Istanbul as a hub is unthinkable without Turkish Airlines as its home carrier. The parastatal company is pursuing ambitious growth plans. Its passenger fleet will grow by about 50 percent to 460 aircraft by the end of 2023. The planes are also intended to serve routes to the EU countries. Turkish Airlines will thus be able to transport even more passengers from the EU to Istanbul where they will then be transported in long-haul aircraft to the Far East and Africa. Istanbul is thus competing for the same passengers as London, Frankfurt or Munich.

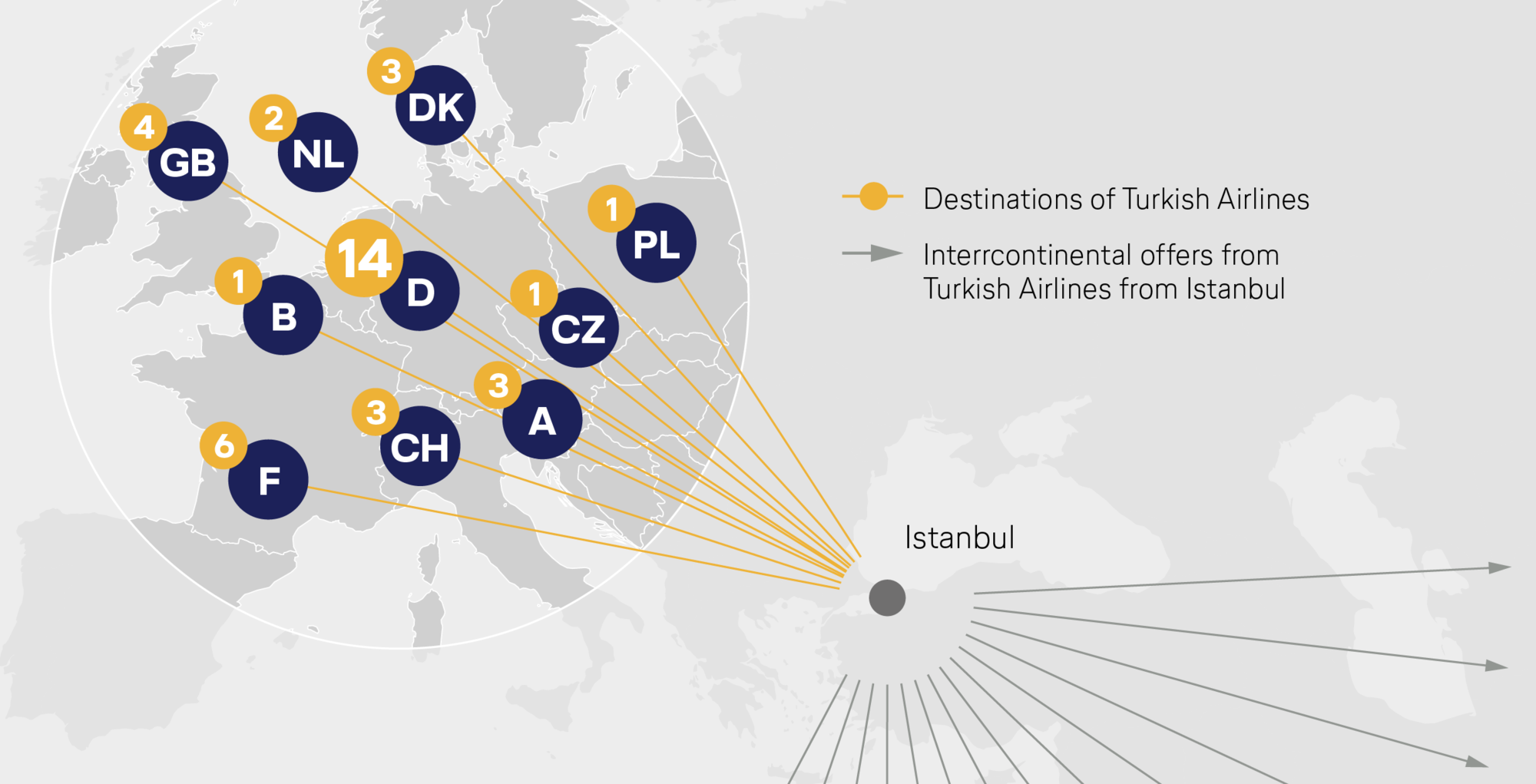

The German market plays a key role in all this. These days, Turkish Airlines already flies to Germany an average of 38 times a day. In total, there are 14 airports in Germany on the Turkish Airlines flight plan. In comparison, Turkish Airlines serves six destinations in France, and four in the UK.

Unequal framework conditions

The Turkish state is forcing through this expansion of aviation by means of tailor-made framework conditions. Some examples:

Taxes: Special charges such as the aviation tax that is applicable in Germany are not levied in Turkey – as in the vast majority of EU member states. In Germany, the financial burden in 2017 alone amounted to over 1.1 billion euros.

Aviation security checks: In Germany, airlines have to pay the costs themselves – including for passenger and luggage checks. Frankfurt Airport charges nine euros per passenger, for example. In Turkey, the state covers part of the cost and the airlines pay about 1.60 euros per traveler.

Operating restrictions: In Istanbul, airplanes can fly around the clock. This means that the expensive infrastructure can be utilized most efficiently. This is not the case in Frankfurt and Munich, where extensive restrictions prevail.

The Lufthansa Group has had to reduce its Turkey programme by 50 per cent over the past 5 years. The new airport in Istanbul is considering to draw off further passenger traffic. This will be comparatively easy, as airlines at the Bosporus can work under much better general conditions. Against this backdrop, the EU, the German government and the federal states are being called upon to relieve the domestic aviation industry of unilateral burdens and to actively support the modernization of our infrastructure.