Subjects

Europe’s air traffic:

Airline industry in upheaval

Europe’s air traffic is changing fundamentally. Four developments in particular are shaping the industry.

1. Fleet growth in the Gulf states

There is also upheaval at the Gulf airlines. But this should not hide the fact that they are continuing to expand their aircraft fleets. Thus, Emirates is expecting 45 new Airbus A380. Currently, the state-owned airline is operating 97 of these wide-body aircraft. In comparison: all European airlines together have a total of 36 A380. The situation is similar for Boeing’s wide-body aircraft 777X, which is due to be delivered starting 2020. Emirates has ordered 150 such aircraft; the Lufthansa Group has only ordered 20. No doubt: Emirates continues to focus on the displacement of competing airlines from the EU and the US.

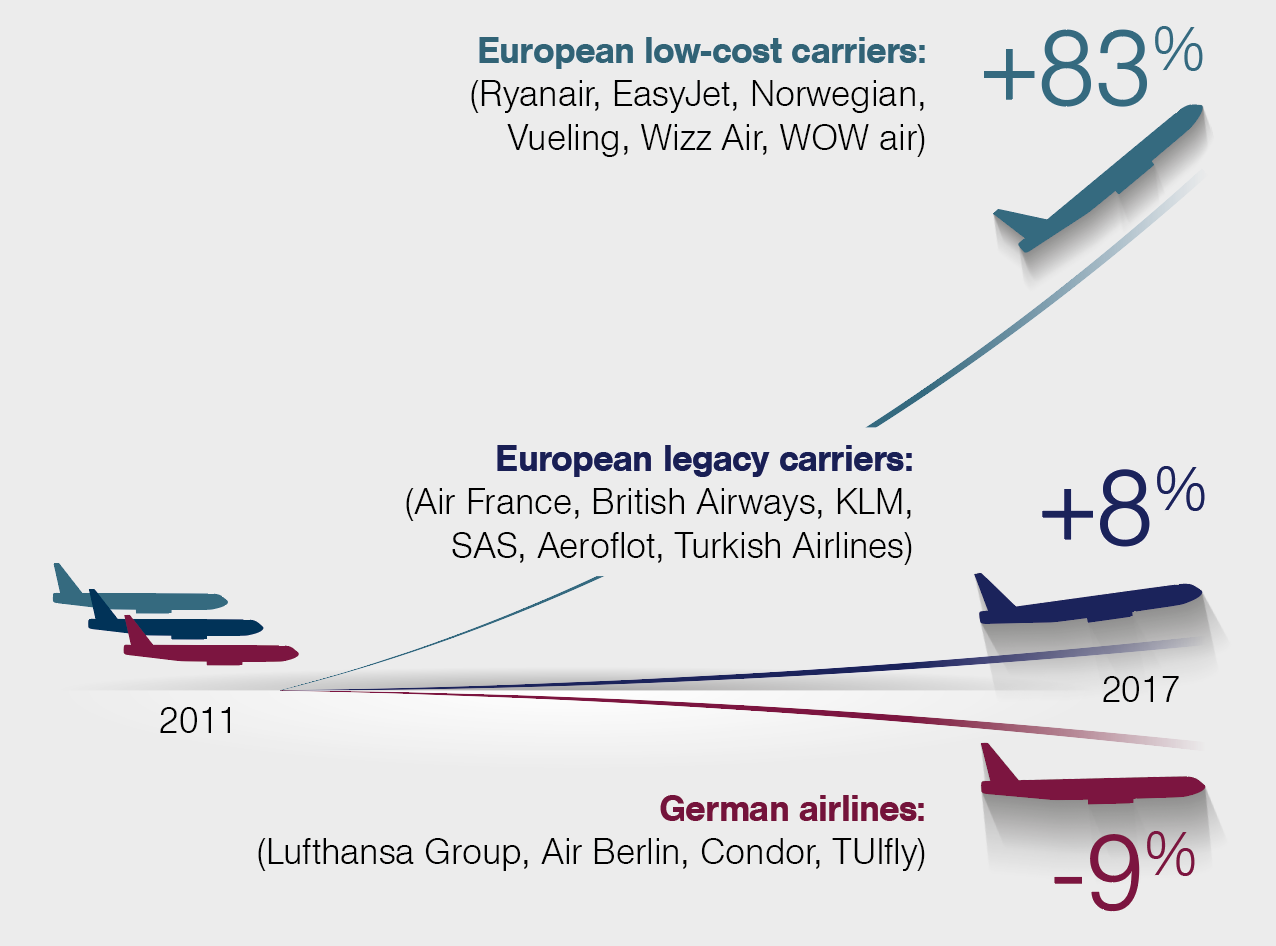

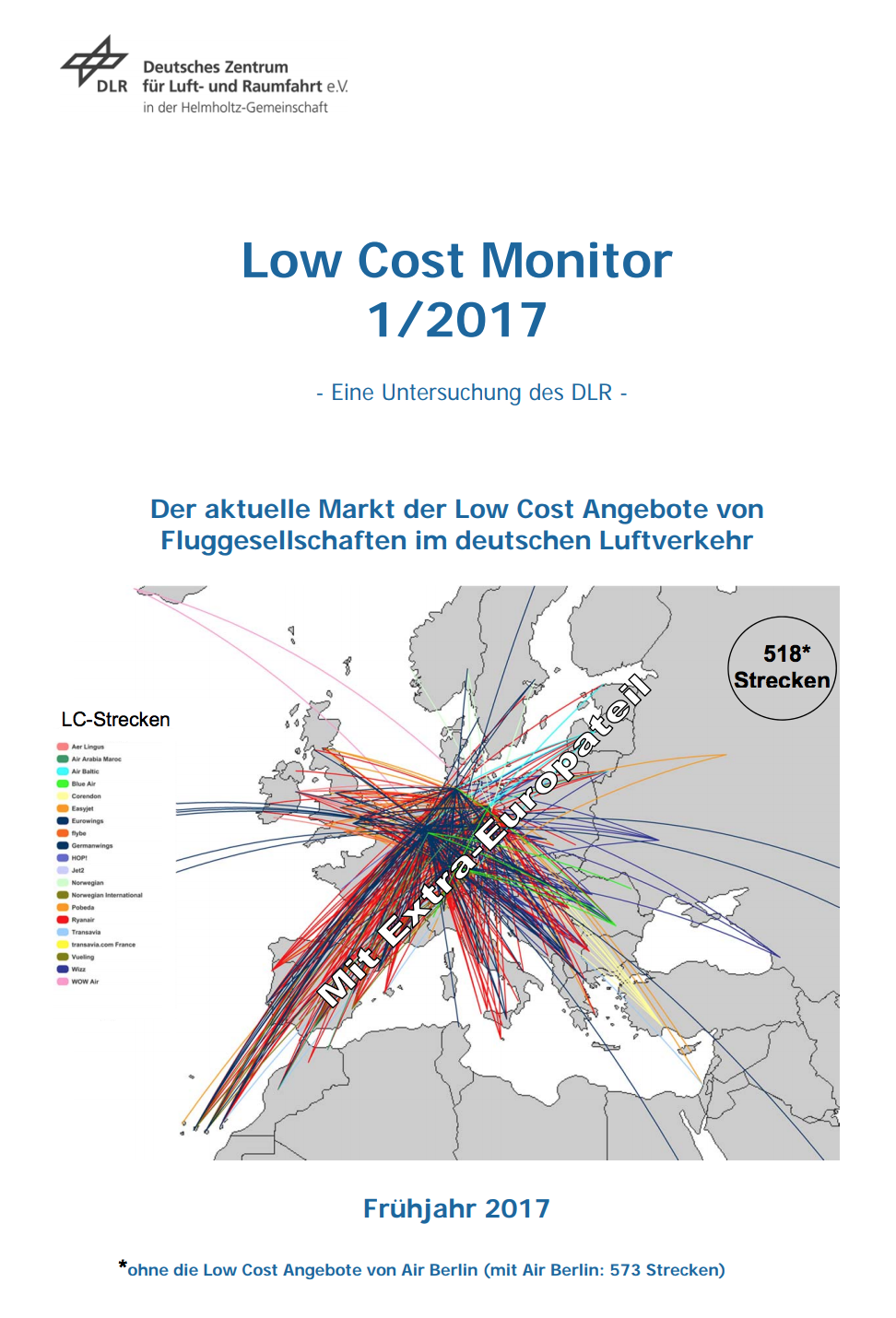

2. Low cost airlines with market increases

According to the latest calculations by the German Aerospace Center (DLR), low-cost airlines reached a new record high in Germany with 518 destinations in last year’s winter flight plan. The highest growth rate was recorded by Irish Ryanair with 25 percent. At the same time, ticket prices are increasingly under pressure: for a single domestic flight, they sank from an average EUR 64 to 107 to EUR 44 to 105. And the next shift in the sector is already mapped out. Thus, more and more low-cost airlines are preparing to offer flights on intercontinental routes.

