Subjects

Air Berlin insolvency:

The German market remains fiercely contested

Subject to approval by the competition authorities, the Lufthansa Group will purchase parts of the Air Berlin Group. The Group will invest EUR 1.5 million and hire 3,000 new employees. This is good for Germany as an aviation location, especially as competition intensity in Germany and Europe continues to be extremely fierce.

Size a major factor in aviation

Airlines have to invest millions of Euros in fuel-saving and quiet aircraft. This becomes all the easier to do, the more efficient they operate. Here, fleet size and passenger numbers are important parameters. A comparison with the US shows, however, that Germany’s and Europe’s aviation markets are extremely fragmented – a further consolidation is thus unavoidable.

A major Irish competitor in particular is warning of the ostensible threat of market dominance by the Lufthansa Group and increasing prices. A contrary indication is that there has been fierce competition in Europe and Germany for years – in Germany alone, 160 airlines are competing for passengers. As a result, ticket prices have continued to drop. This competition will go on, even after the exit of Air Berlin from the market. And: German and European competition regulators will closely examine any transactions.

No market dominance foreseeable

Together, the Lufthansa Group airlines comprise a market share of 34 percent in Germany; Air Berlin has 14 percent. The Lufthansa Group is interested in acquiring only a part of Air Berlin. This makes it clear that its market share will lie permanently and clearly under 48 percent – the market share of Ryanair in Ireland.

Special role for feeder traffic

In a market assessment, it is also important to consider that almost two thirds of Lufthansa passengers are travelling internationally on their domestic flights. For example, for passengers flying from Shanghai via Frankfurt to Hamburg, the domestic route is part of international travel. Those who are complaining about the alleged market dominance of Lufthansa on domestic German flights would have to subtract this 60 percent of passengers.

Intercontinental transfer passengers, just like European transfer passengers, have a wide selection of different offers: From Berlin to Bangkok, a passenger can choose from ten different airlines and transfer in Amsterdam, Doha, Helsinki, Istanbul, Frankfurt, Cologne, London, Moscow, Paris, Vienna or Zürich. From Düsseldorf to Miami, passengers even have 14 different transfer options available.

Ryanair shines with polemics

There is nothing but polemics to be heard from Ryanair, the largest European airline in terms of passenger numbers. The Irish airline chose not to take the opportunity to submit its own offer in order to show responsibility towards the German market. They are obviously only interested in media attention, which is intended to distract from their own serious problems.

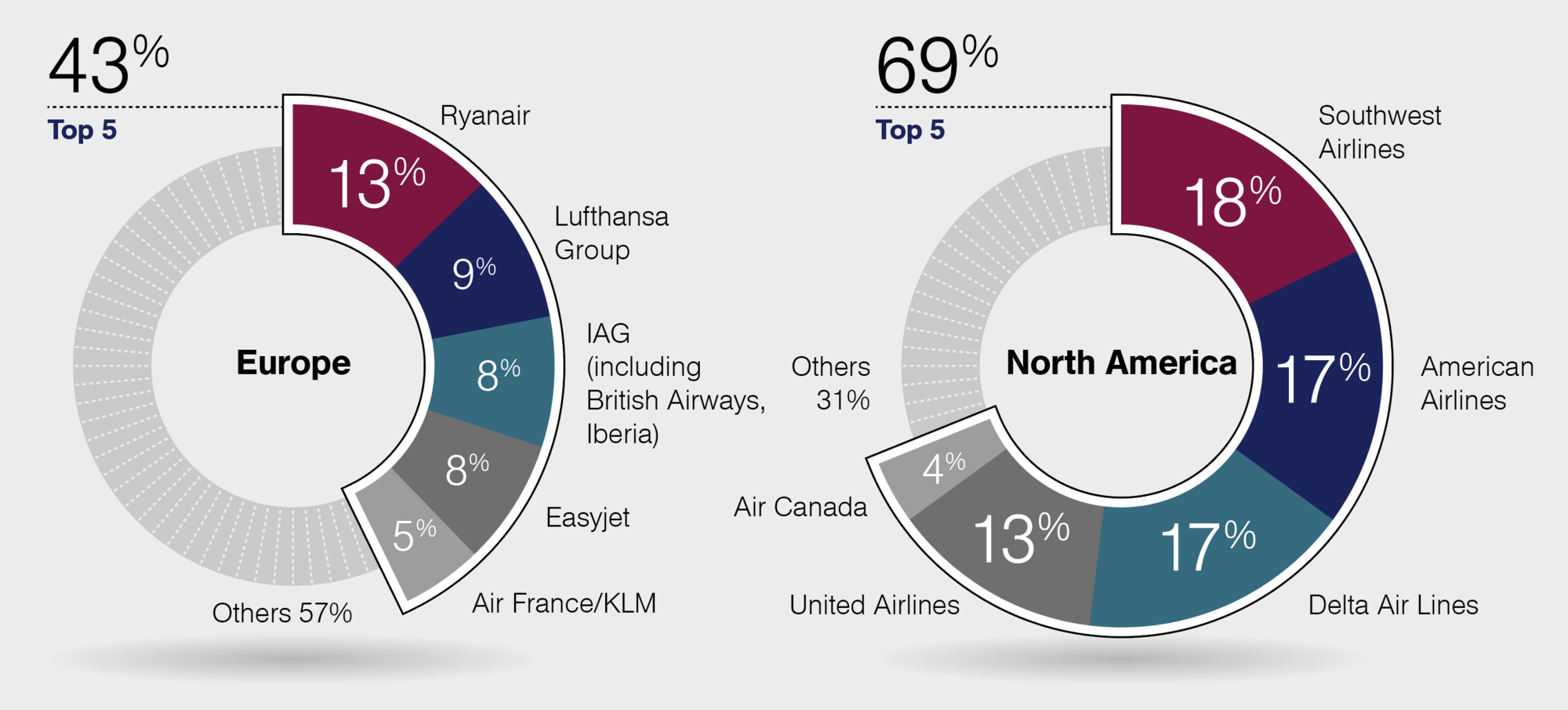

Market shares of airlines in Europe / Market shares of airlines in the US

Percentage of passengers flying from, to and within Europe/North America, incl. long-haul flights

Size a major factor in aviation

Airlines have to invest millions of Euros in fuel-saving and quiet aircraft. This becomes all the easier to do, the more efficient they operate. Here, fleet size and passenger numbers are important parameters. A comparison with the US shows, however, that Germany’s and Europe’s aviation markets are extremely fragmented – a further consolidation is thus unavoidable.

Further content on the topic

Press release

Contract for the purchase of parts of Air Berlin Group signed

– Lufthansa Group acquires NIKI and Walter airline

– Purchase is subject to approval by the competition authorities

– Purchasing price of approximately 210 million euros agreed on