Lufthansa Group helps shape consolidation

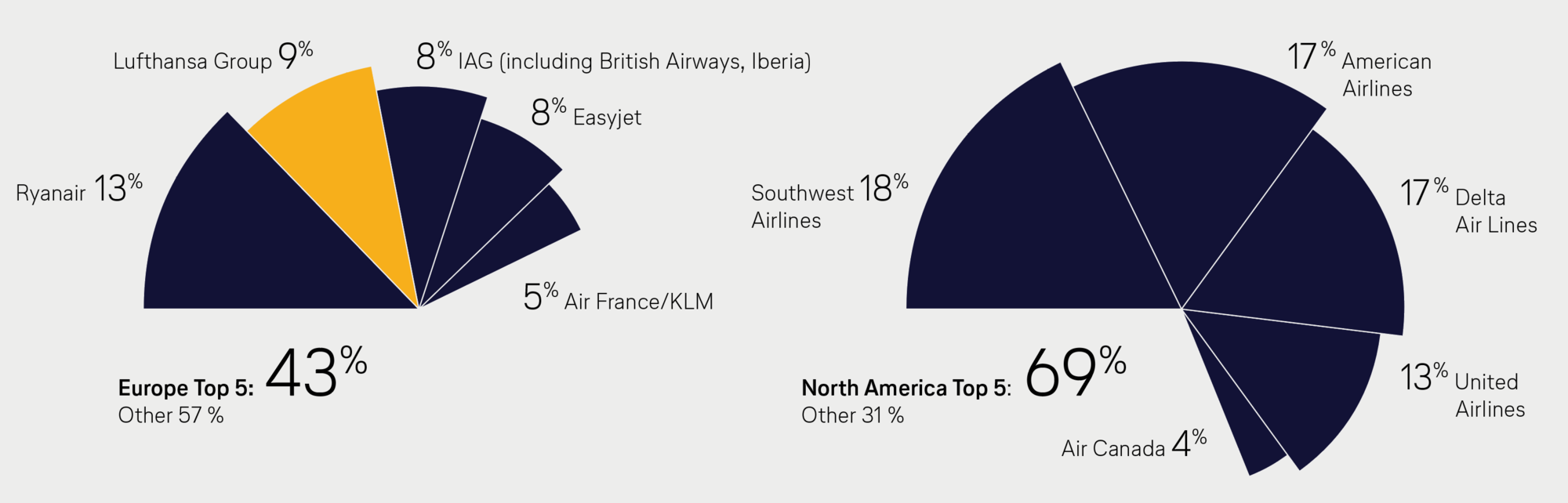

Given the 160 airlines who in Germany alone are fighting for passengers, a further consolidation is being mapped out. Thanks to a radical modernisation of the fleet, the products and the collective agreements over the past few years, Lufthansa Group is now in a position to play an active role in shaping this consolidation. The best example of this: Lufthansa Group is currently integrating the former Air Berlin subsidiary airline Walther (LGW). All employees of LGW are coming to Eurowings with their existing employment contracts. With additional recruitment, the number of employees in LGW flight operations in 2018 will grow to 870. A total of over 60 of the 140 aircraft used by Air Berlin will then be at the service of the Lufthansa Group. Many hundreds of former Air Berlin staff have already found a new home at the Lufthansa Group, and 8,000 new employees will join the group this year - never before in the history of German aviation have so many people been offered new prospects. Lufthansa Group was also willing to take to take over the Air Berlin subsidiary Niki. As the EU Commission clearly signalled its rejection despite the far-reaching concessions granted by the Lufthansa Group, they had to abstain.

Consolidation is taking place across Europe - the traditional airline Alitalia could also be affected. Lufthansa group has also expressed its interest here. The precondition, however, is a fundamental reorganisation of the Italian airline by its current owners. Only once this has been fully implemented, new perspectives can be developed again at a renewed Alitalia. With the acquisitions of Swiss, Austrian Airlines and Brussels Airlines, Lufthansa has sufficiently proved that it is a good partner for the national airlines of other countries: the airlines are once again generating profits, count as the most popular airlines in Europe for passengers and they also provide employees with good and secure jobs.

Strong airlines – strong airports

In addition to customers and employees, Lufthansa’s home airports also benefit from it being an attractive and powerful airline. The best example of this is Munich - at the World Airport Awards, MUC was chosen as the best airport in Europe. Lufthansa has made a major contribution to this: it draws its Star Alliance partners to the location like a magnet and operates Terminal 2 in conjunction with the airport - characterising it as the world's best terminal.