Aircraft data

Preventing monopolies

It is the gold of today – data. Whoever has data, profits. Exclusive data access can give businesses a competitive edge and create additional business models. Since the question “Whose data is it?”

is so central, there is a risk that businesses will exploit their market power and attempt to obtain exclusive data access. Policymakers are planning countermeasures here, including measures aimed

at aircraft manufacturers.

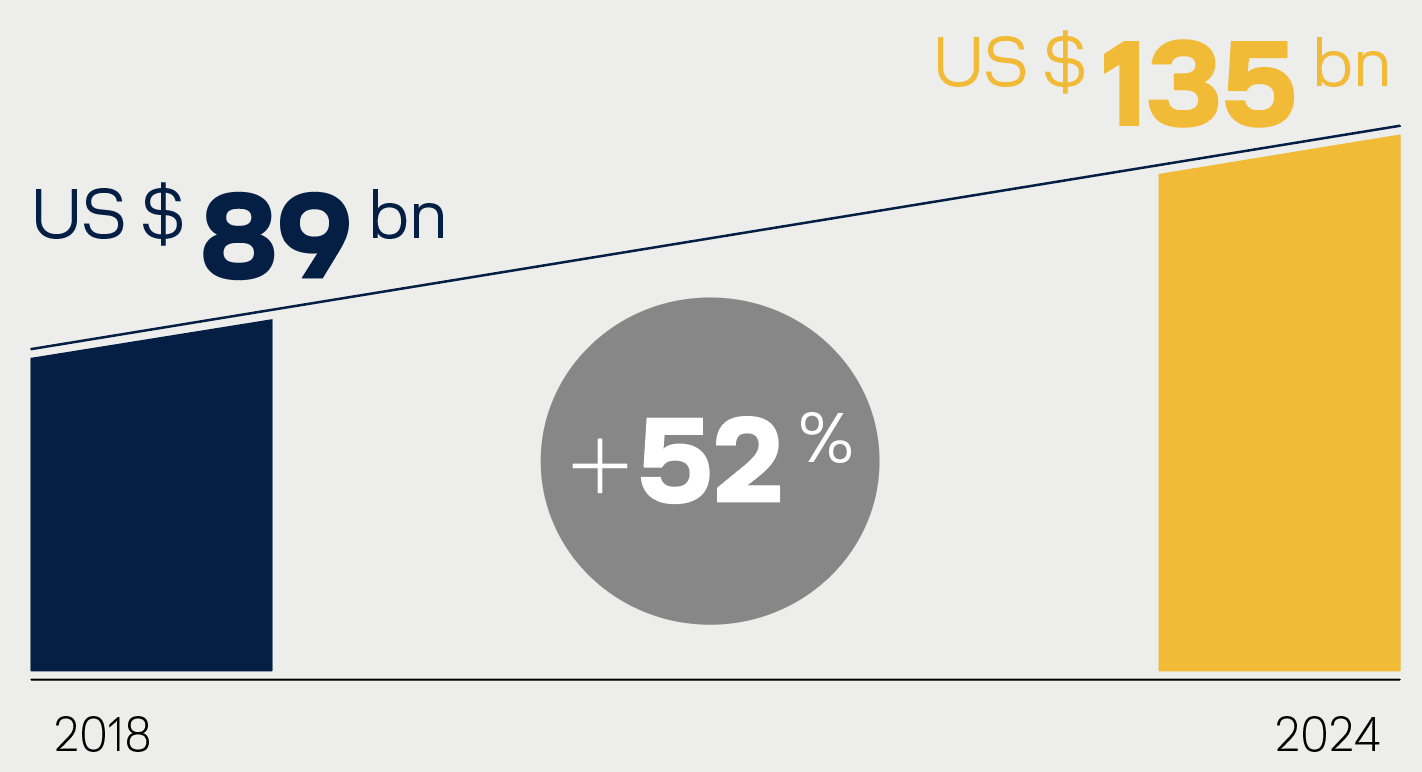

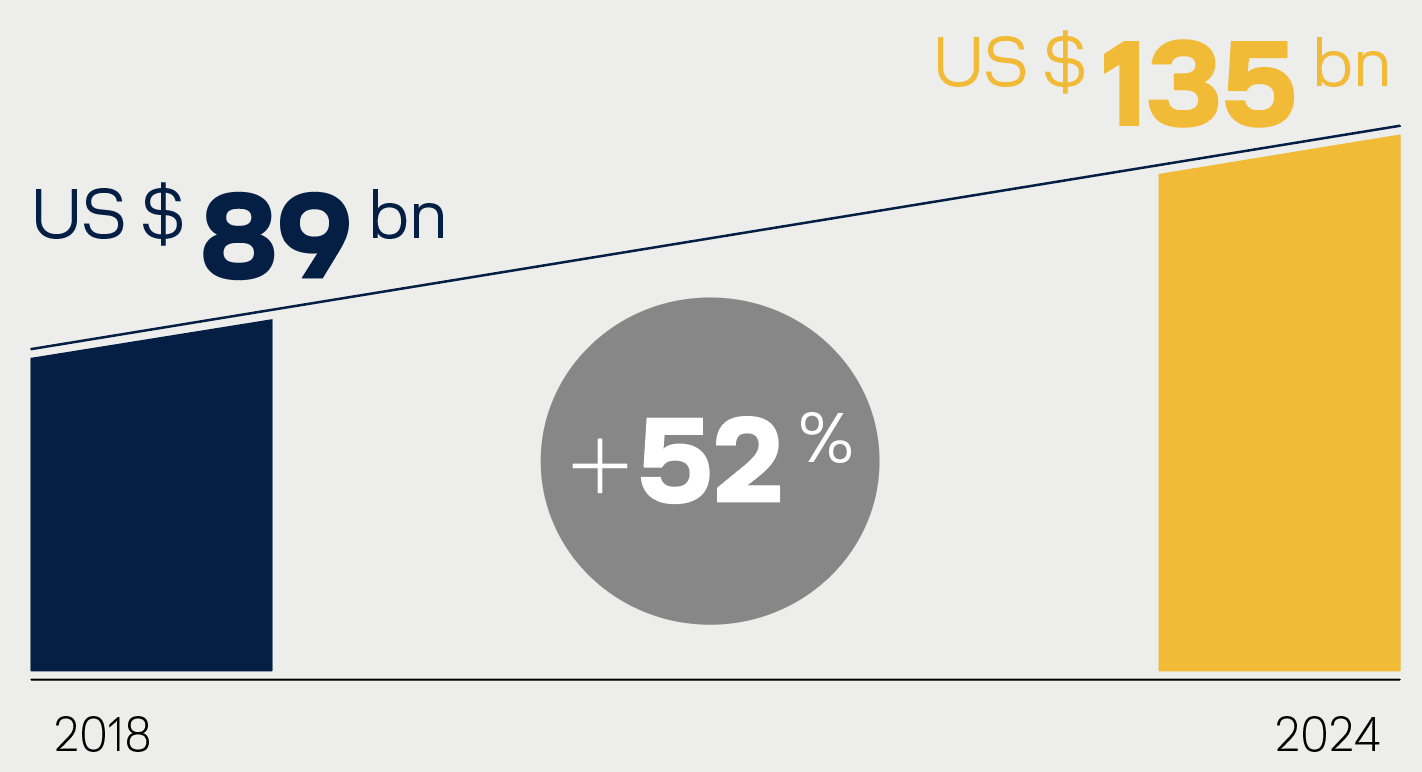

Market with lots of potential

The market for maintenance, repair and overhaul services for aircraft (MRO) will grow to US$ 135 billion by 2024 – aircraft manufacturers want to massively expand their share.

Every flight generates significant quantities of digital information. Dozens of sensors record temperatures, monitor pressures, or control the position of engine blades or valves. The intelligent use of data offers airlines and aircraft manufacturers a lot of possibilities. They can ensure greater safety or form the basis for new, attractive services.

Airbus wants data sovereignty

The situation becomes critical when manufacturers want to monopolise flight data. Airbus is engaged in efforts to keep digital information exclusive via encrypted or undocumented channels, even once the aircraft have been paid for and delivered. This would prevent airlines from transferring and using data independently. This cannot be allowed: the data must be placed in the hands of the airline when the aircraft is purchased. For security reasons, airlines require time-independent access to all available information and control of the data. Data sovereignty of aircraft manufacturers would make this impossible.

Service providers, for instance for repairs and maintenance, also require access to data. At the moment, maintenance companies can read out aircraft data free of charge on behalf of their customers. More than 1,600 independent providers and aircraft manufacturers are competing with each other. This promotes innovation and fair prices. In order to strengthen its own competitive position, Airbus wanted to charge independent maintenance companies fees for the use of all data or make access to the data more difficult or impossible. This would have led to price increases without added value and a reduction of competition.

Politics to the rescue

In its latest report, the Competition Commission listed the relationship between aircraft manufacturers and maintenance companies as an example for which legislature should mandate data access. We are counting on the upcoming amendment of the Act against Restraints of Competition (GWB) to stop the abuse of market power: aircraft data must remain the property of the airlines, which can then provide it to their maintenance partners.

Market with lots of potential

The market for maintenance, repair and overhaul services for aircraft (MRO) will grow to US$ 135 billion by 2024 – aircraft manufacturers want to massively expand their share.