Subjects

2018:

Austria to halve aviation tax – and Germany?

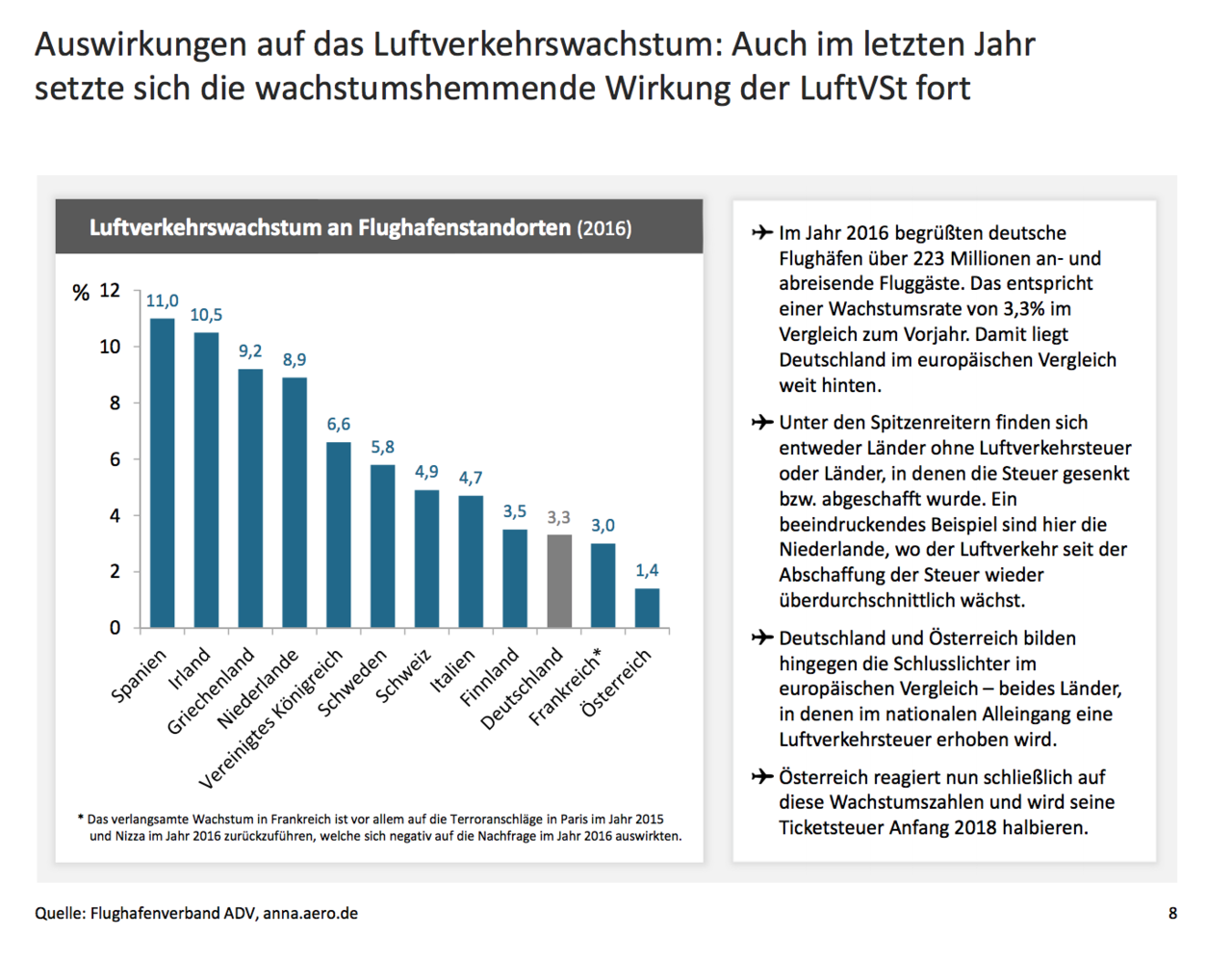

Since the introduction of the aviation tax in 2011, German airlines have paid a total of EUR 3.2 billion to the treasury. During the same period, the airlines at domestic airports have forfeited six percent of the market share. And Germany’s former second-largest airline Air Berlin has declared bankruptcy – also due to this particular expense. There is an urgent need for action in this area.