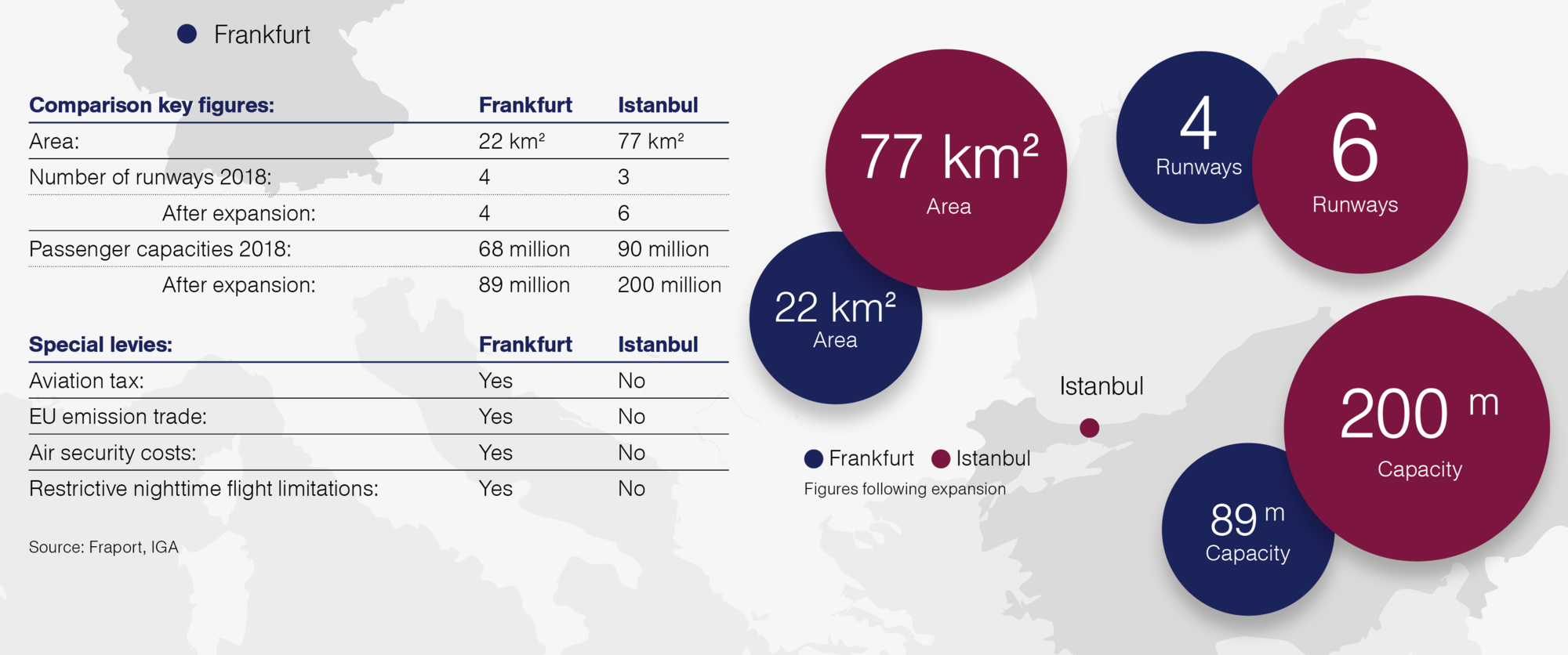

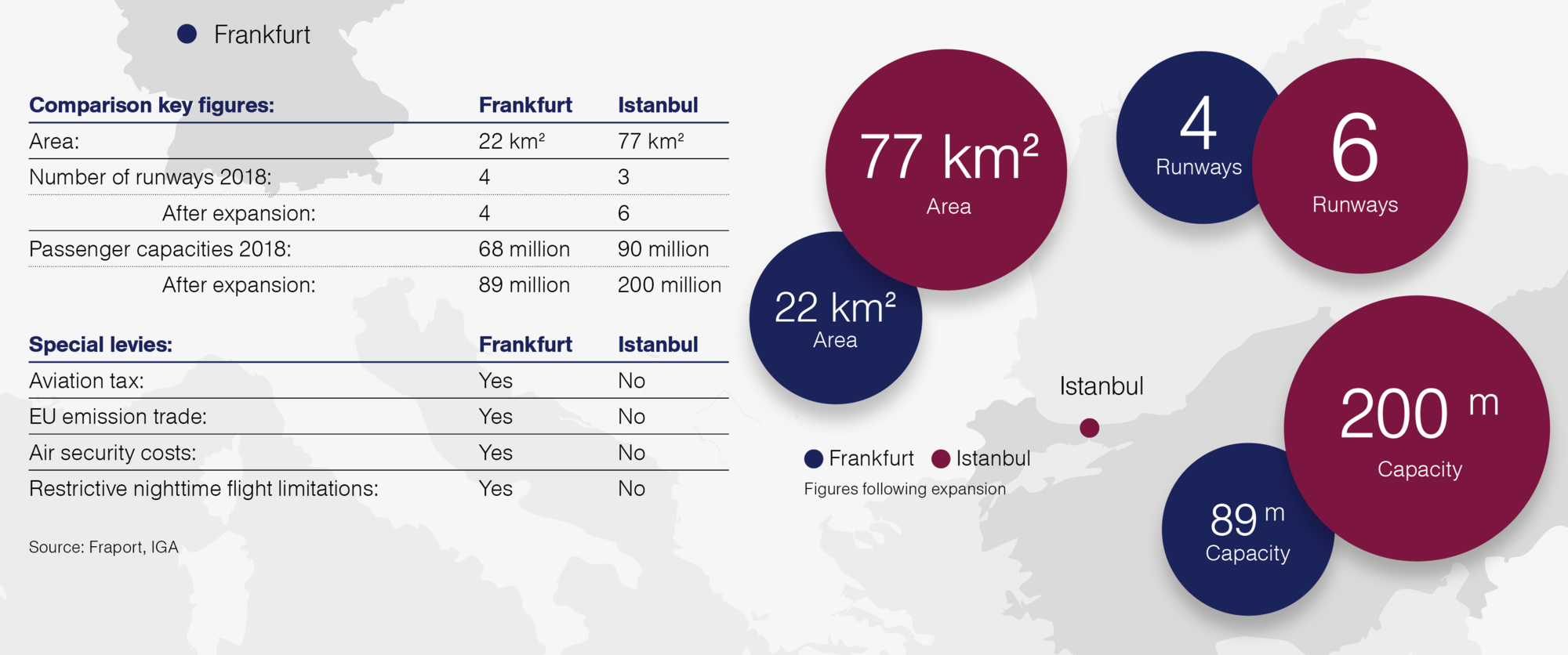

3. World’s largest airport in Turkey

In 2018, Istanbul will open its new airport. Initially, capacity will cover 90 million passengers per year; in the next few years, this is set to grow to 200 million. As such, Istanbul will become the world’s largest airport and will push London, Paris, Frankfurt and Munich well into the shadows. Also, due to nighttime flight bans, strict environmental requirements or comprehensive work protection law – things common in EU countries – are of little importance in Turkey.

