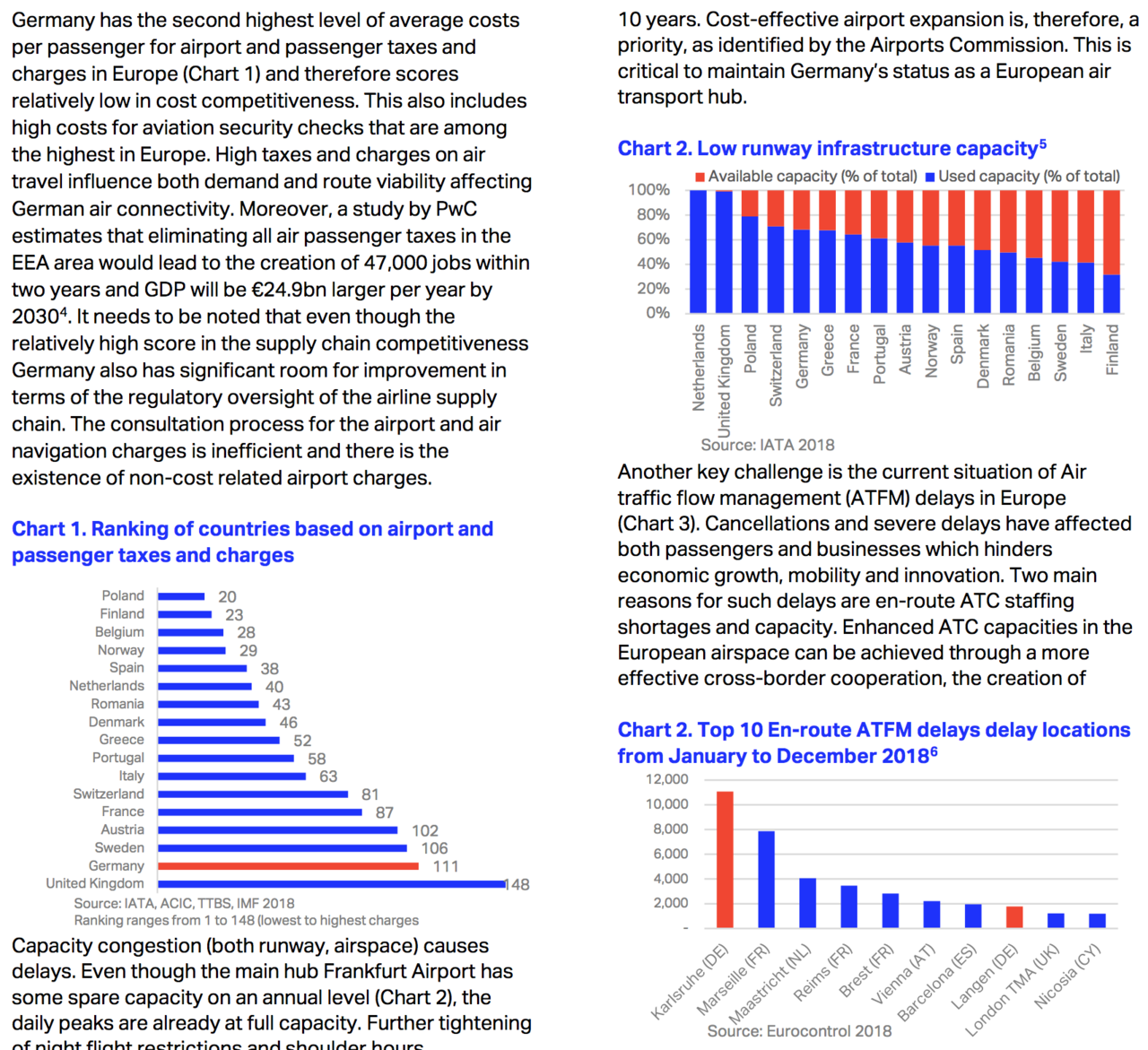

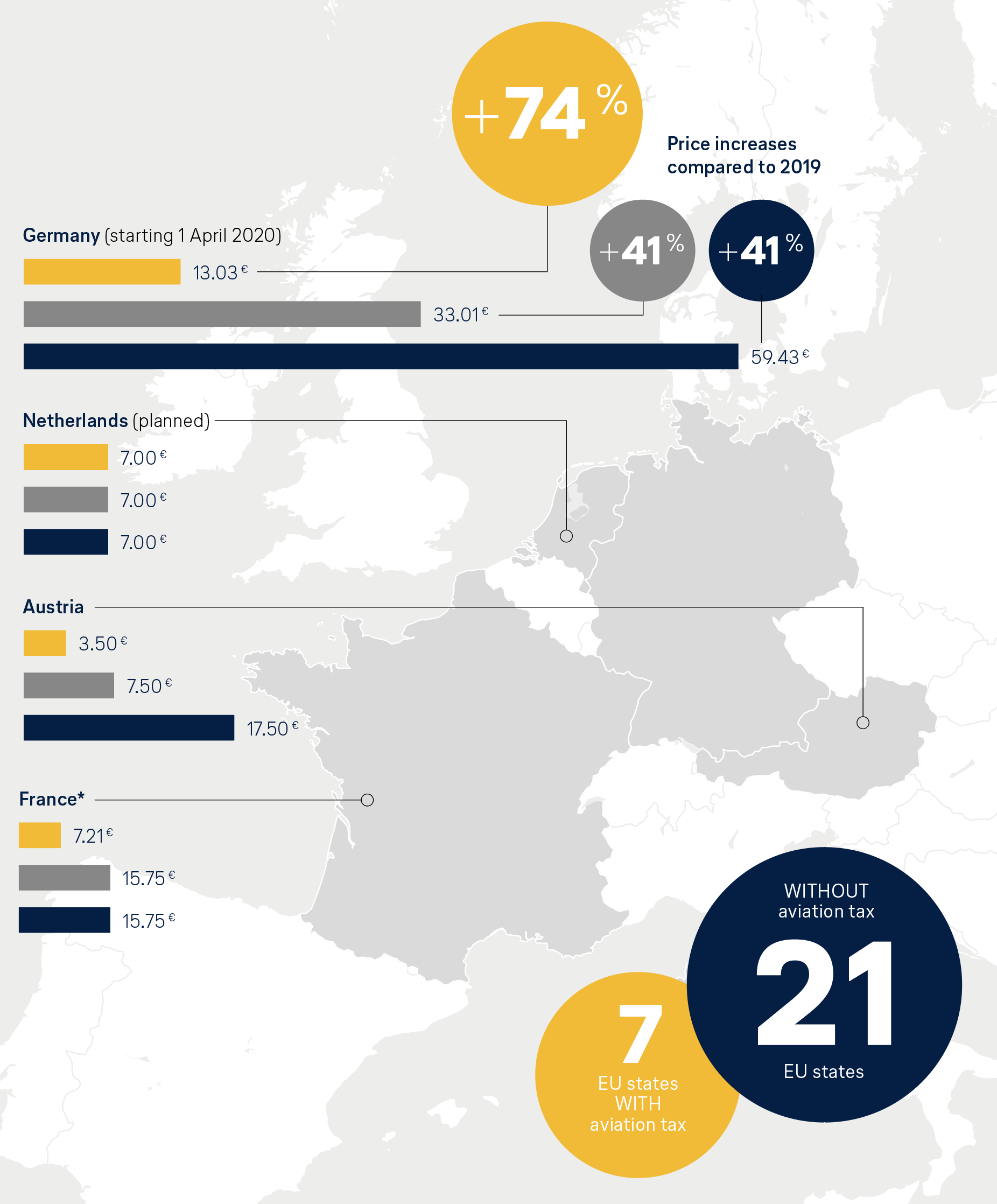

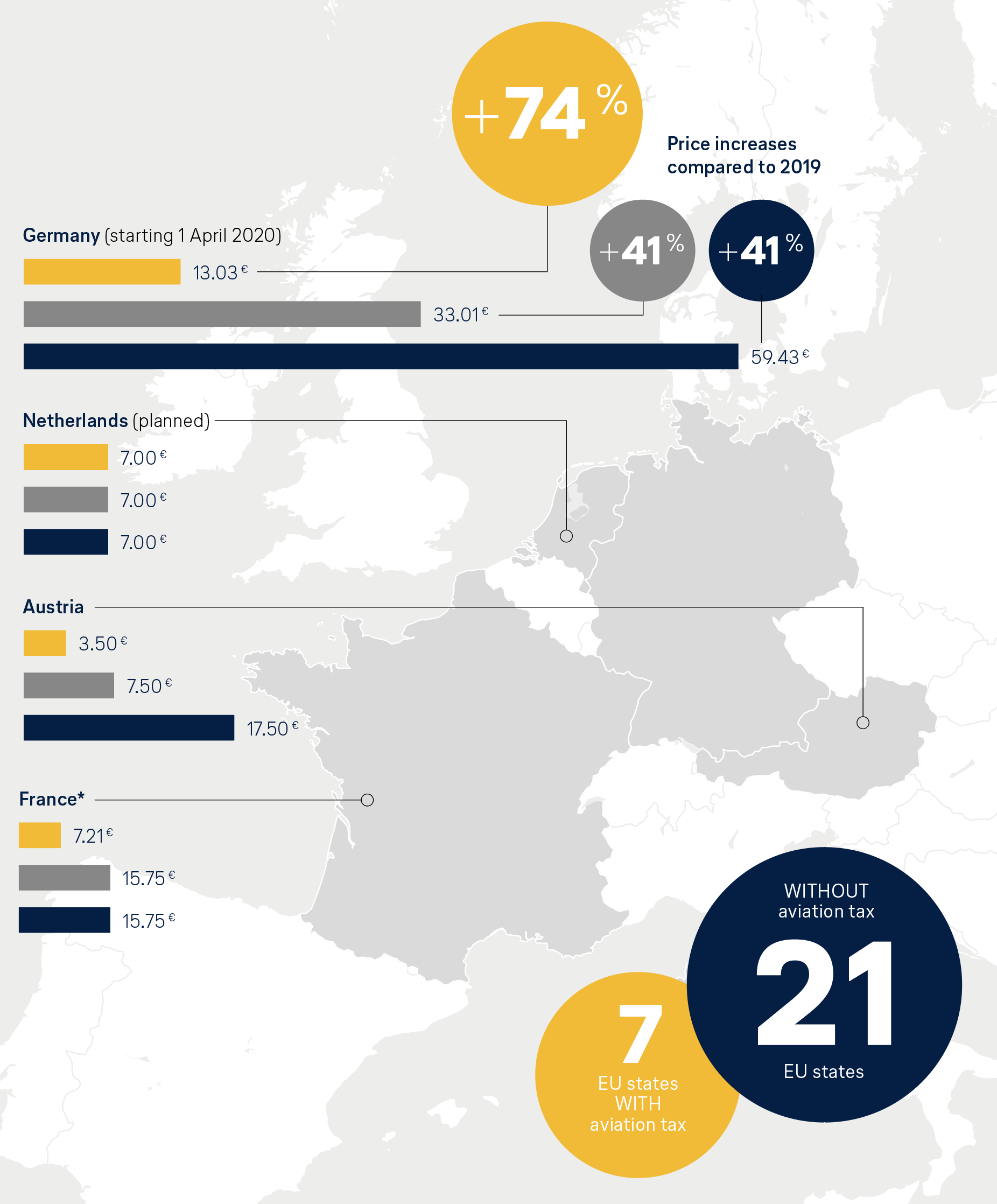

Taxes and fees

German aviation policy at the expense of the location

The competition in the skies is tough. Just in Europe, the number of operating airlines decreased from 131 to 107 within one year until mid-2019. And the consolidation continues: according to forecasts, 12 airline groups will define the world market in a few years. The Lufthansa Group wants to be one of this dozen and feels that it is currently well positioned. However, continually increasing burdens at home weaken our competitiveness.

Comparison of air transport tax in Germany and neighbouring states

Source: EU-Kommission, BDL

High costs in the aviation location Germany

A new study of the International Air Transport Association (IATA) shows: nowhere else in Europe are the costs for security controls as high as here – and this in return for poor quality and efficiency. Airport fees in Germany are also among the highest. Only in Great Britain do airlines pay more for using airports.

The aviation tax burdens the domestic industry

