Long-distance buses: wide range on offer for price-sensitive passengers

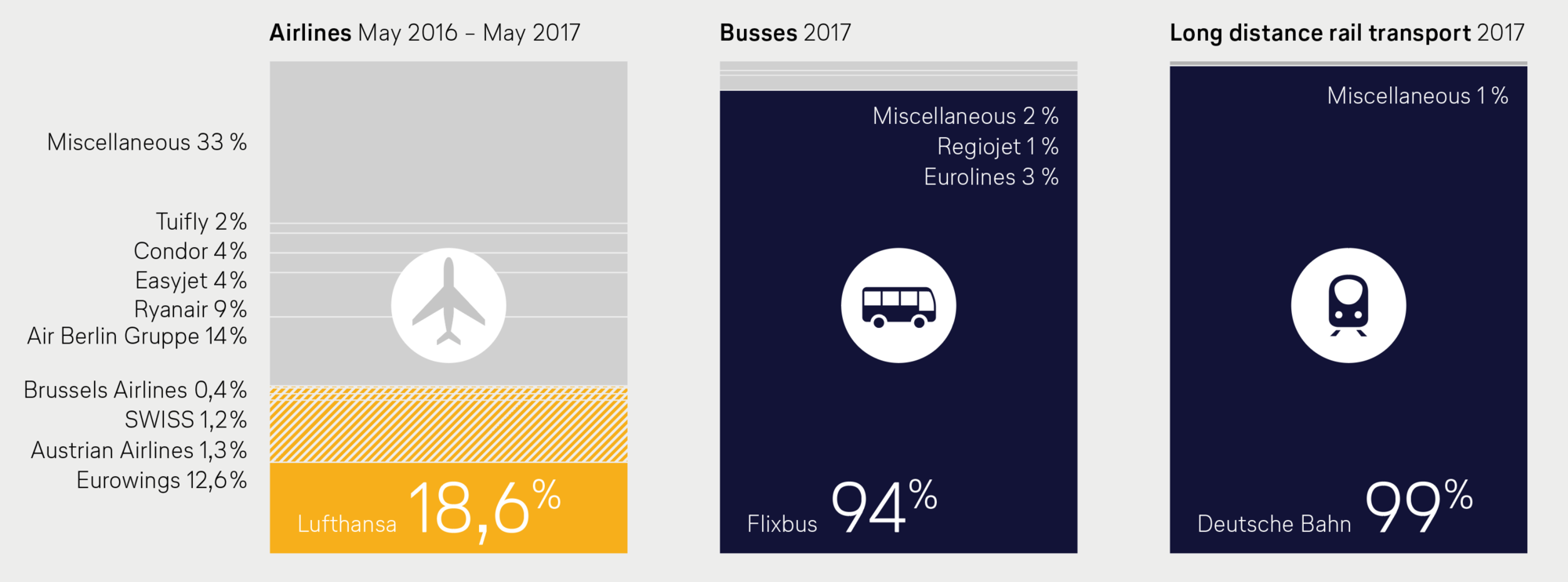

With the liberalisation in 2013, the number of German bus destinations within Germany quadrupled. This means of transportation clocks up 24 million passengers per year and presents especially price-sensitive customers with attractive offers. An enormous consolidation took place within it – Flixbus now accounts for 94 percent of the German long-distance bus market. The company controls 1,200 stops throughout Europe. And the trend is rising: in the German-speaking world alone, around another 140 new stops will be added in 2018. Thanks to this strength on the home market, the Munich-based company is now lining up routes in the United States from summer 2018.

Rail: increasing competition for airlines

Also on course for growth is Deutsche Bahn. In November, the group expected an increase in bookings of ten percent for the next six months, aided by the new high-speed routes between Berlin and Munich. Since 10 December, this journey with the Sprinter is scheduled to only take 3 hours and 55 minutes - a time saving of over two hours. The declared objective of Deutsche Bahn is to take on significant market shares from airlines with these routes. In fact, Deutsche Bahn has no competitors in the long-distance rail transport sector.

Air transport: highest level of competition

The situation for air transport is somewhat different. In Germany alone, 160 airlines are competing with each other. Although travellers had to switch to more expensive booking classes due to the discontinuance of hundreds of Air Berlin connections on certain routes, that was only a snapshot in time. With the takeover of the Air Berlin subsidiary airline Walter, Lufthansa Group can now further expand its capacity. The British company Easyjet – who took on 25 aircraft from Air Berlin – is also massively expanding its offering, for example to 250 weekly flights from Berlin. The IAG subsidiary Vueling wants to operate Niki routes again in the coming weeks and other airlines want to expand their business from Germany.

Never before has there been such a large selection on offer for travellers in Germany and in Europe. The fact that aviation is currently entering a new phase of consolidation, as it is in other regions of the world, secures diversity in the long run – only well-established airlines can invest billions in fuel-efficient aircraft and even more comfort.