Istanbul: Optimal infrastructure, minimal strain

At the gateway to the European Union, Turkey is strengthening its air traffic in two ways: firstly, it is building the world’s largest airport in record time in Istanbul. Secondly, just like the Gulf states, it will spare its aviation market from special levies. As a result, even more transfer passengers will travel via Turkey in the future, while hubs such as Frankfurt, Munich, Paris and Amsterdam will lose out.

Istanbul: Optimal infrastructure, minimal strain

At the gateway to the European Union, Turkey is strengthening its air traffic in two ways: firstly, it is building the world’s largest airport in record time in Istanbul. Secondly, just like the Gulf states, it will spare its aviation market from special levies. As a result, even more transfer passengers will travel via Turkey in the future, while hubs such as Frankfurt, Munich, Paris and Amsterdam will lose out.

Source: Fraport, IGA

(Kopie 7)

4. Cross-shareholdings

In early September, Air France-KLM decided to conclude a very close cross-shareholding with non-European airlines. Delta Airlines and China Eastern will participate in French and Dutch airlines with ten percent for each. Air France-KLM, in turn, will take over 31 percent of the British company Virgin Atlantic. This will result in a first global network to bundle its forces on the North Atlantic market in particular.

Lufthansa to accept the challenge

The Lufthansa Group wants to continue to take an active role in shaping Europe’s aviation market. The bankruptcy of Air Berlin, in addition to that of Alitalia, is only one example of the high level of pressure facing European aviation. Together with its subsidiary Eurowings, the Lufthansa Group will offer good and secure jobs for new colleagues. Accordingly, the company is working hard to further lower unit costs. This will create the necessary leeway for billions’ worth of investments in the latest aircraft, attractive lounges and completely new digital products and services. At the same time, the Lufthansa Group is securing its international position through joint ventures with United, Air Canada, Singapore Airlines, Japan’s ANA and Air China.

Still urgent: improve framework conditions

Europe’s air traffic urgently needs better overall conditions to survive international competition. One-sided disadvantages must be deconstructed by policy-makers to enable a sustainable European aviation industry:

- Abolish aviation tax: The special levy places a burden on German airlines with over EUR 540 million per year. No other European country forces its own airlines to make such unilateral payments.

- Lower air security costs: Air security costs have risen since 2011 by EUR 270 million to just under EUR 700 million per year. They must be paid by the airlines, although this is a sovereign responsibility. The government must face up to its responsibility and bear its fair share of the costs.

- Maintain operation periods: German airports are today already subject to strict nighttime flight regulations.

- End EU emission trading: From 2021, the CO2 compensation system CORSIA, agreed by the UN International Civil Aviation Organization (ICAO), will come into effect. EU emission trading for air traffic will thus become obsolete. Accordingly, the EU must end this stand-alone solution. Double payment obligations would be disastrous.

- Ensure fair competition: The strongly state-funded airlines in the Gulf states in particular, above all Qatar Airways and Emirates, are pursuing a clear and hard displacement strategy in Europe. The EU is urgently called upon, as part of the currently ongoing negotiations with the Gulf States, to create reliable competition supervision and penalty mechanisms in the event of illicit subsidies.

Germany and Europe are driven by exports and need strong domestic and globally operating airlines for reasons of economic sovereignty. Because, without its own network, the continent will become dependent on state-owned airlines from politically unstable regions. The newly-elected German parliament has the opportunity to strengthen considerably the working conditions for domestic airlines.