German airlines are disproportionately affected

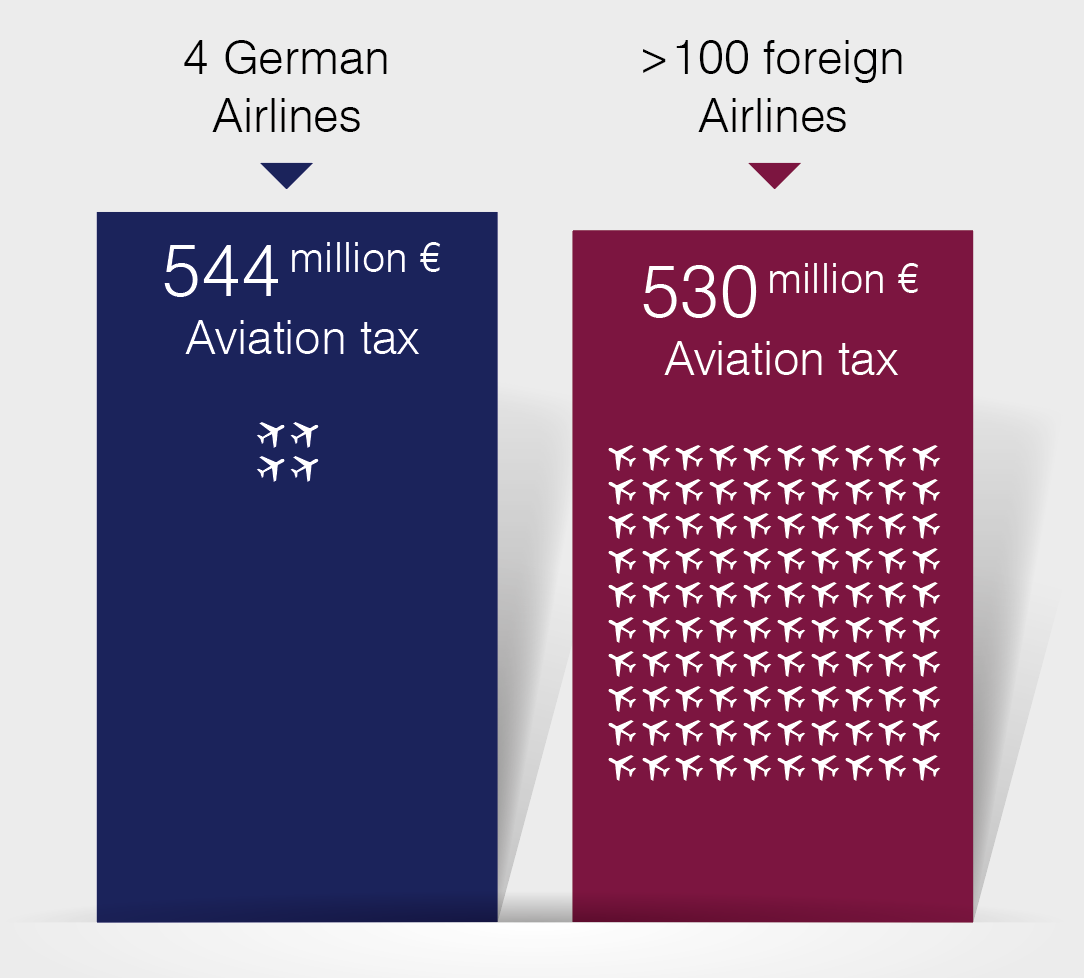

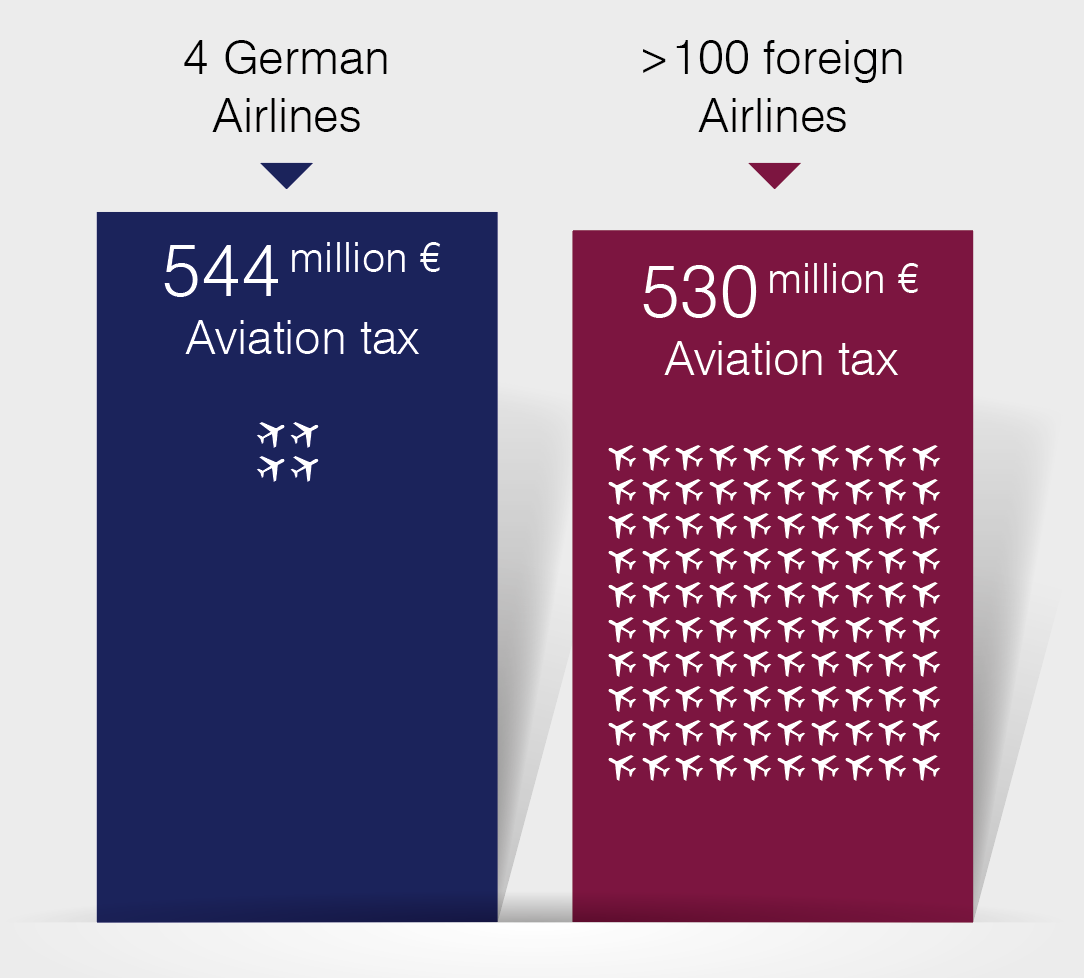

In 2016, the federal government collected EUR 1.1 billion. EUR 544 million came from German airlines.

