Framework conditions in aviation

allow an appropriate level of growth

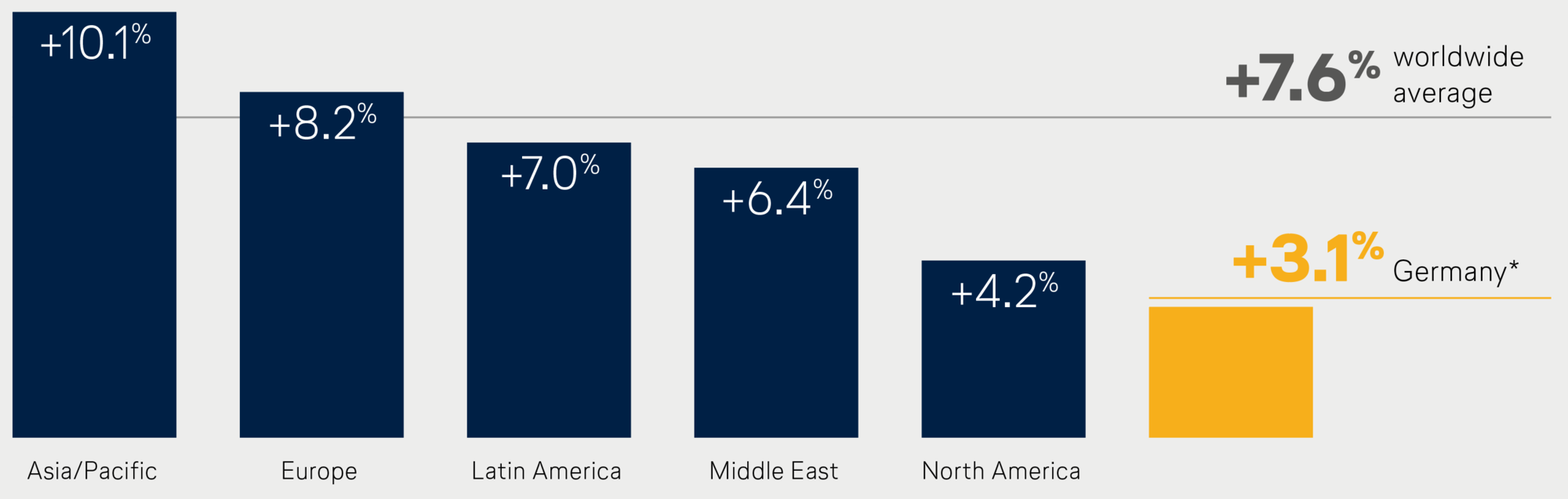

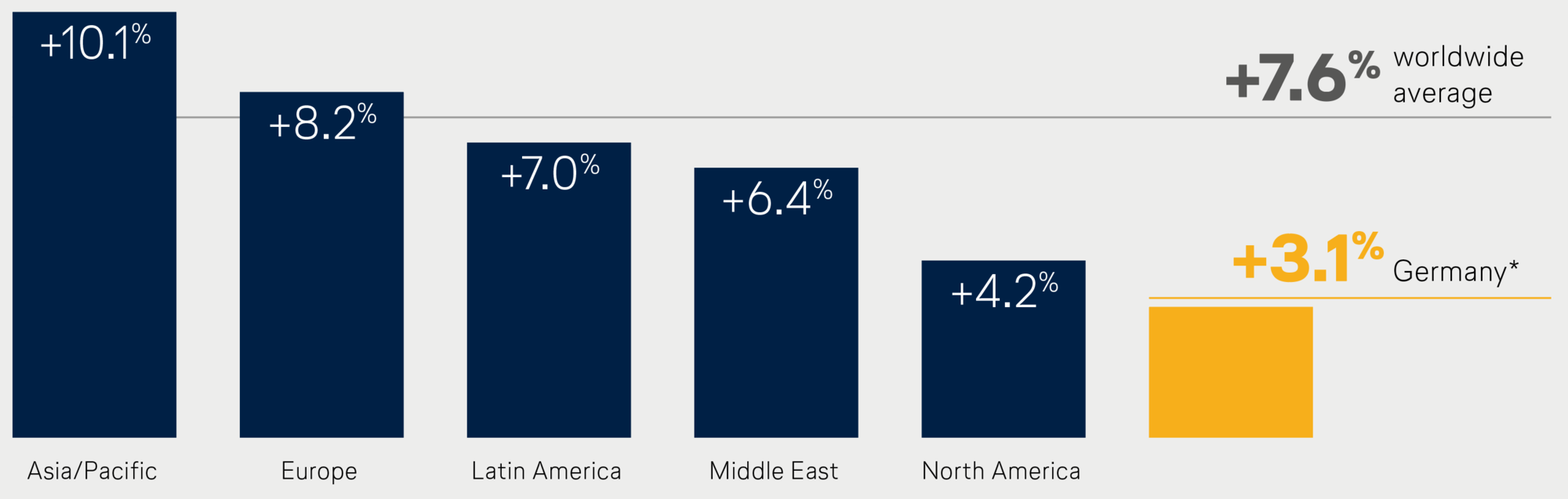

In 2017, airlines worldwide grew in size by 7.6 percent. In Europe, a figure of 8.2 percent was recorded. The figures for German airlines are in stark contrast to this, however, with a growth rate of only 3.1 percent. Government policy can to a considerable extent help to enable the domestic air transport sector to catch up again in the future.

The growth rate of german airlines is below average

Growth of airlines according to region in the year 2017; in passenger kilometers sold

* includes projected transport figures for Air Berlin from August 2017; sources: DESTATIS, IWF, SVR, IATA, BDL

Three themes need to be given priority

The lost opportunities for growth are closely associated with national charges which other air transport locations do not have to reckon with.

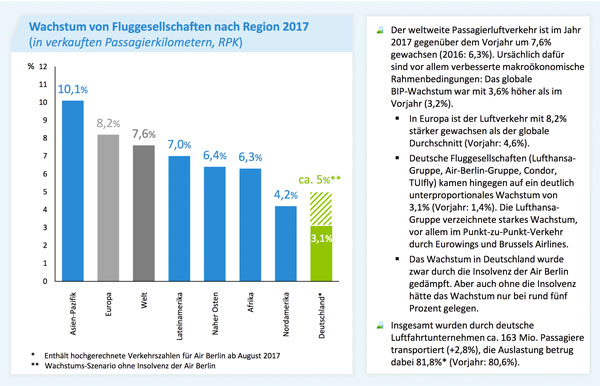

- Aviation tax – in 2017 alone, German airlines had to pay EUR 590 million to the tax authorities in aviation tax. There are very few countries that place such demands on their airline industry – in fact, quite the opposite. Austria recently cut their aviation tax in half; Ireland and the Netherlands have abolished it completely. Three countries, one goal – to get rid of additional charges in order to stimulate growth far beyond just the airline industry. The figures for Germany are also convincing. According to the calculations of PricewaterhouseCoopers, abolishing aviation tax by 2020 would trigger an annual GDP growth of EUR 4.1 billion, would create 12,000 new jobs – and in doing so would bring in increased income for the tax authorities.

- Aviation security costs – in Germany, the costs for security checks on passengers and baggage are charged to the airlines in the form of aviation security fees. Between the years 2011 and 2017, these costs increased by 64 percent to EUR 693 million per year. In Germany, this figure is passed on in full to the airlines. The situation is different in Italy, Spain and the US, for example, where the state assumes up to two thirds of the costs. There is good