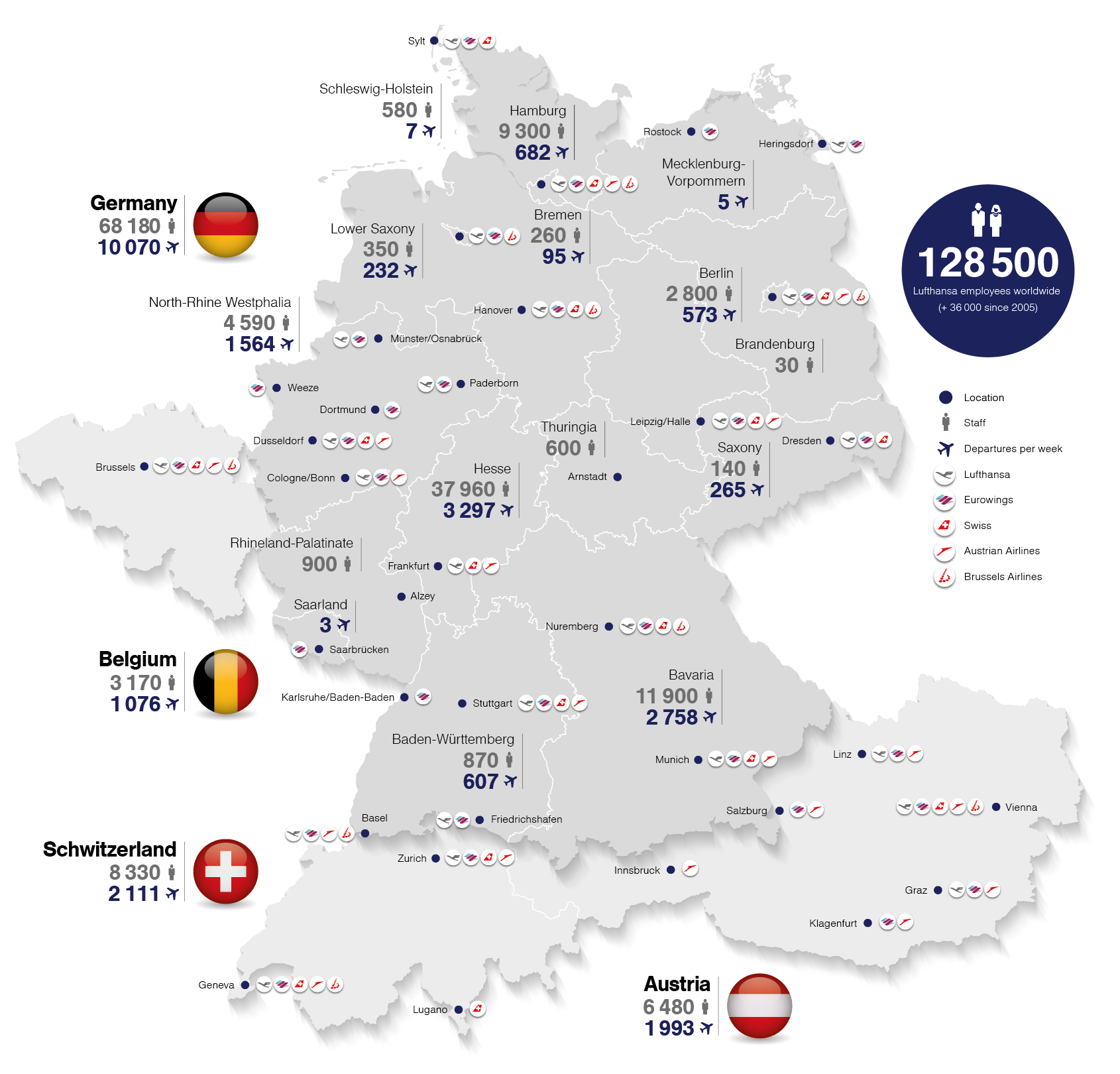

Staff and departures per country

The Lufthansa Group employs 128,500 people worldwide, 68,200 of whom are in Germany, and over 24,000 of whom are in other European countries. Together, they enable more than 15,000 take-offs per week to all corners of the globe.

Further content on the topic

Study – only in German

Low Cost Monitor 1/2017

In mid-May, the German Aerospace Center (DLR) published its latest study on the market development of low-cost airlines in Germany. The brief conclusion: Record range, increasing competition and falling prices

Document – only in German

Aviation concept of the Federal Ministry of Transport

The aviation concept includes, firstly, the key findings of the assessment report to determine basic principles. Secondly, in 19 individual chapters, the concept proposes concrete suggestions for the strengthening and securing of Germany as an aviation location.

Quote: “It is the task of the Federal government and the European states to create, at least for the most part, competitive conditions in air traffic which provide equality of opportunity by means of a sound legal framework.”