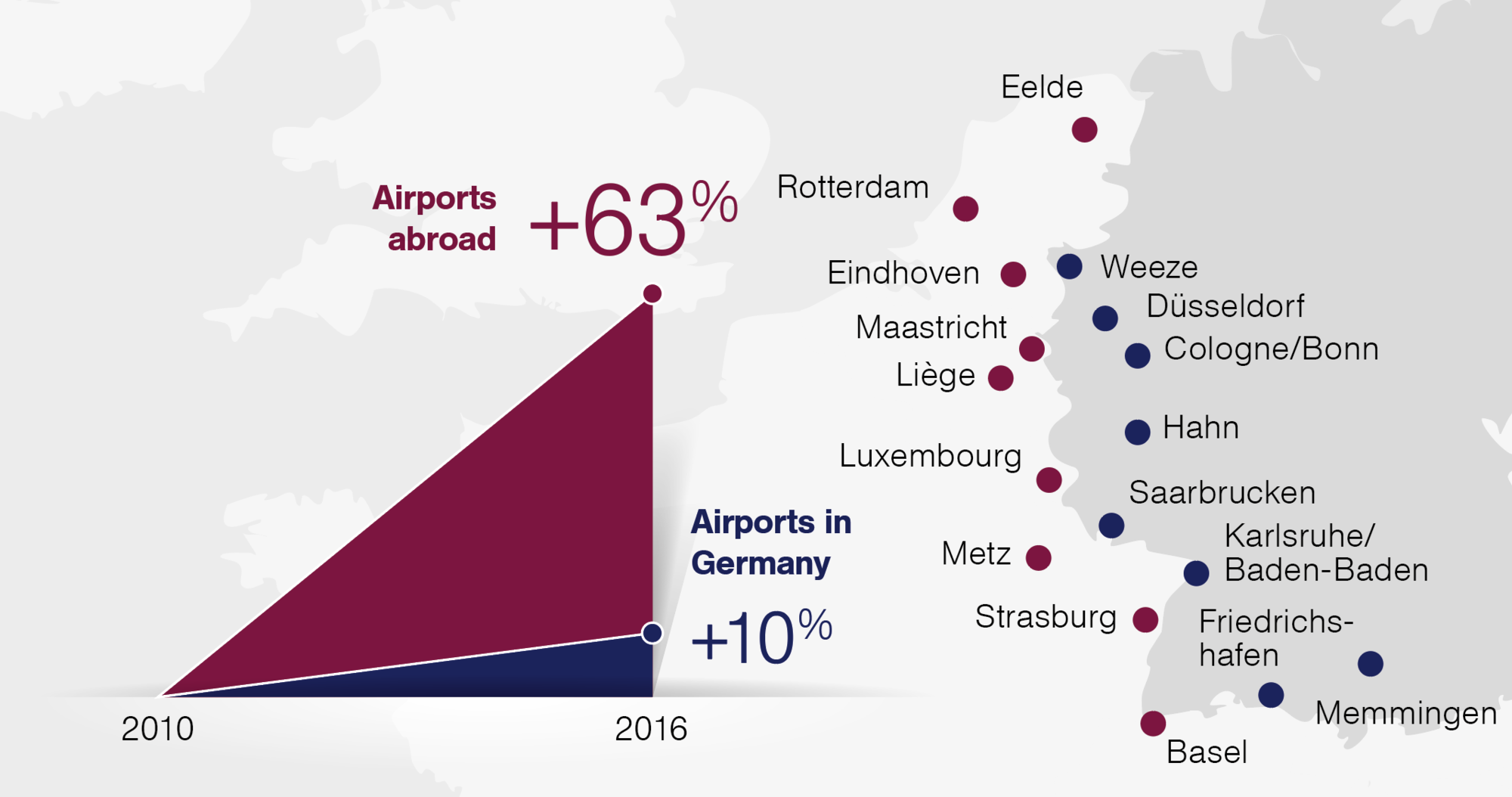

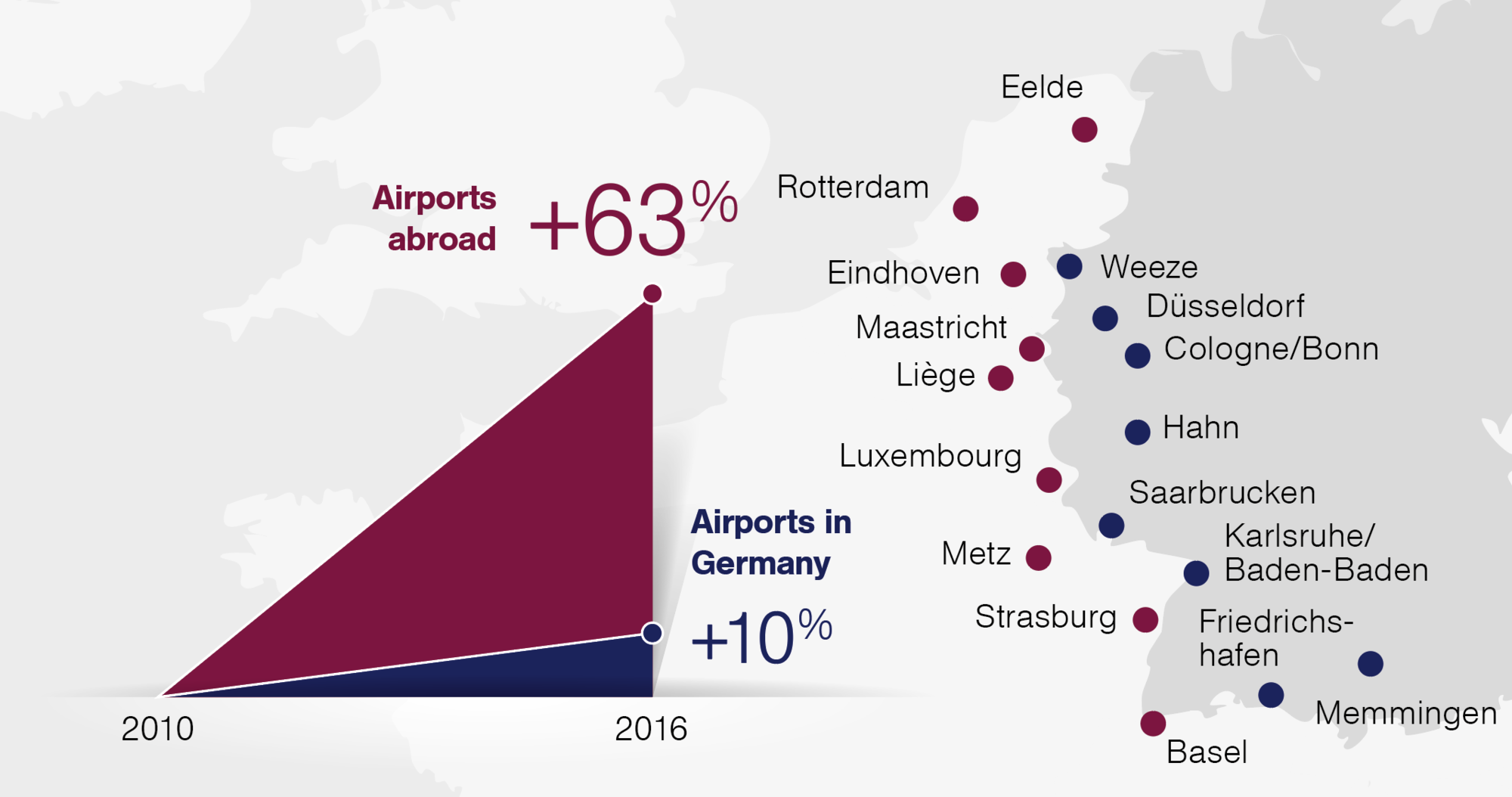

Growth of airlines close to the German border

Source: BDL

In contrast to Germany, Ireland and the Netherlands, among others, have learned from the disastrous consequences for airlines and airports and have abolished the aviation tax. The success has proven the countries right: Over the two years following the 2014 abolition of aviation tax, Ireland’s air traffic recorded a considerable growth in passengers of 13 percent. The Netherlands recorded a passenger plus of 10 percent in the first half of 2017 alone. And Amsterdam Schiphol consolidated its position as third-largest airport in Europe – until 2016, Frankfurt was at third place; the airport has since dropped positions.

Austria to halve aviation tax

Austria has also taken an important step in the right direction and will halve aviation tax in 2018. The market development is clear: Prior to the introduction of the tax in 2011, passenger numbers increased at an above-average rate. Since then, the figures have stalled. The lowest point in an EU comparison was reached in Austrian passenger growth in 2015: Among the 28 EU states and Switzerland, the country took 29th place. And in 2016, Austria took a modest place of 27th with a mini growth of 1.0 percent. The radical cut in aviation tax will once again create growth prospects.

Germany should follow

The pressure for action has also been recognized across parties in Germany. Thus, Volker Kauder, Chair of the CDU/CSU faction, said at the end of March: “Aviation tax will soon be a thing of the past”. And Federal Economics Minister Brigitte Zypries, SPD, stated clearly in mid-August: “Aviation tax presents a unilateral disadvantage to German aviation companies. Its abolition would strengthen competitiveness”. On federal state level, the pressure is also mounting. As such, the CDU/FDP government coalition in North-Rhine Westphalia will take the initiative to abolish the tax in accordance with the coalition agreement in the Bundesrat.

In the face of the continuing positive economic forecast, the federal government and the states will benefit from increasing tax revenue. This financial leeway should be used to secure growth and prosperity in the long term. The end of aviation tax would be a first important step in the right direction.