reason for this, as the protection of citizens against terrorist attacks—which is, after all, the objective of the security checks—is one of the state’s core tasks. This is also the way the new federal government sees things and, according to the coalition agreement, they are in favor of the state taking on a larger share of aviation security costs.

- Operating hours – even as things stand today, the restrictions imposed on night flying in German airports are considered strict by international comparison. For example, Frankfurt, as an international hub, is completely closed between the hours of 11.00 pm and 5.00 am – a stark contrast to all comparable competitor airports in Europe and the Middle East. As the infrastructure—which cost many billions of euros—has therefore to be amortized within shorter working hours, the German air transport sector is effectively more expensive in structural terms. The ever-increasing additional fees levied on noise-related charges also represent a financial burden for airlines and lead de facto to a ban on night flights in economic terms.

The growth rate of german airlines is below average

Growth of airlines according to region in the year 2017; in passenger kilometers sold

* includes projected transport figures for Air Berlin from August 2017; sources: DESTATIS, IWF, SVR, IATA, BDL

Further content on the topic

Document

Annual Figures 2017

With regard to global air traffic growth, Germany was also clearly left behind in 2017 too. This is again backed up by the figures issued by the German Aviation Association (BDL). The overview contains key figures relating to growth in the passenger and freight sectors.

PwC study

The economic impact of air taxes in Europe: Germany

- PwC study estimates an increase of 24.6 million passengers and an extra € 1.6 billion tourism expenditure by 2020.

- €1 of abolished air passenger tax creates €1.08 in indirect taxes – Tax will raise €1 billion in 2017.

- Berlin: 4.6 million additional passengers and €300 million additional tourism spending by 2020.

The growth rate of german airlines is below average

Growth of airlines according to region in the year 2017; in passenger kilometers sold