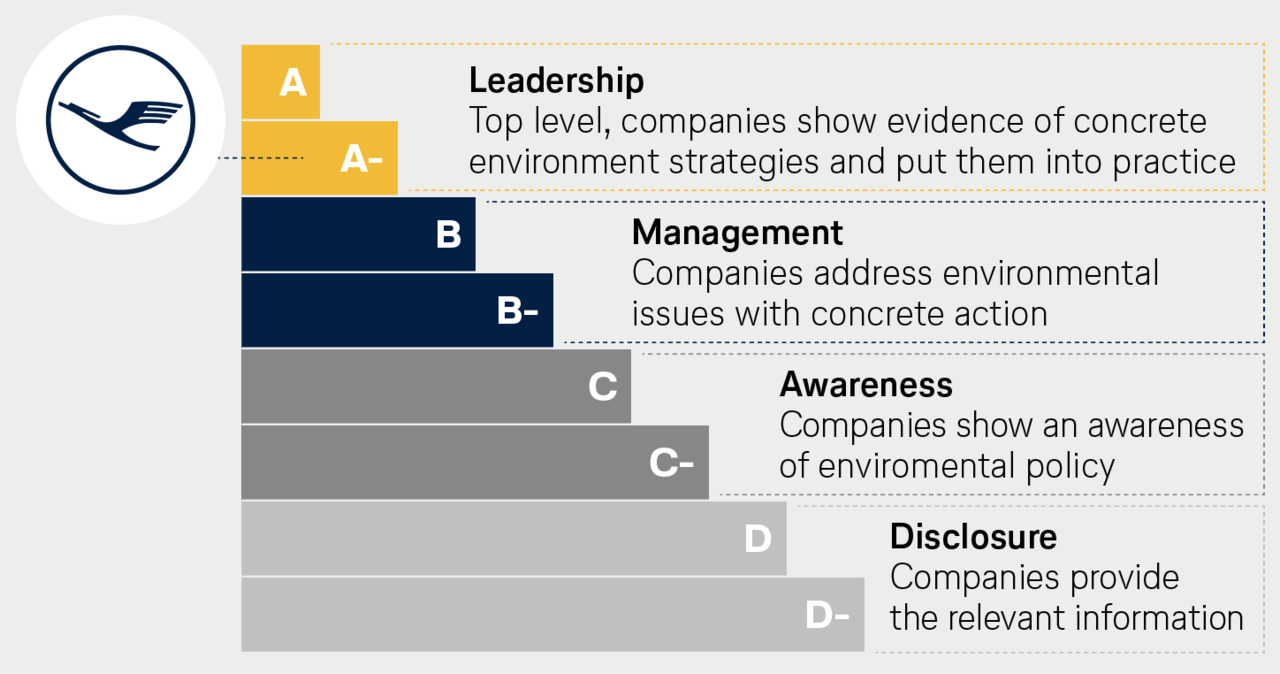

| | | | The CDP ranking

| |

| | | | In the global climate ranking for 2022 of the non-profit organisation CDP, the Lufthansa Group received top marks for its CO2 reduction strategy and its implementation. LHG improved on the previous year, moving up from B to A-. This makes the Lufthansa Group one of the Top 5 airlines worldwide with the best grades. Each year, CDP gathers information on CO2 emissions sustainability strategies and sustainability goals from more than 18,700 companies. In environmental reporting, their climate ranking is considered the gold standard worldwide. CDP is a partner of the independent Science Based Targets Initiative (SBTi). | |

| | | | Sustainable aircraft fuelsMoU signedWorldwide, the demand for sustainable aviation fuels (SAF) is increasing dramatically. The Lufthansa Group is one of the drivers of this development: No other airlines group in Europe uses more SAF. In addition, the company has also been involved in innovative SAF research projects for some years now. The most recent milestone: At the beginning of February, the Lufthansa Group and the Swiss Energy Group VARO Energy signed a Memorandum of Understanding (MoU) for the production and supply of SAF. According to this MoU, large quantities of SAF can be supplied as early as 2026, including supplies to the Munich hub. VARO and the Lufthansa Group are also pushing ahead with innovative processes to manufacture green hydrogen from biogenic waste materials. | |

| | | | Carbon LeakageExplained in 2 minutes

One of the key tasks of climate protection policy is to prevent carbon leakage. The German Aviation Association (BDL) explains the background and potential risks in a recent video (in German language). | |

| | | | LUFTHANSA GROUPYour Contacts Show PDF Show PDF

Andreas Bartels

Head of Corporate

Communications

Lufthansa Group  +49 69 696-3659 +49 69 696-3659

andreas.bartels@dlh.de andreas.bartels@dlh.de

|

Dr. Kay Lindemann

Head of Corporate

International Relations and

Government Affairs

Lufthansa Group  +49 30 8875-3030 +49 30 8875-3030

kay.lindemann@dlh.de kay.lindemann@dlh.de

|

Martin Leutke

Head of Digital Communication

and Media Relations

Lufthansa Group  +49 69 696-36867 +49 69 696-36867

martin.leutke@dlh.de martin.leutke@dlh.de

|

Jan Körner

Head of Government Affairs

Germany and Eastern Europe

Lufthansa Group  +49 30 8875-3212 +49 30 8875-3212

jan.koerner@dlh.de jan.koerner@dlh.de

|

Sandra Courant

Head of Political Communication

and Media Relations Berlin

Lufthansa Group  +49 30 8875-3300 +49 30 8875-3300

sandra.courant@dlh.de sandra.courant@dlh.de

|

Jörg Meinke

Head of EU Liaison Office

Lufthansa Group  +32 492 228141 +32 492 228141

joerg.meinke@dlh.de joerg.meinke@dlh.de

|

| |

| | | | Published by:

Deutsche Lufthansa AG

FRA CI,

Lufthansa Aviation Center

Airportring, D-60546 Frankfurt Andreas Bartels

Head of Communications

Lufthansa Group Dr. Kay Lindemann

Head of Corporate International

Relations and Government Affairs

Lufthansa Group Martin Leutke

Head of Digital Communication

and Media Relations

Lufthansa Group | Editor in Chief:

Sandra Courant

Head of Political Communication

and Media Relations Berlin

Lufthansa Group Editorial Staff:

Matthias Hochleitner, Markus Karassek, Holger Kindler, Dr. Christoph Muhle, Thomas Schomburg, Alexandra Zill Press date:

14 March 2022 Agency Partners:

Köster Kommunikation

GDE | Kommunikation gestalten |

| |

|