Abolish aviation tax – generate billions’ worth of profit

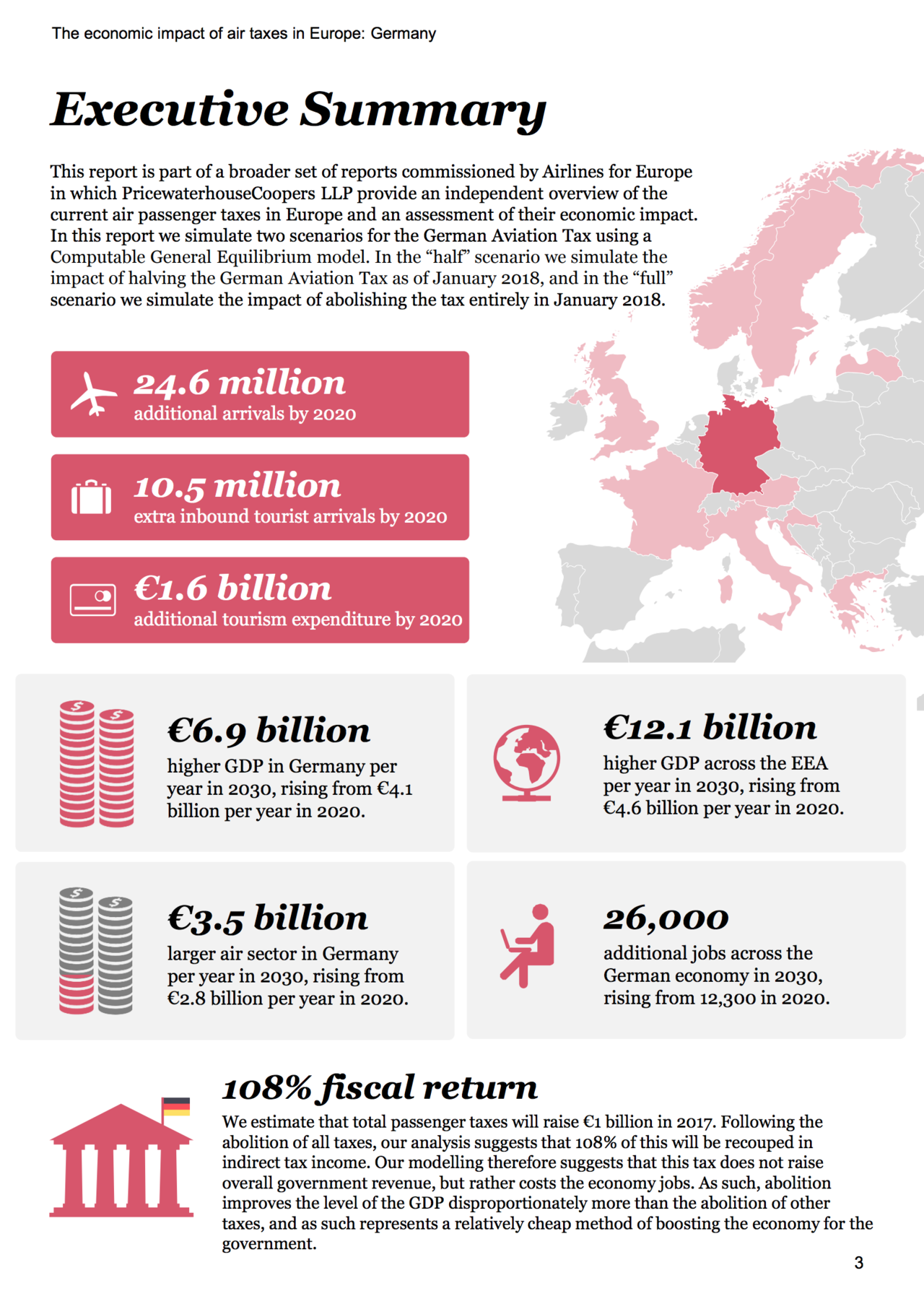

According to a recent study by PwC, the abolition of German aviation tax would unleash a GDP growth of EUR 4.1 billion and create over 12,000 new jobs. And: The omitted aviation tax would be overcompensated by a factor of 1.08 in indirect taxes – good for passengers, the job market and the treasury.

German airlines are disproportionately affected

In 2016, the federal government collected EUR 1.1 billion. EUR 544 million came from German airlines.

Growth of airlines close to the German border

Source: BDL

Further content on the topic

PwC study

The economic impact of air taxes in Europe: Germany

- PwC study estimates an increase of 24.6 million passengers and an extra € 1.6 billion tourism expenditure by 2020.

- €1 of abolished air passenger tax creates €1.08 in indirect taxes – Tax will raise €1 billion in 2017.

- Berlin: 4.6 million additional passengers and €300 million additional tourism spending by 2020.

Charts – only in German

Evaluation report on aviation tax

The Federal Association of the German Aviation Industry (BDL) regularly evaluates the effects of aviation tax. The latest report from September 2017 underlines once again its competition distorting effect.