The Federal Government has repeatedly announced that they would decrease one-sided local burdens – most recently in their coalition agreement. But the opposite has happened. The disproportionate increase of the aviation tax affects domestic airlines and airports more than others and makes German even more expensive as a location. Long-distance flights via non-European hubs are indirectly made cheaper, for the benefit of our international competition.

This continues the previous negative trend: since the aviation tax was introduced in 2011, the German aviation industry has seen significantly weaker growth than other western European markets. The market shares of German airlines in domestic airports decreases steadily – from 67% in 2012 to only 56% in the first half of 2019. This development is particularly striking in border regions. There, domestic airports have recorded passenger increases of 14% between 2010 and 2017. Directly competing airports abroad recorded increases of around 80% in the same time span. This shows that German passengers shift away for price reasons and accept longer onward travel in return.

Using income from the aviation tax for climate protection

As questionable as the increase itself is the intended use of the aviation tax. The additional millions hardly go towards climate protection measures in aviation but rather compensate for the VAT decrease for rail traffic and flight security for unprofitable small airports, which are often used by foreign low-cost providers. Only about € 100 million are to be used for subsidizing sustainable fuels. This is climate and industrial policy shooting itself in the foot.

Germany, the second-most expensive aviation location

Ranking of European aviation locations based on airport and passenger taxes and airport fees. The rising aviation tax in Germany has not yet been included.

Comparison of air transport tax in Germany and neighbouring states

Source: EU-Kommission, BDL

Further content on the topic

IATA study

Competitiveness indicators

In November, the airline association IATA published a study on the competitiveness of German air traffic. The top 5 demands:

- 1. Abolish aviation tax

- 2. Improve ground and air capacities

- 3. Increase cost efficiency of air traffic control services (ATC)

- 4. Introduce cost-efficient airport charges

- 5. Promote innovative border security and customs technologies and processes