Charts – only in German

Half-year figures 2017

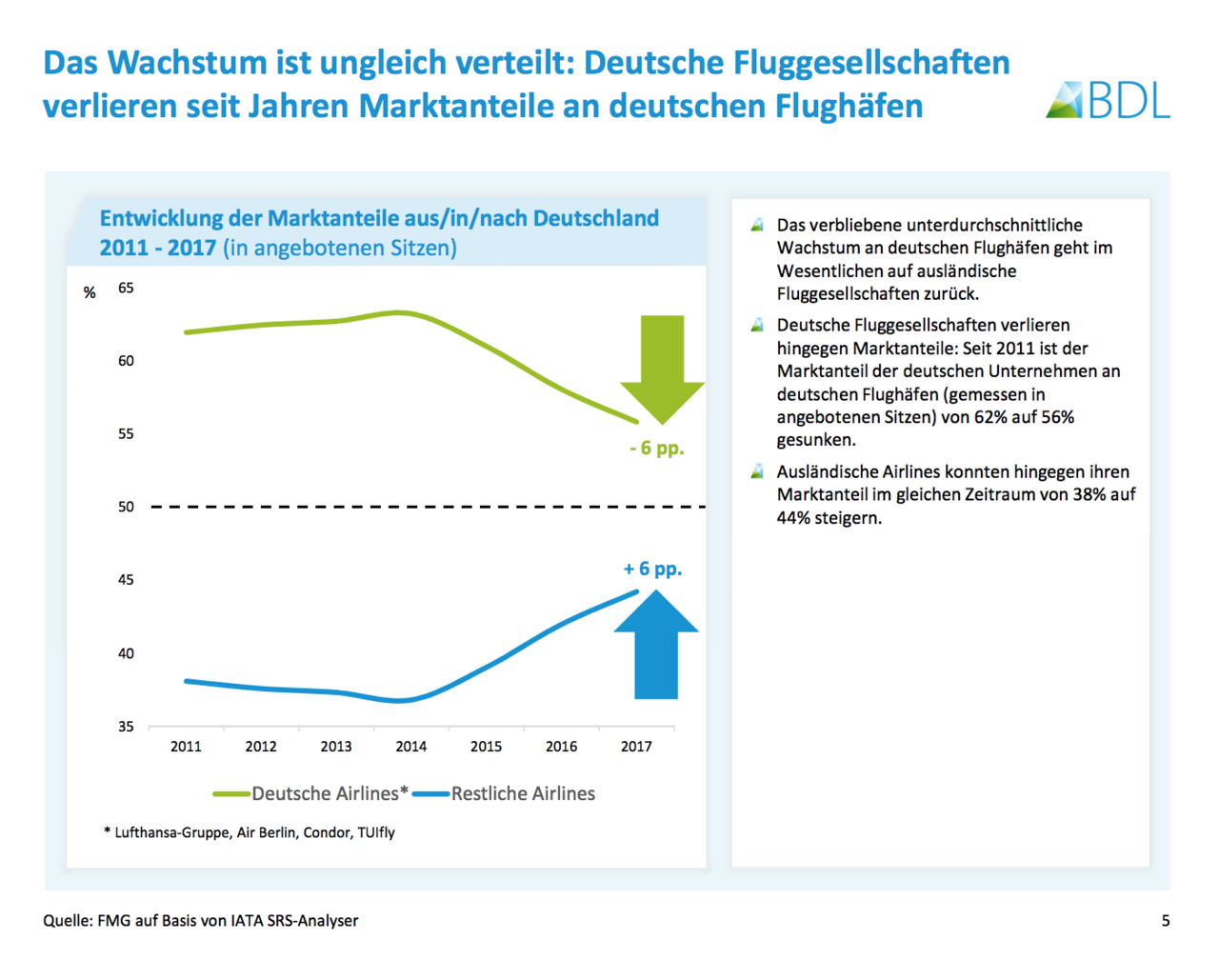

Air traffic is on a growth trajectory worldwide. In Germany, passenger numbers are also increasing – nevertheless, the domestic airlines are continuing to lose market shares.