Oligopolies prevent competition and are bad for consumers. This is also the case with the GDS: Over many years, they have achieved a return on sales of more than 30 percent – financed by airlines and ultimately by passengers. Further-more, they have inhibited technological development, thus weakening the innovative power of the industry. The result is that to date, for example, travelers can only compare prices and flight times when choosing different flight offers.

Airlines are developing a new NDC standard

That’s why the IATA seized the initiative in 2012: Since then, airlines, together with technology providers, travel agencies and start-ups, have developed the New Distribution Capability (NDC) standard as an alternative. The partners can thus access the diverse range of airlines direct and offer their customers comparative offers that are markedly more nuanced.

Airlines require authority over distribution

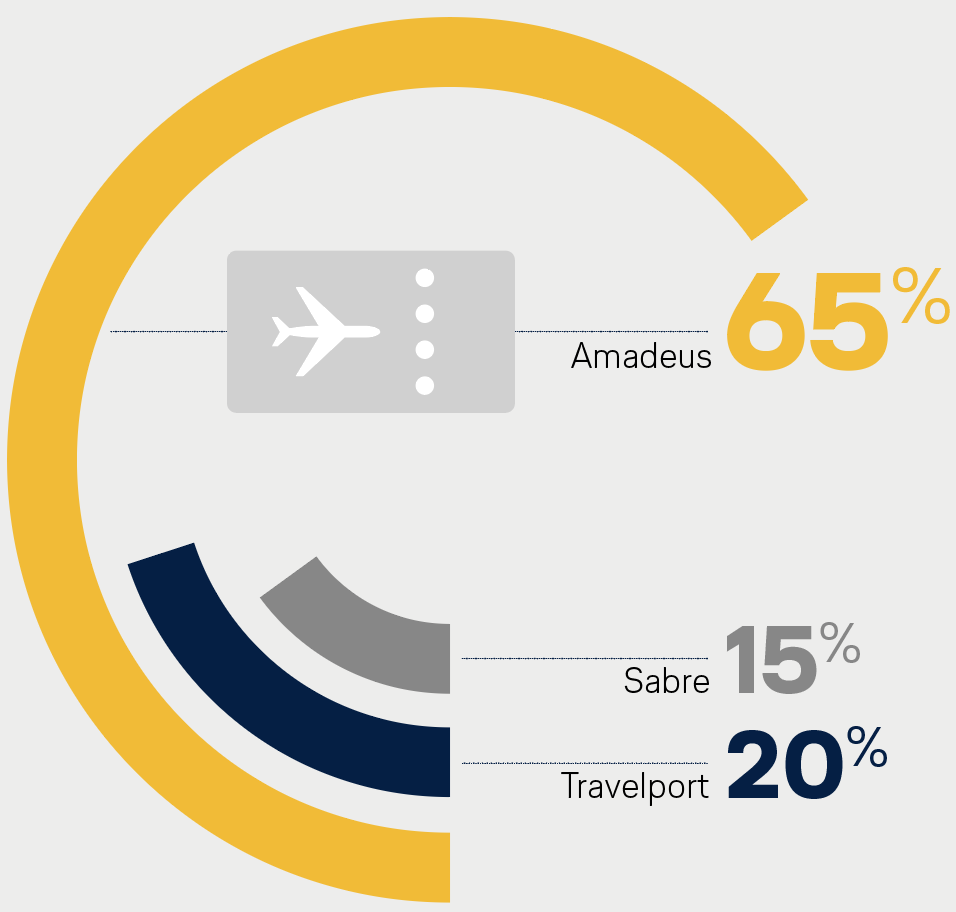

The EU Commission is currently working on the conditions for ticket sales through GDS providers. The big GDS companies of Amadeus, Travelport and Saber are lobbying to preserve the dominant market structure and to regulate innovative sales channels in their favor.

We believe that airlines should choose which offers they should sell and through which distribution channels. This position is also shared by the Federal Cartel Office, which already dealt with the distribution channels of the airlines in 2017. In addition, measures that restrict competition must finally be called into question. For example, the GDS providers’ contracts with the airlines contain many questionable clauses. Any market regulations should ensure innovative competition and that new entrants can grow and develop without market barriers.